The stock market is experiencing significant gains, with major indices reaching record highs. Notably, the Dow Jones, the broader S&P 500, and the NASDAQ have all achieved unprecedented levels. The Dow, in particular, has captured attention by surpassing the 40,000 threshold for the first time in history.

As the first half of 2024 draws close, some stocks still have upside potential and will likely attract increased buying pressure. This potential rally is supported by signs of a cooling economy, easing inflation concerns, and the equities’ underlying fundamentals.

In this context, Finbold has identified two stocks poised to reach a market cap of $200 billion in the first half of 2024.

Cisco

Cisco (NASDAQ: CSCO) remains a dominant force in networking hardware despite its stock experiencing significant fluctuations in 2024. The company is on track to achieve a market capitalization of $200 billion in the first half of 2024, driven by strong financial performance, strategic growth initiatives, and potentially favorable economic conditions.

For example, Cisco’s revenue for the fourth quarter of fiscal 2024 surpassed analysts’ expectations, reaching $12.7 billion. However, this figure represented a 13% year-over-year decline. Net income was $1.88 billion, or 46 cents per share, down from $3.21 billion, or 78 cents per share, in the same quarter last year.

The stock might see further upside as Cisco raised its full-year revenue guidance to between $53.6 billion and $53.8 billion, from the previous range of $51.5 billion to $52.5 billion issued in the second quarter and above analysts’ projection of $53.24 billion.

Additionally, Cisco’s strategic business deals support its push towards a $200 billion market cap. Notably, Cisco recently completed its acquisition of Splunk, an enterprise data infrastructure solutions provider.

As of press time, Cisco’s market cap stood at $195.04 billion, meaning the stock needs an increase of about 2% to hit the milestone.

By press time, CSCO was valued at $48.17 per share, having dropped over 4% in 2024. However, the stock has risen 0.12% over the past month.

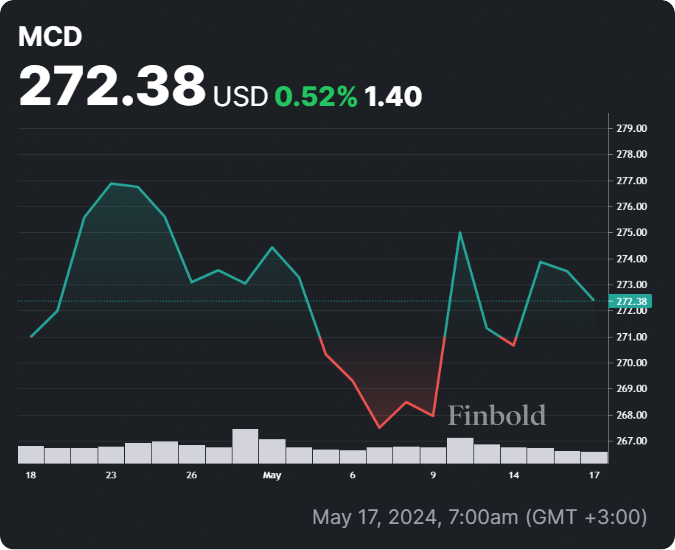

McDonald

While McDonald’s (NYSE: MCD) stock has faced challenges throughout 2024, it is poised to reach the $200 billion market cap milestone, leveraging its enduring fundamentals. The company continues to rely on pillars such as strong financial performance, global expansion, and innovative strategies.

Despite recent hurdles, including boycotts related to its stance on the Middle East conflict, the fast-food giant has consistently delivered robust financial results, with steady revenue growth and significant profitability. However, it’s worth noting that the company’s recent earnings missed analyst estimates.

In the first quarter of 2024, McDonald’s reported a net income of $1.93 billion, or $2.66 per share, up from $1.8 billion, or $2.45 per share, a year earlier. Meanwhile, net sales rose 5% to $6.17 billion, with global same-store sales increasing 1.9%, slightly below estimates of 2.1%.

Amid the boycotts, McDonald’s is implementing new strategies to attract more customers, including the reported launch of a $5 meal deal. The move seeks to entice lower-income customers who were priced out by menu price increases.

Additionally, the company is updating its menu to meet changing consumer preferences, introducing healthier options and plant-based alternatives. McDonald’s strong brand equity and loyal customer base remain crucial assets.

Moreover, McDonald’s is well-positioned to benefit from economic resilience, as fast-food chains typically perform well during economic downturns when consumers seek affordable dining options.

As of now, McDonald’s market cap stands at approximately $196.29 billion, indicating a modest increase of about 2.5% needed to reach the $200 billion milestone.

At press time, McDonald’s traded at $272.38, reflecting a gain of about 0.5% over the past month.

Overall, these stocks will heavily depend on the economic outlook to achieve the $200 billion market cap milestone.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.