Although the stock market continues to struggle with bearish sentiment, and the weaker-than-expected labor market report failed to ease investors’ fears about the United States economy, some stocks have the potential to join the exclusive society of the S&P 500 index (SPY) next year.

Indeed, The S&P 500 Index, or The Standard and Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. but also includes other criteria besides market cap, and these three stocks might become part of it.

#1 Palantir (PLTR)

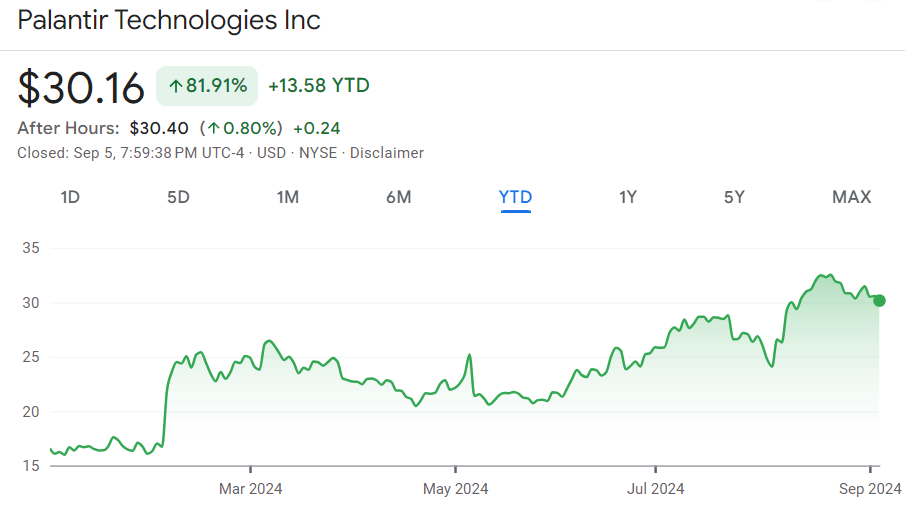

Among the most obvious choices is Palantir (NYSE: PLTR), which meets all the criteria – a U.S. company, a market cap of at least $18 billion (PLTR has $68 billion), and a public float of over 50% of total shares outstanding, boasting high liquidity and positive Palantir earnings in the last quarter, and positive earnings in the four most recent quarters.

Notably, the data analytics and software provider for government and commercial sectors has displayed strong bullish signals in recent weeks, and its price currently stands at $30.16, down 1.41% on the day and losing 1.44% across the week but gaining 13.43% on the month and 81.91% this year.

#2 Coinbase (COIN)

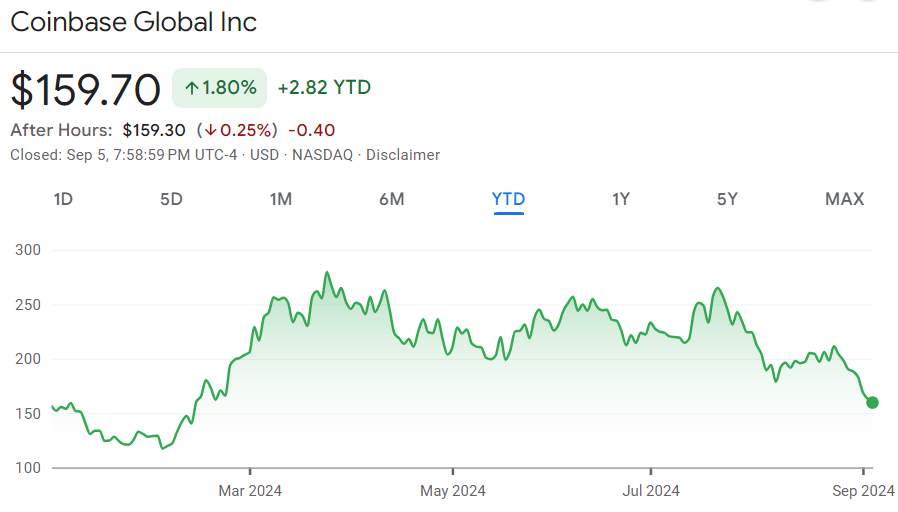

Meanwhile, Coinbase (NASDAQ: COIN) could also make the S&P 500 list, as cryptocurrencies are increasingly present in the mainstream, and every fourth investor is ‘very likely’ to buy crypto assets in some form. Plus, it is a U.S. company with a market cap of $42 billion and nearly $1.4 billion in net income over the past four quarters.

At press time, the stock price of one of the largest cryptocurrency exchanges in the world amounted to $159.70, which illustrates an increase of 1.80% on its daily chart, a decline of 18.01% across the past week, and an accumulated 17.75% drop in the last month, while gaining 1.80% year-to-date (YTD).

#3 The Trade Desk (TTD)

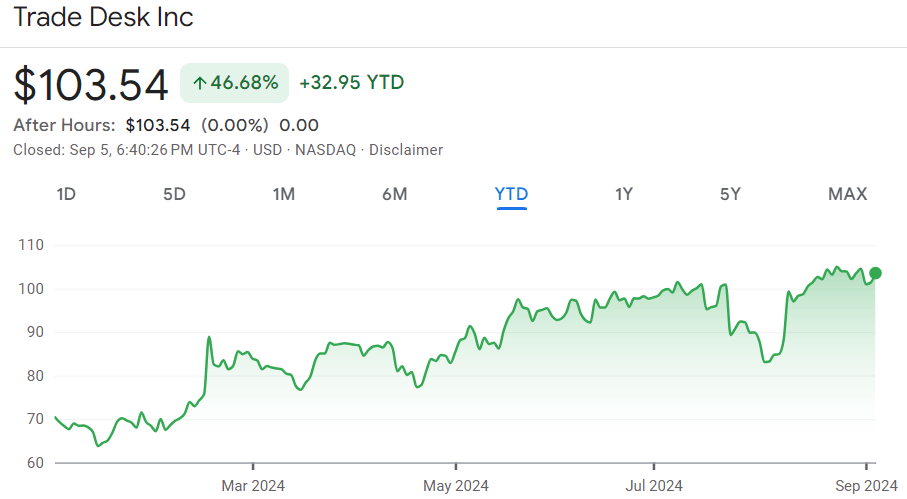

Finally, The Trade Desk (NASDAQ: TTD), a technology company focusing on real-time programmatic marketing products and services with the help of artificial intelligence (AI), is another potential S&P 500 candidate, with a $50 billion market cap, as well as revenue of nearly $1.1 billion and net income of $117 million for the first half of 2024.

In terms of TTD stock’s price, at the moment it stands at $103.54, up 2.16% on the day, gaining 0.62% over the past week, adding up to an accumulated monthly increase of 22.11%, as well as 46.68% advance since the year’s start, as per the latest data on September 6.

Conclusion

All things considered, these three stocks meet most, if not all, the criteria for the S&P 500 commission to introduce them into the index, but time will tell whether they indeed do so by 2025. Regardless of the committee’s decision, doing one’s own research is critical when investing, as trends in the stock market can easily change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.