Veteran trader Peter Brandt, with more than four decades of experience in commodities and futures, has said the recent pullback in gold is creating an attractive long-term buying opportunity.

Notably, gold has surged into early 2026 as safe-haven demand rose amid geopolitical risk, inflation concerns, and sustained central bank buying.

That sharp, extended rally has since been followed by a correction, reinforcing Brandt’s view that investors should avoid chasing momentum after vertical moves.

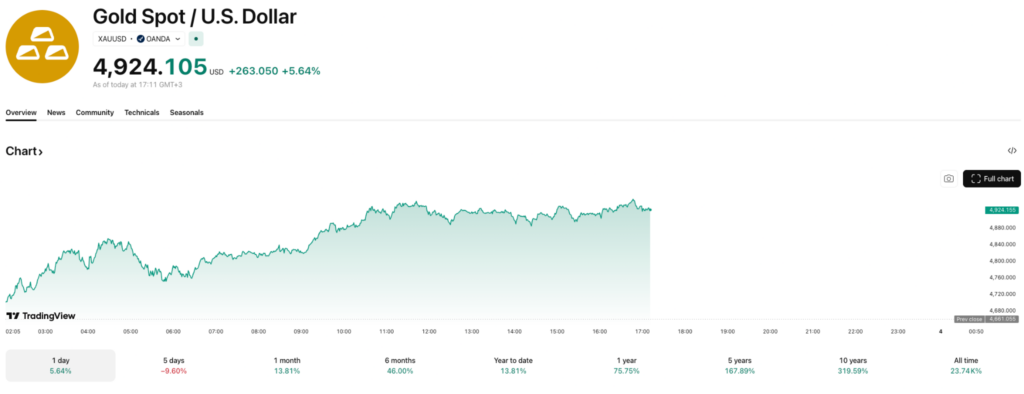

At press time, gold was trading at $4,933, up nearly 6% on the day and about 15% year to date.

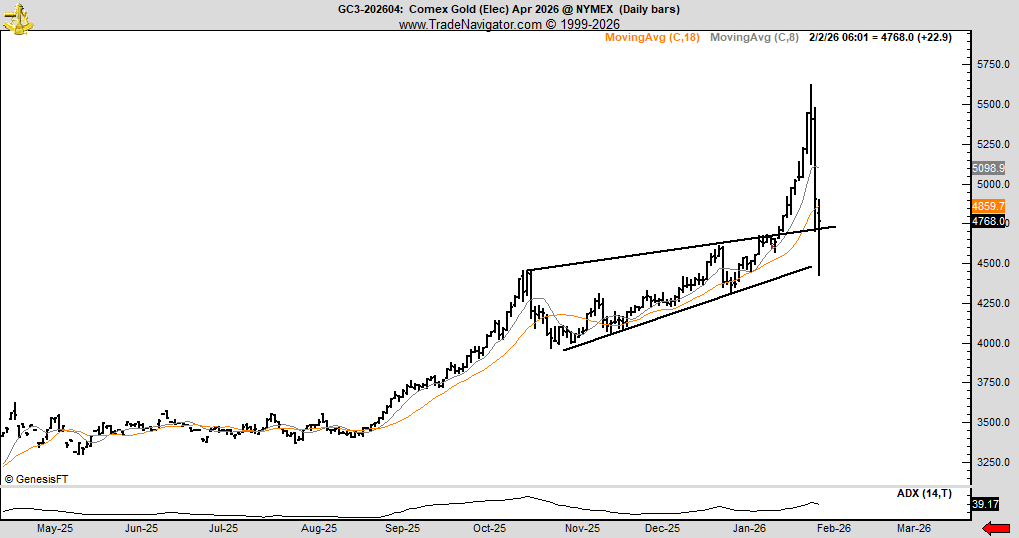

According to Brandt’s February 1 X post, the broader uptrend remains intact despite the sell-off. Gold continues to trade within a rising multi-month channel that began in mid-2025, holding above long-term trend support and key moving averages. He views the pullback as a reset of overbought conditions rather than a breakdown of the bull market.

Brandt sees the most attractive risk-reward below $4,500, where former resistance, channel support, and moving averages converge. While a deeper retracement toward $4,000–$3,700 is possible, he believes the strength of the prevailing trend makes those levels harder to reach.

Gold’s cooling momentum

It’s worth noting that momentum has cooled since the January peak, allowing speculative excess to unwind without breaking gold’s underlying bullish structure. Similar resets in past bull cycles have often been followed by renewed gains.

Brandt views gold as a long-term wealth position, emphasizing patience over short-term trading. With macro tailwinds such as rising debt, currency debasement risks, and ongoing central bank demand intact, he sees pullbacks as healthier entry opportunities than buying near cycle highs, framing the recent decline as a normalization within a strong long-term bull market.

This setup reinforces Brandt’s long-term bullish view, where in January 2026, he said gold could reach $8,000 per ounce if the current bull cycle follows historical patterns, noting such cycles often deliver multi-fold gains.

His stance aligns with broader market optimism, with J.P. Morgan projecting gold averaging $5,055 in Q4 2026, with upside to $6,300 driven by sustained central bank buying. Goldman Sachs has raised its end-2026 target to $5,400, while UBS and Deutsche Bank see potential for $6,000–$6,200 on ETF inflows, physical demand, and fiscal uncertainty.

Featured image via Shutterstock