The cryptocurrency market is gearing up to commence April on a high note, with most digital assets experiencing increased buying pressure, resulting in a spike in their respective market caps.

Currently, several cryptocurrencies have the potential to surpass the $10 billion capitalization mark if the bullish trend continues throughout the month. The upcoming Bitcoin (BTC) halving event further bolsters the bullish sentiment.

Some of the projects with the potential to hit $10 billion already have a market cap close to the threshold.

In addition to relying on the continuation of the bull run, these projects could benefit from high supply inflation, which may contribute to an increased market cap even if prices experience minimal movements. Against this backdrop, the following cryptocurrencies can claim the $10 billion market cap mark.

Polygon (MATIC)

Currently, Polygon (MATIC) is close to hitting this milestone, buoyed by its ongoing upside potential. The attractiveness of MATIC to investors stems from its core technology, which serves as a scaling solution for Ethereum (ETH), addressing scalability and transaction fee issues.

Given Ethereum’s continued dominance, Polygon’s solutions are poised for significant adoption.

Achieving a $10 billion market cap for Polygon would necessitate a rise of approximately 1% from its current market capitalization, indicating a tangible possibility and a factor likely to influence its overall price.

Moreover, the consolidation of MATIC’s price within a defined range over recent months has created an environment of possible accumulation and the prospect of a breakout. This consolidation phase signals a period of stability, further validating a bullish scenario.

Litecoin (LTC)

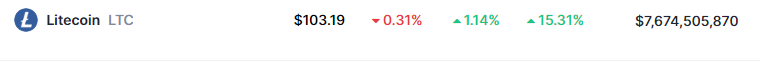

Following Polygon’s footsteps, Litecoin (LTC) is poised to potentially clinch a $10 billion market cap as it edges closer to the target. The push towards this milestone is fueled by Litecoin’s well-established reputation, encompassing fast transaction processing and lower fees, which continue to attract investors.

The project has recorded growth in key metrics, such as increasing holders. Recent data from IntoTheBlock revealed that the number of LTC holders had surpassed the eight million mark towards the end of March. Should this trend of rising holders persist, the resulting buying pressure could propel Litecoin to achieve a $10 billion market cap by April’s end.

Furthermore, Litecoin stands to benefit from speculation surrounding a potential Litecoin Exchange-Traded Fund (ETF). Such rumors have already spurred a rally in LTC prices in the short term, highlighting the market’s keen interest and optimism surrounding the digital asset.

For Litecoin to reach the $10 billion milestone, it would require an approximate 30% upside from its current valuation.

It’s worth noting that despite being supported by several fundamentals, the possibility of the highlighted cryptocurrencies reaching the $10 billion mark will largely depend on whether the market maintains a bullish momentum.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.