Going into 2026, the banking giant Standard Chartered was consistently and decisively bullish regarding cryptocurrencies despite the decline from the October 2025 all-time highs (ATH) arguably being in full swing.

Indeed, the British behemoth with some $800 billion in assets under management (AUM) was forecasting very high 2026 year-end prices for multiple digital assets, with XRP – with a predicted rise to $8 – being no exception.

The situation has changed since, and Standard Chartered appears to be capitulating to the prevailing cryptocurrency market winds. In a Thursday note, the banking giant revealed it is slashing its XRP price target by a staggering 65%.

“Recent price action for digital assets has been challenging, to say the least. We expect further declines near-term and we lower our forecasts across the asset class,” the head of Standard Chartered’s head of digital assets research, Geoffrey Kendrick, wrote.

Still, it is notable that, as drastic as a 65% price target cut is, Standard Chartered remains surprisingly bullish about XRP. At press time on February 17, the token was changing hands at $1.45, meaning that the updated forecast for a $2.80 year’s end price still indicates a 91% rally is anticipated.

Standard Chartered still remains bullish on crypto

XRP’s momentum since 2026 started makes such relative optimism somewhat unexpected. Specifically, the cryptocurrency started the year changing hands at $1.84, meaning it had collapsed 20.93% in approximately one and a half months.

On the other hand, Standard Chartered’s $2.80 2026 XRP price forecast is consistent with the bank’s outlook for the greater cryptocurrency market.

For example, the corporation reduced its Bitcoin (BTC) forecast from $150,000 earlier in February but elected to continue predicting a 2026 upside.

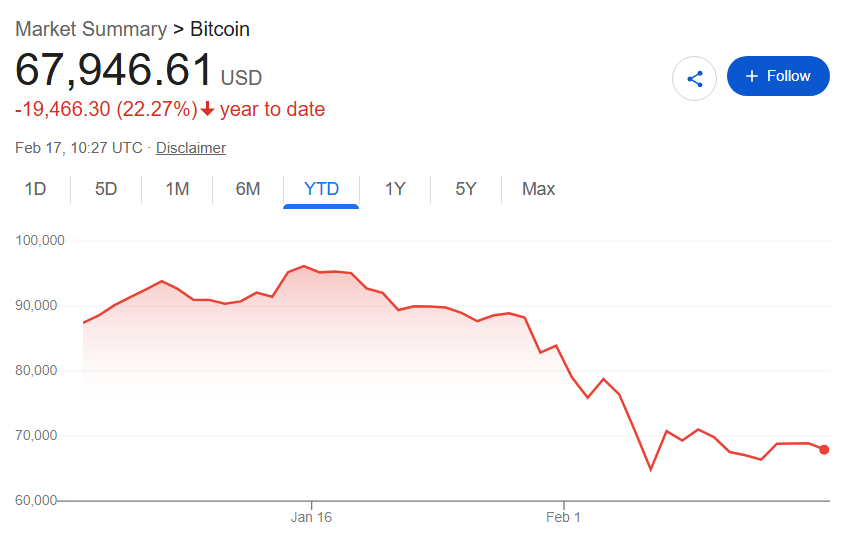

At press time, BTC is trading at $67,946 following a 22.27% year-to-date (YTD) crash.

In stark contrast, Standard Chartered, even after the downward revision, estimates Bitcoin will rally 45% to $100,000 through the rest of 2026.

Featured image via Shutterstock