The Bitcoin (BTC) mining sector is experiencing renewed investor interest, driven by Bitcoin’s recent rally past $70,000 and a shift toward AI-focused business models among key mining players.

After a sluggish mid-2024 performance due to pressures from Bitcoin’s halving event, companies like Core Scientific (NASDAQ: CORZ) and Iris Energy (NASDAQ: IREN) are repositioning themselves to tap into the high-growth AI market.

These two stocks stand out as they leverage their extensive infrastructure to venture into high-performance computing, making them promising investment opportunities in the converging worlds of Bitcoin mining and AI.

Core Scientific (NASDAQ: CORZ) stock

Core Scientific, with a market cap of $3.7 billion and an enterprise value of $4.22 billion, is at the forefront of this shift. The company has garnered renewed interest, especially from institutional investors holding over 55% of its shares.

Core Scientific’s pivot to AI includes a transformative 12-year partnership with AI hyperscaler CoreWeave, a deal anticipated to generate up to $3.5 billion in revenue.

Through this agreement, CoreWeave’s total contracted high-performance computing capacity across five Core Scientific sites reaches 382 megawatts, solidifying Core Scientific’s standing in the expanding AI-driven computing sector.

Jefferies analysts note that a successful rollout could attract other major tech firms, potentially securing Core Scientific’s role as a significant player in AI.

To further strengthen its financial standing, Core Scientific has announced plans to issue $400 million in convertible senior notes maturing in 2029, with an option to increase the offering by an additional $60 million.

These notes will accrue interest semi-annually and offer holders the flexibility of conversion or redemption options. The funds have been strategically allocated to repay $267 million in high-interest debt, reducing the company’s interest rate from 12.5% to a manageable 3%.

This move not only strengthens Core Scientific’s balance sheet but also boosts its cash reserves, providing the company with the flexibility to expand its high-performance computing capabilities and pursue future acquisitions and capital investments.

With a current price of $14, Core Scientific’s strategic shift toward AI applications offers a compelling growth opportunity for investors looking to gain exposure to both AI and the mining sector.

Iris Energy Limited (NASDAQ: IREN) stock

Iris Energy, with a market cap of $2 billion and an enterprise value of $1.59 billion, has strategically expanded into AI, introducing a valuable new layer to its revenue streams and bolstering its growth potential.

Institutional investors, holding a 44% stake according to StockAnalysis, support Iris Energy’s ambitions in AI. The company generated $3.1 million in revenue from its AI cloud services in fiscal year 2024, showcasing early success in this emerging segment.

Recently, Iris Energy invested $43.9 million to acquire 1,080 NVIDIA H200 GPUs, increasing its total GPU count to 1,896 high-performance units.

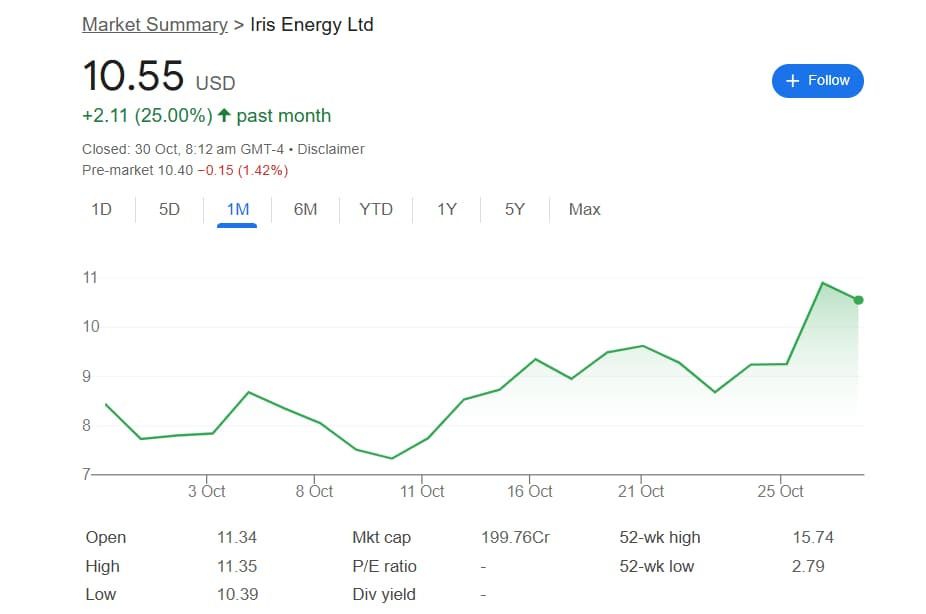

This significant investment is expected to yield $32 million in annualized hardware profit, diversifying the company’s revenue stream beyond traditional Bitcoin mining. The stock is currently trading at $10.55.

Iris Energy’s plans also include exploring AI data center opportunities at its expansive 1.4 GW West Texas site, with Morgan Stanley managing the process to identify potential partners.

The company reported an EBITDA of $19.6 million, a notable improvement from the previous year’s loss of $123.2 million. Bitcoin mining revenue reached a record $184.1 million, supported by operational efficiencies that keep its all-in mining cost per Bitcoin at $31,000.

These achievements, coupled with Iris Energy’s ongoing transformation into AI services, underscore its adaptability and position it as a compelling investment option within the Bitcoin mining sector.

With Bitcoin holding firm above $70,000 and AI demand projected to grow, Core Scientific and Iris Energy are strategically poised to benefit from this convergence of AI and Bitcoin mining.

For investors looking to diversify, these stocks represent strong candidates in a rapidly evolving landscape.

Featured image:

LP Studio – October 30, 2024. Digital Image. Shutterstock.