The excitement in the cryptocurrency community is mounting as one of the most important events in the crypto industry – Bitcoin (BTC) halving – is just hours away, with only 100 blocks left before the reward for mining the flagship decentralized finance (DeFi) asset cuts in half.

Indeed, although predicting the exact Bitcoin halving dates is challenging, the more accurate method of understanding when this will happen is counting down the leftover blocks to be mined, and the Bitcoin block reward halves every 210,000 blocks – coinciding with a period of roughly four years.

As a reminder, Bitcoin’s original creators have introduced this scheduled reduction mechanism to decrease the number of new Bitcoin coins going into circulation and keep the supply in check, limiting it to a finite total supply of 21 million BTC and setting it apart from conventional fiat currencies.

When is next Bitcoin halving?

Hence, after the first Bitcoin halving in November 2012, which reduced the mining reward from 50 to 25 BTC per block, the following event happened in July 2016, when it dropped from 25 to 12.5 BTC. The third halving event occurred in May 2020, reducing the block reward by another 50%.

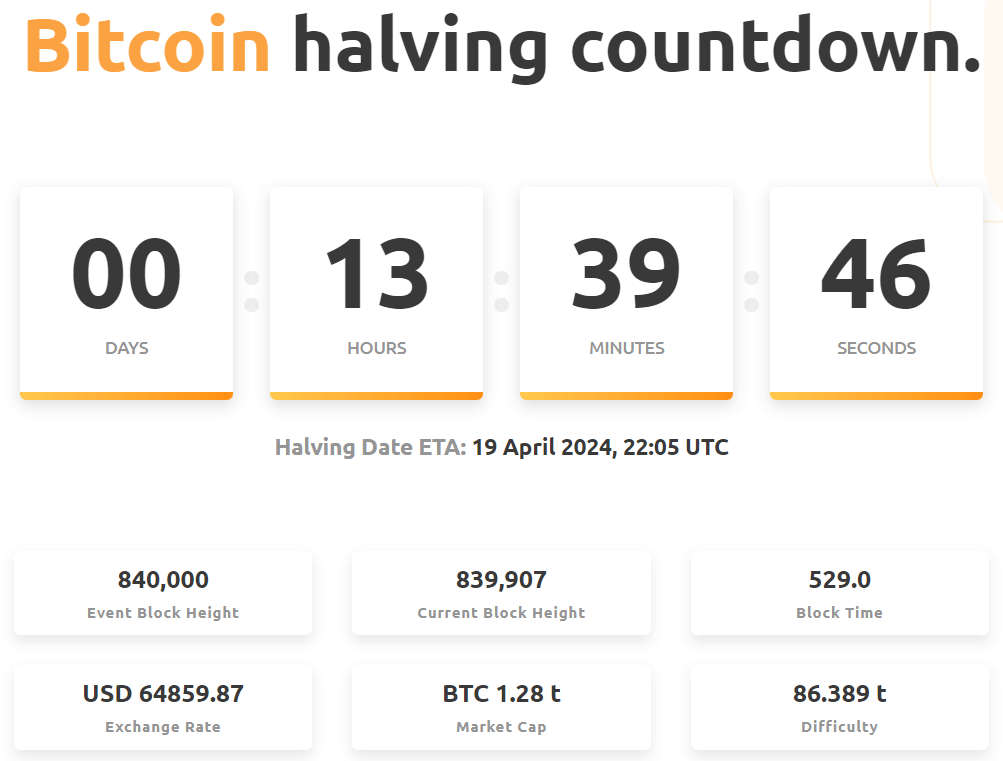

Specifically, the next Bitcoin halving will further reduce this reward – to 3.125 BTC and will happen at exactly 840,000 blocks mined. According to data from multiple Bitcoin halving countdown platforms, there are now fewer than 100 blocks left until this comes to pass.

BTC price prediction as halving nears

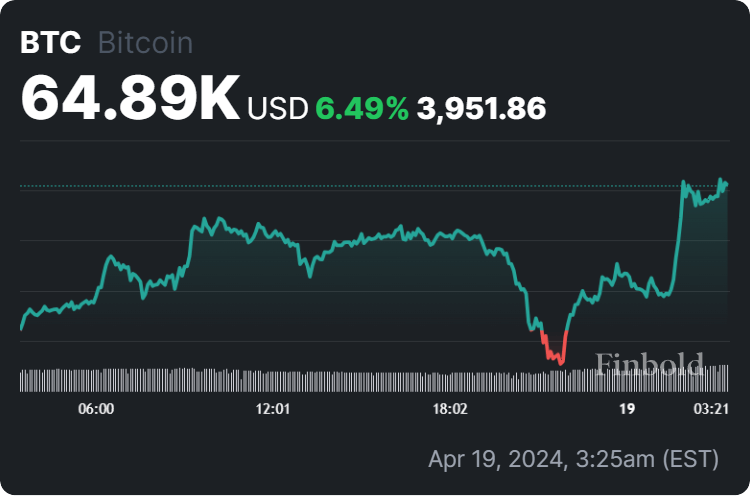

In the meantime, the price of Bitcoin, which has traditionally moved under the influence of these halving events, is starting to recover from its declines earlier this week that have seen it drop below the critical psychological price level at $65,000 and is getting stronger.

Currently, the largest asset in the crypto market is changing hands at the price of $64,890, which suggests a 6,49% gain in the last 24 hours as it moves to erase the loss of 8.42% accumulated over the previous seven days and changing its monthly chart into green by advancing 2.67%.

All things considered, time is running out before the reward for mining Bitcoin cuts in half again, increasing scarcity for the maiden crypto asset and potentially kick-starting a massive rally that some analysts believe could imminently lead it to $80,000 shortly after and then to even more massive heights.

However, it is important to remember that trends in this sector can sometimes change suddenly, so doing one’s own detailed research and in-depth risk analysis is critical before investing a significant amount of money in any of its assets, regardless of how bullish things may seem.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.