Advanced Micro Devices (NASDAQ: AMD), one of the leading chipmakers, has delivered a mixed year-to-date performance so far.

After a strong start to 2024 fueled by excitement surrounding its advancements in artificial intelligence (AI) chip development, AMD stock has experienced a notable correction over the past month, with 15.53%.

However, since January 1, AMD’s stock price has increased from $138.58 to its current price of $160.23 as of April 17, which represents a surge of 15.62%.

To put this into perspective, if you had invested $1,000 into AMD shares at the start of 2024, that investment would be worth roughly $1,156.2 today.

Analyst rate AMD as ‘strong buy’

Despite its recent declines, the majority of analysts on Wall Street remain bullish on the semiconductor company.

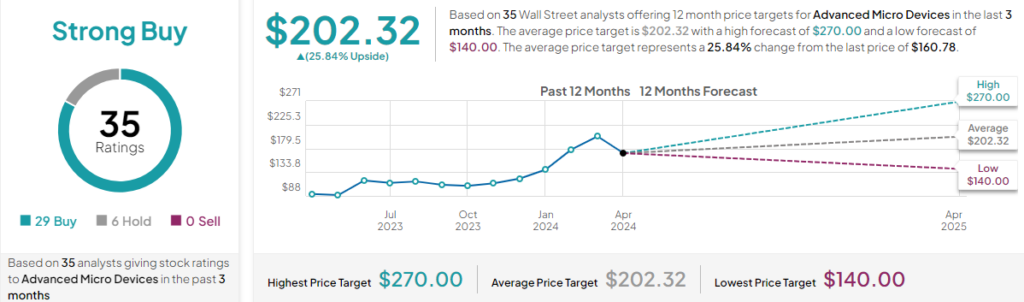

Notably, the average 12-month price target on the stock sits at $202.32, implying a potential upside of more than 25% from its current share value, TipRanks data shows.

At the same time, the consensus rating on AMD is ‘strong buy,’ based on 35 analysts’ views declared in the past 3 months. Out of those, 29 experts said AMD is a ‘buy,’ while 6 advised a ‘hold.’ No analysts recommended selling the stock.

As of the time of publication, the highest price target is $270, while the lowest is $140.

On April 16, HSBC upgraded AMD from “hold” to “buy” with a price target of $225, up from $180. They believe AMD has the capacity and demand to exceed its AI revenue guidance due to strong market position and upcoming next-generation chips.

This bullish outlook comes as AMD outperformed the broader market, with its stock price rising 1.6% while the S&P 500 dipped 0.1% on Tuesday, following the news of the upgrade.

The upgrade also coincides with AMD’s launch of new AI-powered Ryzen processors.

Essentially, despite recent stock price declines, AMD maintained a strong buy rating, a high average price target, and continued to receive bullish outlooks, such as HSBC’s upgrade.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.