The second half of 2025 is fast approaching, and the stock market is promising a crazy ride with some exciting news hitting the headlines.

If you’re the kind of investor to plan for the long run, strapping in with some value stocks is definitely the way to go amid shifting interest rate expectations and trade tensions.

Accordingly, we’ve pinpointed two companies with promising fundamentals that you should consider in the following months.

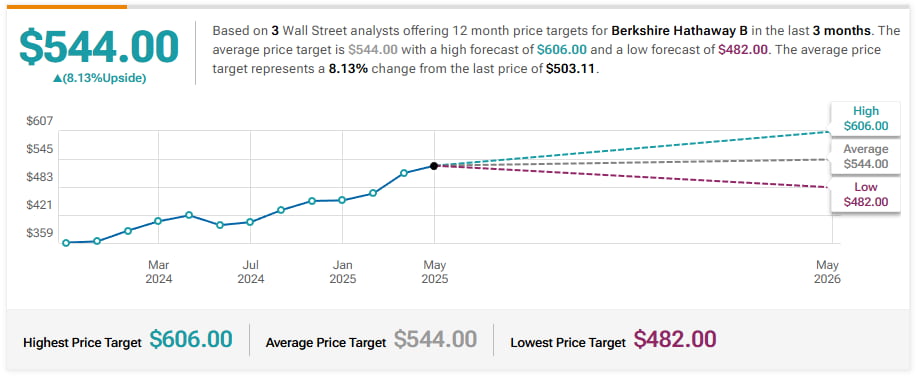

1. Berkshire Hathaway (NYSE: BRK.B)

Berkshire Hathaway (NYSE: BRK.B), the conglomerate holding company run by Warren Buffett, has exposure to everything from utilities to consumer brands.

However, the stock is down 5.88% this month, following the announcement that Warren Buffett would be stepping down as CEO. This is hardly surprising, as Buffett’s six decades of experience were the chief reason to invest for many people.

Still, there is really no real reason to fear that Buffett’s stepping down will significantly impact the company’s prospects. As mentioned, its portfolio is quite diverse, and it’s also known to be recession-resistant.

Indeed, its subsidiaries are built for long-term value, and many of them are well-positioned to benefit from the ongoing market trends, such as artificial intelligence (AI) and renewable energy.

Take Berkshire Hathaway Energy (BHE), for example, a renewable energy leader with 34,000 MW of clean power capacity. As AI and climate policy drive demand for smarter, cleaner grids, BHE could prove a valuable component to the portfolio, especially given its negative cash tax rate of -107%.

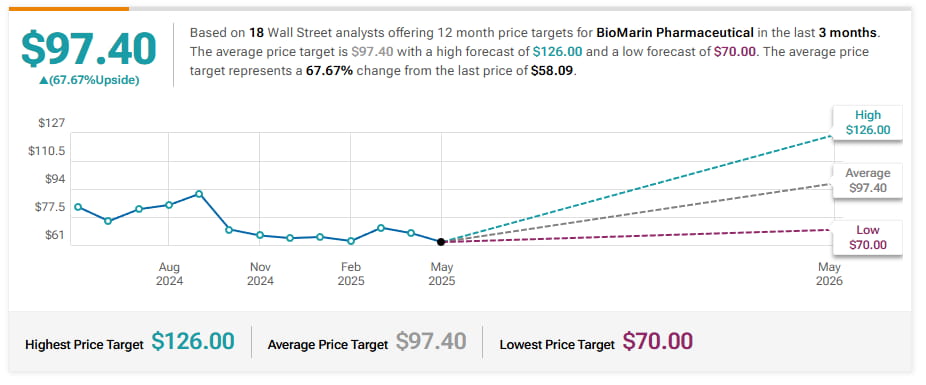

2. BioMarin Pharmaceutical (NASDAQ: BMRN)

BioMarin Pharmaceutical (NASDAQ: BMRN) specializes in developing and commercializing therapies for severe conditions, primarily in children. Accordingly, its pipeline is promising, with ongoing studies for conditions like hypochondroplasia.

While not strictly a classic value stock, BioMarin might still be worth your time, considering some projections indicate a potential growth of 67.7% in the next year.

After all, the company reported a 15% growth for Q1 2025 and a GAAP Diluted Earnings Per Share (EPS) growth of +107% Year-over-Year (YoY). Moreover, it generated operating cash flows totaling $174 million, which was a 271% increase compared to Q1 2024.

It’s also worth noting that its forward price-to-earnings (PE) ratio is 13.85 at the time of writing. Future growth could also be promoted by the recent $270 million acquisition of Inozyme Pharma (NASDAQ: INZY), which is expected to diversifty BioMarin’s pipeline. What’s more, the company has a Debt/Equity ratio of 0.10, suggesting it does not relly heavily on debt to carry its operations.

Since we’re talking about a biotech firm with a solid pipeline, revenues, and margins, this valuation could present an affordable entry point for value-oriented investors eying the sector.

However, there’s a caveat. Namely, BMRN had some of the highest implied volatility of all equity options last month, which suggested investors were anticipating significant price movements. Still, a lot of analysts remain positive, and a number of them have revised their estimates upwards.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Featured image via Shutterstock