For most investors, penny stocks are viewed as sitting at the intersection of high risk and high potential, attracting those willing to navigate significant volatility.

As 2026 approaches, there is growing anticipation around select penny stocks backed by companies positioned in fast-moving sectors.

While these low-priced equities carry greater uncertainty, they can also offer meaningful upside when supported by tangible catalysts, operational progress, and market-shifting developments.

In this case, Finbold has identified the following penny stocks worth monitoring at the start of 2026.

Plug Power (NASDAQ: PLUG)

The first company to watch is Plug Power (NASDAQ: PLUG), a hydrogen and clean-energy firm showing signs of a potential turnaround after years of volatility. In 2025, the company brought a new 15-ton-per-day liquefaction plant online in Louisiana, lifting its total U.S. hydrogen production capacity to roughly 40 tons per day.

Its Georgia facility also set a major benchmark in April by producing 300 metric tons of liquid hydrogen in a single month, the highest monthly output recorded in the U.S. hydrogen sector.

To reinforce liquidity, the company raised $280 million in a March 2025 equity offering and later secured $399.4 million in net proceeds from a November 2025 convertible-note financing, allowing it to retire a first-lien loan and support its expansion plan.

Despite ongoing losses, a capital-intensive business model, and continued dilution risk, Plug’s strengthening production metrics and exposure to rising hydrogen demand—particularly from industrial and data-center customers—position it for a potential re-rating if execution continues to improve.

In terms of stock performance, PLUG shares have plunged almost 10% year to date. It closed the last trading session at $2.11, up 9%.

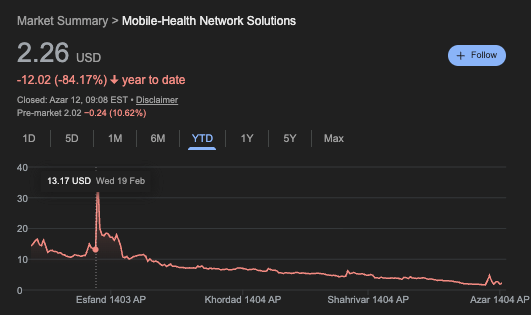

Mobile-health Network Solutions (NASDAQ: MNDR)

The second company to watch is Mobile-health Network Solutions (NASDAQ: MNDR), which is undergoing a major transformation from operating physical clinics to building an AI-driven virtual-care platform.

For the fiscal year ending June 30, 2025, the company reported $7.7 million in revenue, a 45.3% decline tied to its exit from the clinic business. However, the shift dramatically improved its cost structure: MNDR’s net loss narrowed from $15.6 million in FY2024 to $3.4 million in FY2025 as it moved to an asset-light model.

In late November 2025, MNDR announced a significant expansion move by signing a binding agreement to acquire two AI-optimized data centers in Sarawak, Malaysia, a 25 MW facility slated for completion in Q3 2027 and a 150 MW facility targeted for late 2028.

To fund the acquisition, the company may issue up to 3 million Class A shares, a package valued at up to $120 million based on an agreed share price of $40, more than 13 times its trading price of about $3.04 at the time.

Meanwhile, MNDR has had a turbulent run in 2025, dropping almost 85% year-to-date. Despite this correction, the stock ended the last session up over 22% at $2.26.

Although these companies operate in different sectors, both share a key trait for penny-stock investors, each is undergoing a measurable transformation supported by concrete progress in production, financial improvements, and strategic expansion.

Featured image via Shutterstock