The nuclear energy sector is witnessing a surge in demand, driven by geopolitical tensions, rising energy consumption, and its critical role as a low-carbon energy solution.

Adding further momentum is the Stargate Project, a $500 billion joint venture involving SoftBank (TYO: 9984), Oracle (NYSE: ORCL), and OpenAI, aimed at transforming AI infrastructure in the U.S.

As tech giants like Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN) turn to nuclear energy to meet the massive power demands of AI-driven data centers, nuclear power is emerging as the go-to solution for reliable, round-the-clock, high-demand energy needs.

Against this backdrop, Vistra Corp (NYSE: VST) and Constellation Energy (NYSE: CEG) have emerged as standout players, set to leverage the rising demand for artificial intelligence and deliver substantial growth in 2025 and beyond.

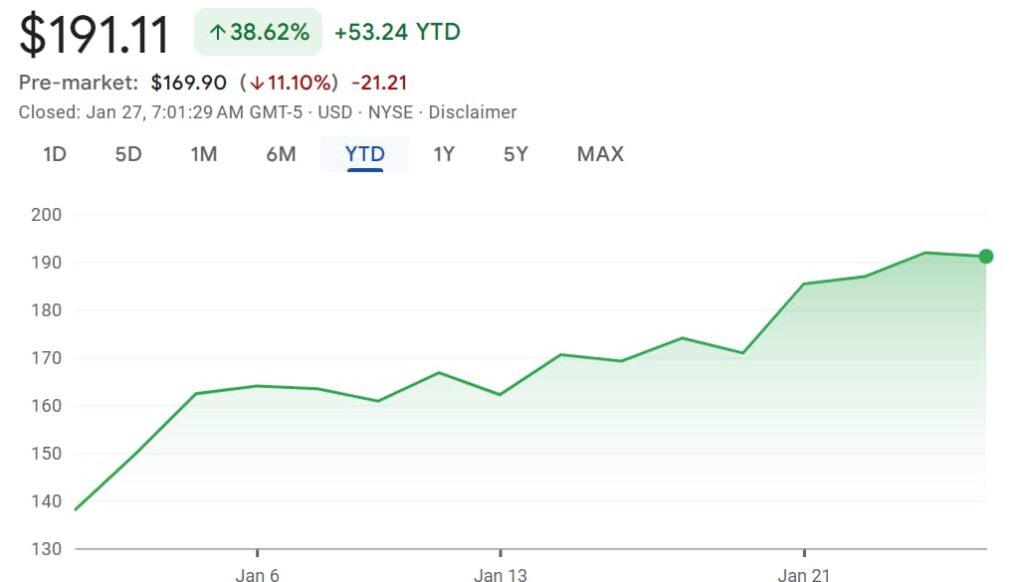

Vistra (NYSE: VST) stock

Vistra has emerged as a major beneficiary of the AI boom, evolving from a traditional integrated retail electricity and power generation provider into a key energy supplier for AI infrastructure.

Trading at $191.11 as of the market close on January 24, the stock has gained 14% over the past five days and posted a 38% year-to-date increase.

Even more notably, Vistra shares have surged 257.9% in 2024, driven by the rapidly escalating energy demands of AI operations.

According to the World Economic Forum (WEF), the computational power required to support the exponential growth of AI is doubling approximately every 100 days, further supporting Vistra’s key role in the sector.

Vistra’s $3.4 billion acquisition of Energy Harbor made it one of the largest competitive power generators in the U.S. The company now operates approximately 41,000 megawatts of installed generation capacity, including four nuclear facilities producing more than 6,400 MW of zero-carbon base load power—enough to supply electricity to 3.2 million U.S. homes.

Vistra’s clean energy initiatives extend to solar projects, with agreements signed with Amazon and Microsoft for over 600 MW of capacity.

Despite challenges such as the recent fire at its Moss Landing battery storage facility, Vistra has maintained strong investor confidence.

