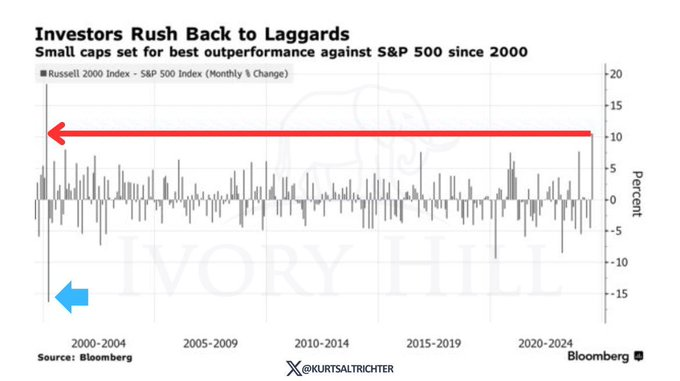

Large-cap companies have long dominated the stock market with a reputation for recording significant returns for investors. However, in recent weeks, small-cap stocks are showing dominance, taking a share from their large counterparts.

For instance, data indicates that small-caps have outperformed the S&P 500 index for the first time in almost 25 years.

Therefore, based on recent performance, investors are potentially looking for high-potential small-cap stocks that could yield substantial returns. Two such stocks recently garnered attention are AMC Entertainment Holdings (NYSE: AMC) and Coursera (NYSE: COUR). Both companies exhibit unique growth opportunities that could turn a modest $100 investment into $1000 by the end of 2024.

AMC Entertainment

AMC Entertainment, one of the world’s largest movie theater chains, has shown remarkable resilience in 2024. Trading around $5.18 per share, AMC has surged 52% over the past three months. This growth is driven by a resurgence in moviegoers returning to theaters, bolstered by the release of major blockbusters.

Additionally, AMC has been diversifying its revenue streams by hosting live events, gaming, and corporate gatherings in its theaters. This innovative approach aims to stabilize and grow its income beyond traditional movie ticket sales.

Moreover, AMC benefits from strong community and investor support. The passionate retail investor base, often called “APE” investors, has bolstered the stock’s performance and provided the company with financial flexibility through shareholder-backed capital raises. With these factors in play, AMC offers substantial potential returns for investors willing to navigate its volatility. A modest investment now could see significant gains if the company’s growth strategies continue to succeed.

The stock is already riding high after a solid second-quarter performance. The company reported quarterly sales of $88.96 million, a 9% decline year-over-year but exceeding the analyst consensus of $76.01 million. Earnings per share (EPS) were $0.18, surpassing the estimated $0.07.

At the same time, Imax has increased its 2024 system installation guidance to 130-150, up from 128 in 2023, to capitalize on new releases from renowned filmmakers and studio franchises. At least 14 films shot with IMAX cameras are expected in 2025, a bullish sentiment for the equity.

Coursera

Coursera, a leading player in the online education sector, is another small-cap stock with significant growth potential. The company has expanded its global footprint through strategic partnerships with top universities and companies worldwide. This broad network enhances Coursera’s course offerings, increasing its appeal to a global audience seeking flexible, high-quality education and professional development.

The rising demand for online education is another key driver of Coursera’s growth. As more individuals seek to upskill and reskill in a rapidly changing job market, Coursera’s user base is expected to grow. The platform offers professional certificates, degree programs, and specialized courses in high-demand fields like data science, AI, and business management. These innovative offerings are tailored to meet market needs, ensuring high enrollment rates and user engagement.

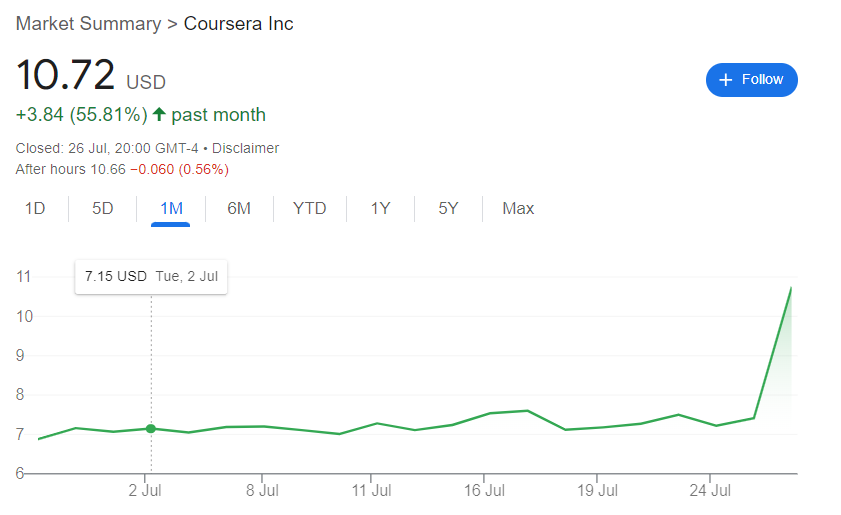

Similarly, Coursera stock is also witnessing massive gains following the company’s strong financials for Q2 2024. Notably, analysts had projected the company would earn a $0.01 per share adjusted profit on sales of $164.4 million. However, it beat both predictions, reporting adjusted profits of $0.09 per share and sales of $170.3 million. Additionally, Coursera grew sales by 11% year over year.

At the close of markets on July 26, the stock was trading at $10, with 24-hour gains of over 44%.

In conclusion, AMC Entertainment and Coursera offer unique opportunities for substantial returns. AMC’s recovery and diversification strategies, combined with Coursera’s expanding market presence, make them promising candidates for high rewards by the end of 2024.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.