Activity on the blockchain points to a major move from BlackRock, with a series of large Bitcoin (BTC) transfers suggesting the asset manager may be preparing to offload.

In this case, the investment giant has deposited 1,634 BTC, worth approximately $142.6 million, into the exchange’s institutional platform on Coinbase Prime, according to the latest data shared by Arkham on December 2.

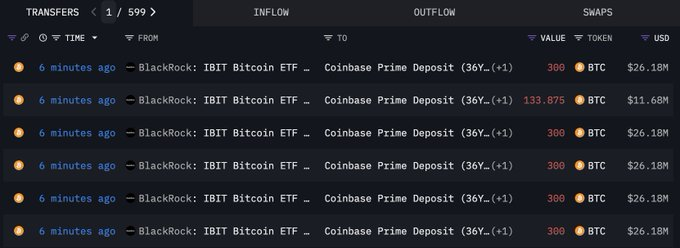

Data from the IBIT Bitcoin ETF wallet shows multiple rapid-fire transfers flowing into Coinbase Prime deposit accounts.

BlackRock moved several batches of 300 BTC alongside a smaller 133 BTC transaction. At current market prices, each 300-BTC batch is valued at just over $20 million, while the 133-BTC transfer reflects roughly $11.4 million. Combined, these transfers alone represent more than $112 million moved in minutes.

Such movement toward a centralized exchange deposit wallet often precedes sell-side activity, signaling that BlackRock may be repositioning or reducing exposure within its Bitcoin ETF structure.

Institutional investors taking caution

The timing is notable, considering that Bitcoin markets have been fragile in recent sessions, and large inflows of liquidity onto exchanges can influence short-term price direction. With IBIT already one of BlackRock’s most successful ETF launches, any strategic adjustment by the firm carries weight across the broader crypto market.

Whether this impending dump triggers volatility or merely reflects routine portfolio balancing remains to be seen.

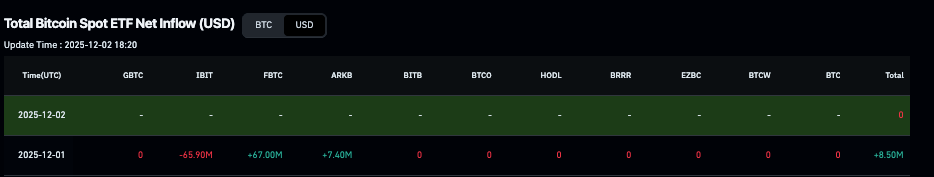

Meanwhile, BlackRock’s signal to sell comes after the firm offloaded massive Bitcoin on December 1. In this case, BlackRock’s Bitcoin ETF (IBIT) saw an outflow of 729.62 BTC, translating to a $113.7 million withdrawal.

This notable decline points to growing concerns among institutional investors, possibly in response to recent market volatility or bearish sentiment surrounding Bitcoin’s near-term prospects.

Bitcoin price analysis

Indeed, this comes at a time when Bitcoin is making a recovery, with the $100,000 spot remaining the long-term resistance to watch. As of press time, BTC was valued at $90,688, up over 6% in the past 24 hours, while on the weekly timeframe, the cryptocurrency has gained about 4%.

Notably, the price sits below both the 50-day SMA ($101,999) and the 200-day SMA ($104,240), signaling a clear downside bias. Trading beneath these major moving averages typically reflects weakening momentum and a market still struggling to reclaim key trend levels.

The 14-day RSI at 33.49 is hovering just above oversold territory, suggesting bearish momentum remains in play but may be approaching exhaustion.

Featured image via Shutterstock