Ethereum (ETH) is trending as the Securities and Exchange Commission (SEC) finally approved exchange-traded funds (ETFs) using spot ETH as the underlying asset. Analysts expect an increased demand for Ethereum, benefiting related cryptocurrencies and other tokens as capital inflows to the ecosystem.

The native token Ether has seen over 25% gains in two weeks, highlighting the investment opportunity as Wall Street weighs in.

In particular, the decentralized finance (DeFi) trader and meme coin enthusiast Clouted explained the dynamic he expects to see.

Ethereum ETFs’ trickle-down effect

According to the analyst, the “trickle-down effect” will be 100 times stronger with the Ethereum ETFs than it was with Bitcoin (BTC), given the Web3 and DeFi ecosystem should benefit from the increased demand in what he calls a “reflexive loop.”

As described, Clouted expects ETH to flow into the funds, increasing Ethereum’s price in the spot market and attracting investors. This increased interest should reflect on the blockchain and DeFi ecosystem usage, improving these metrics and fundamentals.

With more usage, total fees increase, increasing the ETH burn and decreasing Ethereum’s supply, which can cause a supply squeeze and further price surge, repeating the cycle. Moreover, it would further benefit the whole ecosystem and the projects’ respective tokens as a massive capital inflow and spread.

The analyst pointed out decentralized exchange (DEX) liquidity pools’ arbitrage opportunities when the ETH price increases, pumping the correspondent pairs. Therefore, Finbold selected two Ethereum tokens to consider buying amid the ETF hype.

Ethereum Name Service (ENS)

First, the Ethereum Name Service (ENS) is the most popular domain service for Web3 and Ethereum. Users can purchase domains and use them as human-readable addresses to send and receive transactions in the network or interact with the ecosystem.

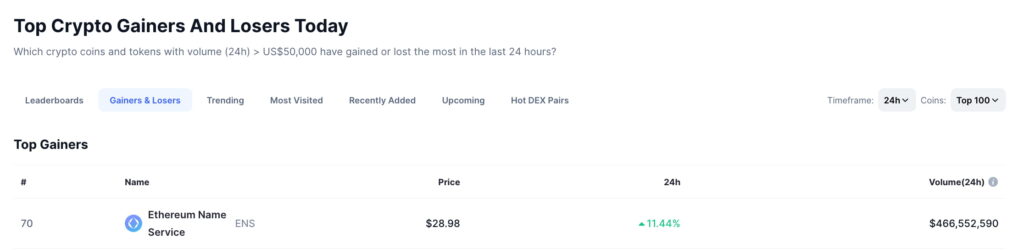

Notably, the ENS token surged in the last 24 hours, becoming the top gainer cryptocurrency of the day. As of this writing, the token was trading at $28.98, up 11.44% following the ETH ETF rising interest.

Uniswap (UNI)

Uniswap (UNI) is the largest and most used decentralized exchange in DeFi, responsible for most of the traded volume. Thus, a capital inflow into the Ethereum ecosystem could directly benefit the project and its native token.

However, a Uniswap team-linked wallet has been selling millions of dollars of UNI, sounding an alarm for its investors. This has caused the UNI price to fall while cryptocurrency whales were seen buying these amounts, absorbing the supply.

Interestingly, the token is up 8.43% year-to-date at $7.82 by press time despite losing 50% of its yearly high at $15.4 in early March.

In closing, the ETH ETF launch presents a valuable opportunity for the Ethereum ecosystem, and some tokens may stand out due to their fundamentals. Investors must do proper research before investing in these assets and understand that the cryptocurrency market is volatile and a risky investment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.