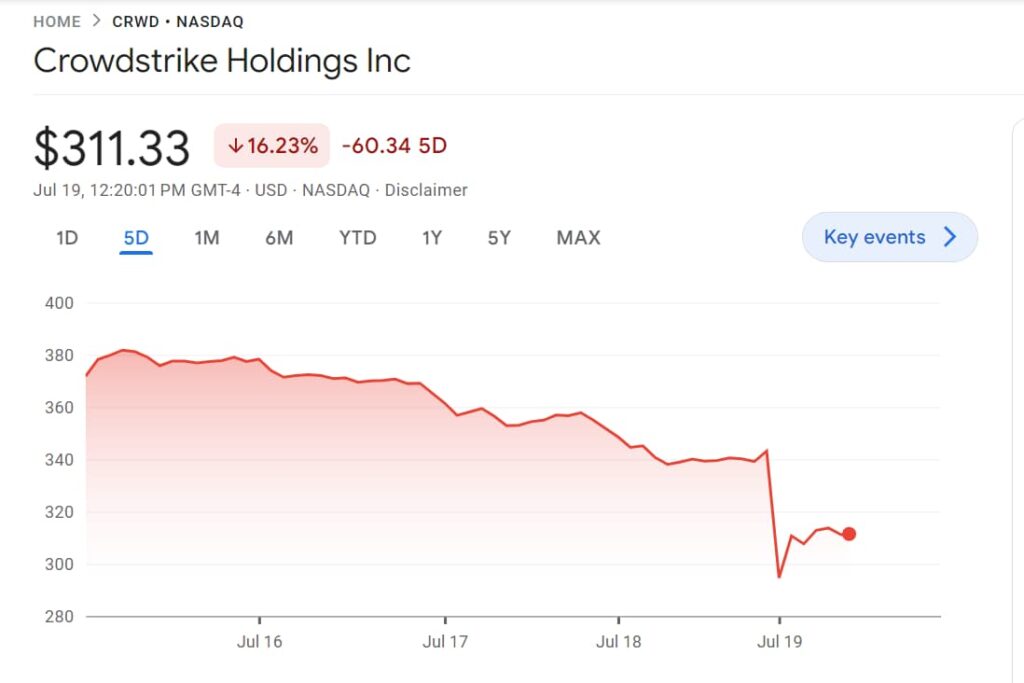

CrowdStrike (NASDAQ: CRWD) stock plummeted nearly 10% today after the opening bell, following a massive outage caused by a software update. This incident brought industries, companies, and businesses worldwide to a standstill.

The stock was down almost 15% in pre-market trading and continued to decline throughout the morning.

This downturn came despite CrowdStrike’s impressive 100% rise over the past year, raising concerns among analysts over its valuation, with the company valued at $83.5 billion as of Thursday’s close.

As CrowdStrike’s stock tumbled, the stock price of other cybersecurity firms saw an uptick. Shares of Palo Alto Networks Inc. (NASDAQ: PANW) rose 2.37% to $331.57, SentinelOne (NYSE: S) rallied 6.95% to $21.54, and Fortinet (NASDAQ: FTNT) climbed 1.19% to $58.82.

Zscaler (NASDAQ: ZS) and Cloudflare (NYSE: NET) were both up around 1% each in premarket trading.

In this context, Finbold analyzed the ongoing trends and tracked down the two best stocks to watch for in the upcoming days.

SentinelOne (NYSE: S) stock

SentinelOne, one of CrowdStrike’s rivals in the cybersecurity space, saw its shares climb 6.95% on Friday morning, following the CrowdStrike outage.

Investors are betting on SentinelOne as a viable alternative amid the outage. SentinelOne generated $186 million in revenue during the fiscal 2025 first quarter, a 40% increase from the year-ago period.

In comparison, CrowdStrike grew its revenue by 33% in its recent quarter, bringing in $921 million.

SentinelOne’s valuation metrics show a market cap of $6.52 billion and an enterprise value of $5.79 billion.

The company’s price-to-sales (PS) ratio stands at 9.70, and its forward price-to-earnings (PE) ratio is a high 333.33, indicating high growth expectations but also significant risk.

With a PB ratio of 4.05, SentinelOne appears expensive, but its rapid revenue growth and recent expansion into the European Union with its Singularity Cloud Native Security platform make it an attractive investment for those seeking high-growth opportunities in the cybersecurity sector.

Fortinet (NASDAQ: FTNT) stock

Fortinet, a leader in cybersecurity and network security convergence, has secured a coveted Challenger position in the 2024 Gartner Magic Quadrant for Single-Vendor SASE.

This recognition underscores Fortinet’s commitment to driving innovation and delivering exceptional customer satisfaction within the rapidly evolving SASE landscape.

On July 18, TD Cowen upgraded Fortinet’s stock from Hold to Buy and set a price target of $75.00, reflecting a positive outlook based on solid channel checks indicating a turning point in the market for security appliances.

Fortinet’s valuation metrics include a market cap of $44.51 billion and an enterprise value of $42.38 billion. The company’s trailing PE ratio is 37.82, with a forward PE of 32.14, suggesting that it is reasonably valued given its growth prospects.

Fortinet’s PS ratio stands at 8.23, and its PEG ratio is 1.79, indicating a balanced valuation relative to its growth rate.

The firm’s strong financial performance, coupled with the positive outlook and recent stock upgrade, make it a solid investment choice in the cybersecurity space.

As the market adjusts to the ramifications of the CrowdStrike outage, investors should keep a close watch on SentinelOne and Fortinet.

These two companies take a unique approach to the ongoing cybersecurity revolution, making their stocks appealing choices among investors and giving them a clear-cut advantage over competitors.

SentinelOne, with its rapid revenue growth and expansion into new markets, presents a high-risk, high-reward investment opportunity. Fortinet, on the other hand, offers a more balanced investment with solid growth prospects and a reasonable valuation.

Both companies are well-positioned to benefit from the increasing demand for cybersecurity solutions, making them attractive alternatives to CrowdStrike.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.