Analysts are optimistic about its prospects, with BMO Capital raising its price target to $191 while maintaining an ‘Outperform’ rating. With its growing role in AI infrastructure, Vistra is positioned for sustained growth.

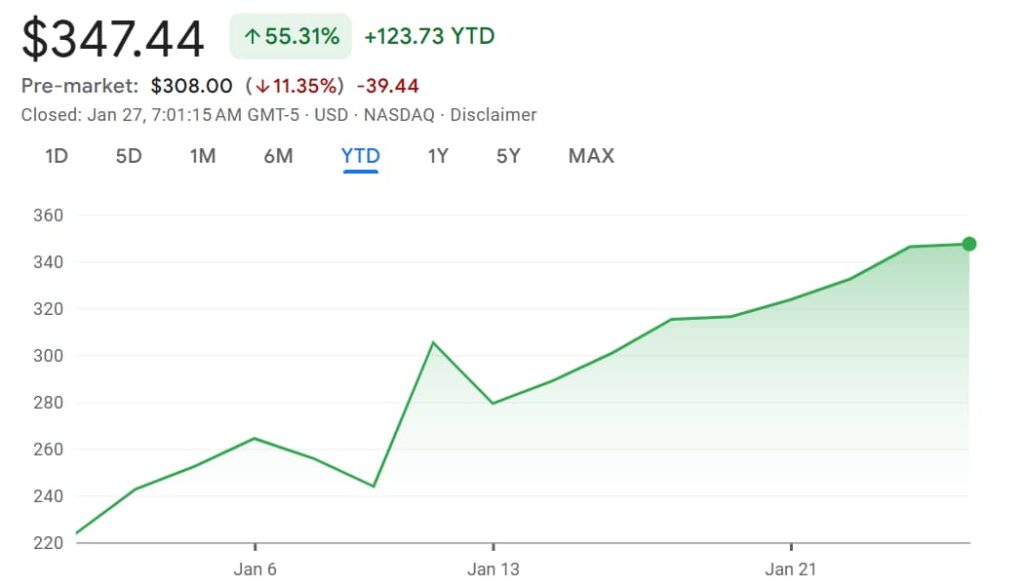

Constellation Energy (NYSE: CEG) stock

Constellation Energy, the largest producer of carbon-free energy in the U.S., has been a standout in the clean energy sector.

As of the market close on January 24, its stock was trading at $347.44, reflecting a remarkable 11% gain over the past week and an impressive 55% increase year-to-date.

The company’s $26.6 billion acquisition of Calpine Corporation marks a significant step, adding natural gas, geothermal, and battery storage assets to its portfolio. Combined, Constellation and Calpine now operate nearly 60 gigawatts of capacity from zero- and low-emission sources.

In Q3 2024, Constellation announced a 20-year Power Purchase Agreement (PPA) with Microsoft, which will enable the revival of the Three Mile Island Unit 1 nuclear facility, now renamed the Crane Clean Energy Center.

Originally retired in 2019 due to economic challenges, the facility’s restart will supply carbon-free energy to Microsoft’s data centers in the PJM region, aligning with the tech giant’s sustainability goals.

Looking ahead, Constellation is positioned to capitalize on the U.S. government’s goal to triple nuclear capacity by 2050. With a 25% dividend increase in 2024 and strong earnings growth, the company offers a compelling mix of stability and growth, making it an attractive choice for long-term investors.

The bearish case with DeepSeek’s low-cost AI infrastructure

However, while these stocks can benefit significantly from the AI boom, a recently released version of the Chinese AI model DeepSeek could pose a threat to their growth potential.

Notably, as reported by Finbold, DeepSeek’s latest model, DeepSeek R1, claims to deliver superior performance at a fraction of the cost, utilizing less sophisticated hardware. This could have caused a pre-market crash to Nvidia (NASDAQ: NVDA) stock and other AI infrastructure providers.

The impact of these concerns is already evident, with both Vistra and Constellation Energy trading 11% lower in the premarket as investors assess the ripple effects on AI-related demand.

Featured image via Shutterstock