Amid rising market volatility and increasing uncertainty over U.S. tariff policies, investors are turning their attention to international dividend-focused ETFs.

As domestic equities come under pressure, these funds have become more attractive by offering broad geographic diversification and consistent payouts, helping investors navigate market downturns.

While dividends may seem less appealing during bull runs, they become a crucial source of returns when markets face volatility. Leading the pack, two Vanguard international ETFs stand out, offering an attractive blend of reliable income and long-term growth while significantly outperforming the S&P 500.

Vanguard Total International Stock ETF

The Vanguard Total International Stock ETF (NYSEARCA: VXUS) is a passively managed fund that seeks to track the investment performance of the FTSE Global All Cap ex US Index.

The fund is designed to measure the equity market performance of developed and emerging markets, excluding the United States.

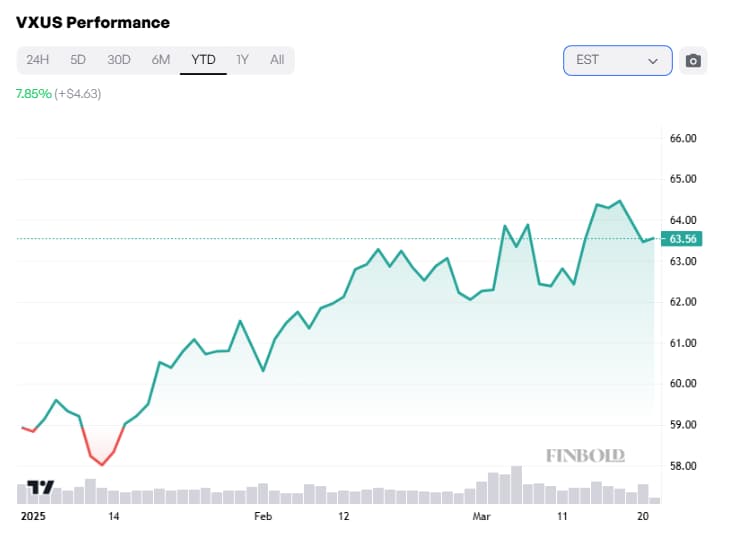

So far this year, VXUS has delivered a solid 7.8% return, with the fund trading at $63.56 per share at press time. It offers broad exposure to global equities, holding 8,580 stocks spanning Europe, emerging markets, the Pacific, and other regions, with Europe commanding the largest portion of the portfolio at 40.10%.

Since its inception in 2011, VXUS has generated an average annual return of 4.63%, with a 5-year return of 7.64% and a 10-year return of 5.02%.

Complementing its long-term performance, the ETF also offers a dividend yield of approximately 3.10%, more than double that of the S&P 500 making it an attractive choice for income-focused investors seeking international exposure.

Vanguard International High Dividend Yield ETF

The Vanguard International High Dividend Yield ETF (NYSEARCA: VYMI) seeks to track the FTSE All-World ex US High Dividend Yield Index. The fund targets companies in developed and emerging markets, excluding the United States, that are expected to offer above-average dividend yields.

So far this year, VXUS has delivered an impressive 10% return, while maintaining strong performance over the long term, returning 7.41% over three years and 9.97% over five years.

Since its inception in 2016, the ETF has averaged an annual return of 8.5%, making it a dependable choice for investors seeking consistent income and long-term portfolio stability.

As of press time, VYMI is trading at $73.81, offering an attractive dividend yield of 4.38%, nearly triple the yield of the S&P 500. The ETF distributes dividends on a quarterly basis, with the latest annual payout totaling $3.27 per share.

Despite its strong performance and consistent dividend payouts, VYMI remains cost-effective, with a low expense ratio of just 0.17% making it a compelling choice for long-term investors seeking global dividend income without high fees.

Featured image via Shutterstock