For years, the technology sector has been seen as the surest way to generate major returns quickly. Even looking at a metric as simple as the market capitalization of the biggest firms in the world, the truth behind the idea becomes apparent.

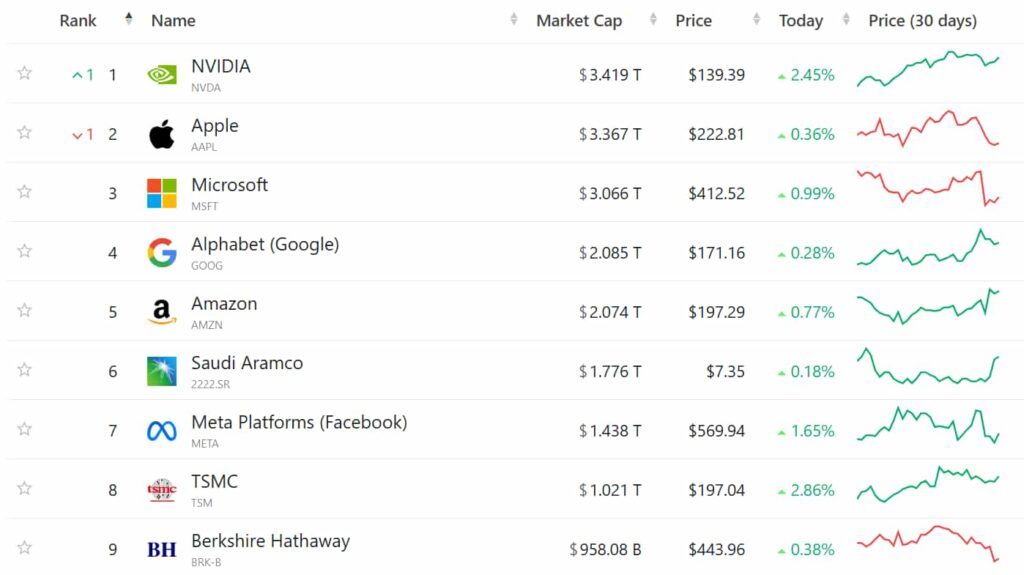

Out of the eight companies that, at press time, have a valuation greater than $1 trillion, all save for the Saudi Arabian Oil Company are numbered in the ranks of big tech.

More recently, the dynamics have changed further as artificial intelligence (AI) has given major tailwinds to companies considered part of the boom – no matter how justified their AI labeling is.

Nvidia (NASDAQ: NVDA) is the poster child of this phenomenon. It was valued at just above $364 billion at the end of 2022 – the year ChatGPT was released to the public – and had become the world’s biggest company, at $3.4 trillion by press time on November 5, 2024.

Though the 2024 stock market movements – movements that ensured major indices like the S&P 500 breached all-time highs (ATH) after all-time highs – ensure there are no truly no-brainer investments, several stocks stand out as easier to pick than others.

Nvidia (NASDAQ: NVDA)

The argument for buying NVDA shares this November boils down to a handful of relatively simple considerations. First of all, a debate about whether the AI boom is, in fact, an AI bubble has been raging for a long time, with the bullish reading of the situation so far remaining prevalent.

Should this state of affairs remain true, Nvidia stock becomes a clear candidate for inclusion in the portfolio, given its positioning as the world’s biggest semiconductor company, technological advancement seen through products such as the Blackwell series, and prominence as one of the most talked-about firms almost guarantee it will benefit from future upsides.

Should the situation turn sour for the AI sector, it is likely that Nvidia’s peers and competitors will not fare much better – particularly in the short term – as the downfall of the industry leader will almost guarantee that the entire market will experience shockwaves.

Though the logic of historical performance falls somewhat flat once a stock starts setting new record prices – historical precedent likewise tells that major and sometimes protracted corrections come in the wake of stellar growth – Nvidia’s track record is, nonetheless, one of strength and resilience.

Since January 2 – the year’s first session – NVDA shares have rocketed 189.31% to their press time price of $139.42. Their latest trend is one of a renewed, if somewhat shaky, upward emergence from the volatility started near the middle of the summer.

Apple (NASDAQ: AAPL)

The case for Apple (NASDAQ: AAPL) is different yet similar – and equally simple – as for Nvidia.

The main difference is that AAPL shares have risen far less than most of the firm’s peers and competitors and, therefore, have far more potential upside. Indeed, Apple stock is only 19.99% in the green at its press time price of $222.76.

Much like Nvidia, Apple’s bull case hinges on the continued success and growth of AI. Much of its stock market lagging this year has been explained by tardiness in adopting the technology, and most of the most optimistic forecasts predict massive growth due to the iPhone 16 and Apple Intelligence.

Should optimism and the current trend hold, buying AAPL shares in November 2024 is not only a sure way for investors to vastly grow their portfolios but also a chance to invest at what may end up being multi-year lows.

Finally, whatever the long-term situation turns out to be, investing in early November will likely lead to significant short-term gains as the markets absorb the U.S. Presidential election results and emerge from the heightened volatility that preceded them.

Featured image:

Gumbariya. Investors analyze the data stock market index via smartphone… Digital image. Shutterstock, April 24, 2024. Date retrieved: November 5, 2024.