As the semiconductor industry continues to thrive, fueled by the expanding demand for 5G, artificial intelligence (AI), and the Internet of Things (IoT), Broadcom (NASDAQ: AVGO) remains a standout player.

With a market capitalization of $771.41 billion, Broadcom’s strong performance in both its semiconductor and infrastructure software segments positions it as a key beneficiary of these technological trends.

To shed light on this, Finbold consulted ChatGPT-4 for insights into the stock’s potential performance.

ChatGPT’s prediction on the stock price

According to the AI model ChatGPT-4 by OpenAI, Broadcom’s stock could experience significant movement by the end of the third quarter (Q3) 2024, driven by various market factors and the company’s strategic execution.

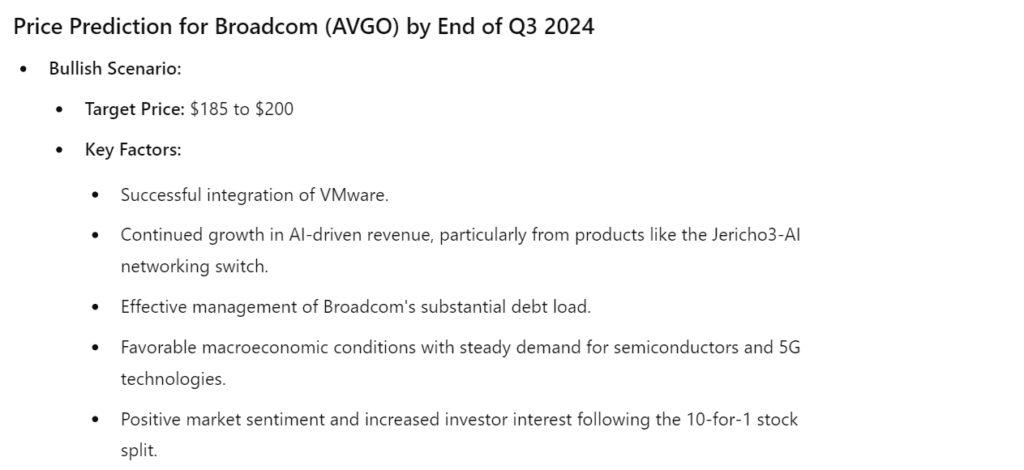

In a bullish scenario, the stock could reach between $185 and $200, propelled by Broadcom’s leadership in AI and 5G technologies, the successful integration of VMware, and strong financial performance.

The rising demand for AI products, along with strategic acquisitions and favorable market conditions, could further boost investor interest, particularly following the stock split.

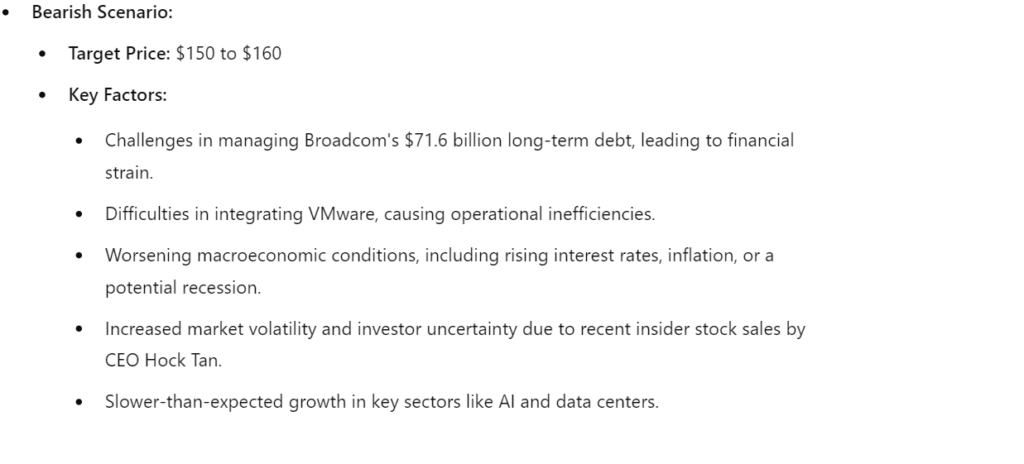

On the other hand, in a bearish scenario, the stock could decline from $150 to $160. This potential downside could stem from challenges in managing substantial debt, inefficiencies in VMware integration, and worsening macroeconomic conditions, which could contribute to market volatility and negatively impact the stock.

Broadcom’s results and fundamentals

Broadcom’s recent financials further underscore its robust position. The company reported a remarkable 43% increase in total revenue, reaching $12.5 billion for the second quarter of 2024.

Additionally, the integration of VMware has significantly bolstered Broadcom’s infrastructure software segment, contributing to a 42% revenue growth forecast for fiscal 2024.

Moreover, Broadcom recently underwent a 10-for-1 stock split in the second quarter of fiscal 2024, aimed at making its shares more accessible to a broader range of investors.

This strategic move, combined with the company’s solid financial performance, has contributed to AVGO stock gaining 41.7% year-to-date, significantly outperforming the tech-heavy Nasdaq Composite’s 18.5% gain.

Key factors affecting Broadcom’s stock price

Looking ahead, several key factors are likely to impact Broadcom’s stock price moving forward. The company’s substantial investments in AI infrastructure, such as the Jericho3-AI networking switch, are expected to drive continued revenue growth.

As AI becomes increasingly integral to various industries, Broadcom’s strong positioning in this sector could significantly boost its stock price. Additionally, the integration of VMware, while strategically beneficial, presents challenges that must be effectively managed to sustain growth and maintain investor confidence.

However, Broadcom has accumulated $71.6 billion in long-term debt due to its aggressive acquisition strategy.

Effectively managing this substantial debt load is crucial to avoid financial strain and maintain investor confidence.

These factors, combined with Broadcom’s leadership in optical interconnects for AI data centers and the development of next-generation switches and optics, ensure that the company remains at the forefront of AI and networking technologies.

Nevertheless, Broadcom’s valuation metrics, including a trailing PE ratio of 72.86, a forward PE ratio of 30.20, and a PEG ratio of 1.68, reflect the company’s growth potential while also indicating a premium valuation.

These metrics suggest that while Broadcom is positioned for continued growth, the stock’s current price already factors in a significant level of expected future performance, making the effective execution of its strategic initiatives crucial for maintaining investor confidence.

Given these challenges and opportunities, investors are left wondering how Broadcom will perform in the third quarter of 2024.

Ultimately, Broadcom’s stock price by the end of Q3 2024 will hinge on how effectively the company navigates its growth opportunities and challenges.

The roles of AI and 5G technologies will be crucial in determining its future success. Investors should closely monitor these developments to assess the stock’s trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.