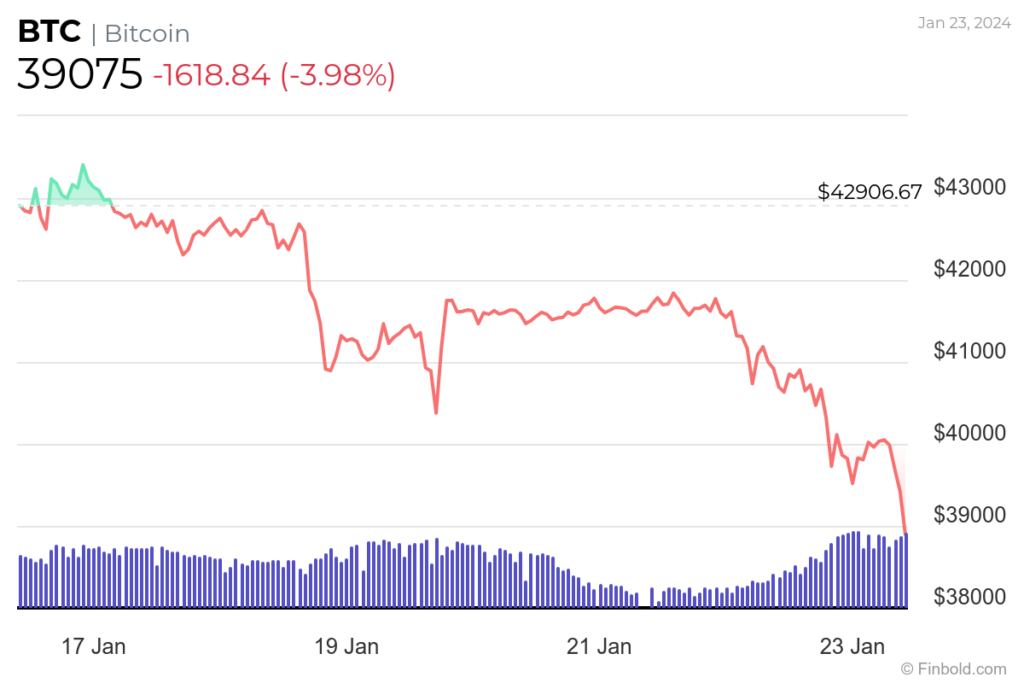

Bitcoin (BTC) is currently undergoing a sell-off, marking the first time since December 2023 that the flagship cryptocurrency has dropped below the $40,000 support zone.

This selling pressure aligns with a phase where Bitcoin whales are actively dumping a significant portion of their holdings. Notably, data from cryptocurrency analyst Ali Martinez revealed that as of January 23, Bitcoin whales had unloaded nearly 70,000 BTC, almost $3 billion, within the past two weeks.

It’s worth noting that the recent activity of the whales has unfolded against the backdrop of the approval of the spot Bitcoin exchange-traded fund (ETF), deemed a bullish catalyst for the cryptocurrency. The product has recorded significant outflows with Grayscale Bitcoin Trust (GBTC) accounting for the highest share.

Picks for you

At the same time, the selling pressure could be interpreted in various ways, such as whales taking some of their profits following Bitcoin’s recent rally that retested the $49,000 mark, or they might be redistributing their holdings. The whale activity might also result in short-term price volatility and a notable drop in the price.

Bitcoin price analysis amid whale selling pressure

Currently, Bitcoin is facing pressure, having dropped below the critical $40,000 support zone, leaving the market uncertain about its next move. In this context, crypto analyst Fiery Trading, in a TradingView post on January 222, pointed out that falling below the $40,000 mark indicates that the crypto has ‘lost a significant daily support.’

According to the analyst, breaching below $40,000 exposes Bitcoin to more bearish sentiments, likely triggering a major sell-off over the next few weeks.

It’s worth noting that Bitcoin’s uptrend began in September 2023 and lost momentum at the start of 2024, with the price predominantly showcasing lower highs and lower lows.

As Bitcoin searches for an upside movement, it faces resistance at the psychological level of $40,000, with bulls and bears contending to maintain control within their respective sides of the zone.

By press time, Bitcoin was trading at $39,075, experiencing daily losses of nearly 4%. On the weekly chart, BTC is down almost 10%.

Finally, on-chain data from the crypto analysis platform Santiment noted that the prevailing bearish sentiment has influenced overall market discussions, resulting in a 35% drop in conversations about the flagship cryptocurrency as of January 22. Therefore, only time will reveal how Bitcoin will react to these market dynamics.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.