Ethereum (ETH) has captured the attention of investors this month with its sharp price movements. As of August 16, Ethereum is trading around $2,576, following a significant rally earlier in the month.

This upward momentum saw Ethereum climb from $2,200 to $2,770, marking a remarkable 31% increase in just ten days. However, the road ahead for Ethereum is fraught with both bullish opportunities and bearish risks, making its price outlook for the end of the month particularly intriguing.

In this context, Finbold has leveraged ChatGPT-4, OpenAI’s most recent and advanced AI chatbot model, to offer insights into how Ethereum is likely to trade by August 31, considering the key factors influencing its future price trajectory.

Key factors influencing Ethereum’s price

Several critical factors are currently shaping Ethereum’s price trajectory, which could drive significant movement in the coming weeks.

Firstly, the recent U.S. Consumer Price Index (CPI) data, released on August 14, showed a year-over-year increase of 2.9%, slightly below the expected 3.0%. This suggests that inflation is cooling, which could lead the Federal Reserve to adopt a more dovish stance, potentially lowering interest rates.

Lower rates generally benefit risk assets like Ethereum, as they make traditional investments like bonds less attractive, driving investors towards higher-yielding options like cryptocurrencies.

Moreover, another factor supporting Ethereum’s bullish case is the significant reduction in gas fees on its network.

Gas fees, which are the transaction costs users pay to use the Ethereum network, have dropped to unusually low levels, recently dipping to 0.9 gwei for low-priority transactions.

Historically, such a drop in fees has often signaled a price bottom, as it suggests reduced congestion and transaction costs, making the network more attractive to users and developers. Lower fees can encourage more activity on the Ethereum network, driving up demand for ETH tokens, which could further support its price.

However, on the bearish side, Ethereum exchange-traded funds (ETFs) have seen substantial outflows, with Grayscale’s ETHE experiencing a $42.5 million withdrawal.

This trend could indicate a shift in investor sentiment, leading to decreased demand for Ethereum in the short term.

Additionally, Jump Trading, a major crypto market maker, has resumed selling large amounts of Ethereum, offloading over 17,000 ETH worth $46.44 million, according to sources.

If this selling continues, it could trigger a broader market correction, putting significant downward pressure on Ethereum’s price.

ChatGPT-4’s Ethereum price prediction

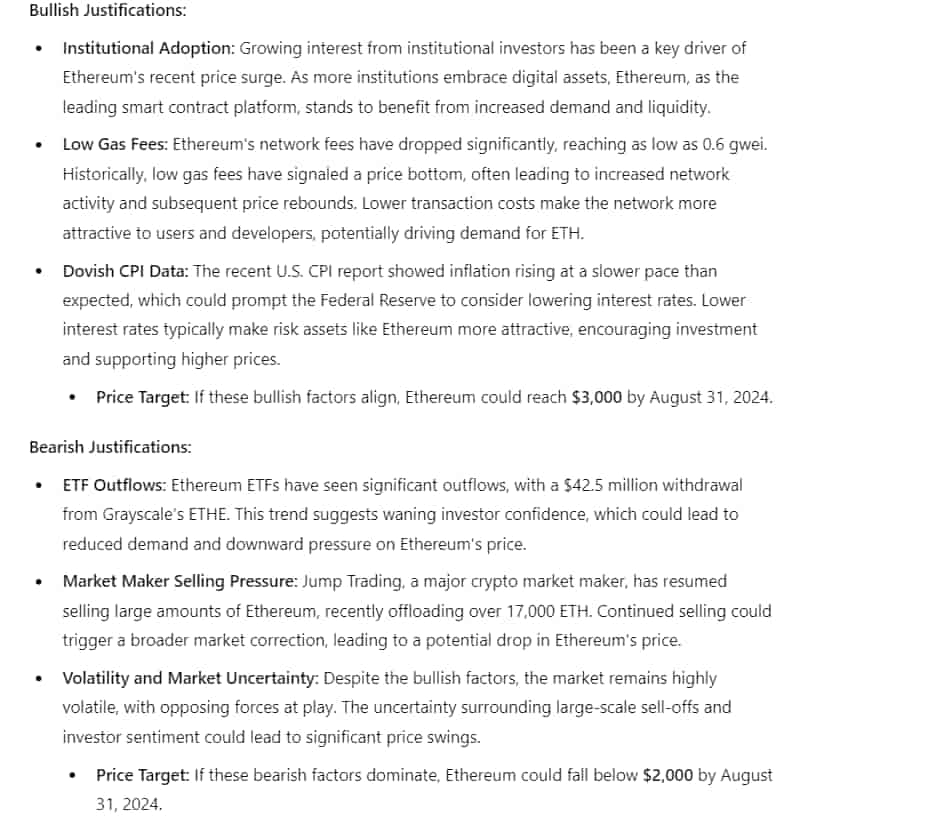

According to ChatGPT-4, by August 31, 2024, Ethereum’s price could experience significant volatility. In a bullish scenario, ETH could reach a target of $3,000, driven by strong institutional adoption, low gas fees, and dovish economic signals.

Conversely, a bearish scenario might see ETH fall below $2,000 due to ETF outflows, market maker selling pressure, and overall market uncertainty.

In conclusion, Ethereum’s price outlook for the end of August 2024 is shaped by a mix of bullish and bearish factors.

While the potential for further gains exists, driven by institutional adoption, low gas fees, and favorable economic conditions, significant risks remain, particularly from ETF outflows and large-scale selling by key market players. Investors should be prepared for a volatile ride as Ethereum navigates these complex market dynamics, with a potential upside of $3,000 or a downside risk below $2,000 by August 31.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.