In the wake of a worldwide IT outage, Fortinet (NASDAQ: FTNT) has emerged as a key player in the cybersecurity sector.

While Microsoft (NASDAQ: MSFT) operating systems using CrowdStrike (NASDAQ: CRWD) experienced crashes due to a faulty update, Fortinet saw its stock price rise. Fortinet’s stock climbed 1.19% to $58.82 as investors sought alternatives to CrowdStrike.

Fortinet has garnered significant investor attention, partly due to its upcoming financial results for the fiscal quarter ending June 30, 2024. These results are scheduled for release after the markets close on Monday, August 12, 2024. Currently, Fortinet’s stock is priced at $57.20, reflecting a decrease of 1.5% in the past 24 hours.

Picks for you

Fortinet’s strong market presence is evident from its recent recognition in the 2024 Gartner Magic Quadrant for Single-Vendor SASE, highlighting its innovation and customer satisfaction in the cybersecurity landscape.

Despite facing a decline due to slower revenue growth and falling billings, Fortinet reported solid Q1 results with $1.35 billion in sales and $0.43 EPS.

The company’s expanding Unified SASE service, now accounting for 24% of billings, promises significant long-term growth.

Additionally, Fortinet serves over 755,000 clients and achieved $1.41 billion in Q1 2024 revenue, maintaining a 33% free cash flow margin and consistent annual growth above 20% since 2020.

Key factors affecting Fortinet’s stock price

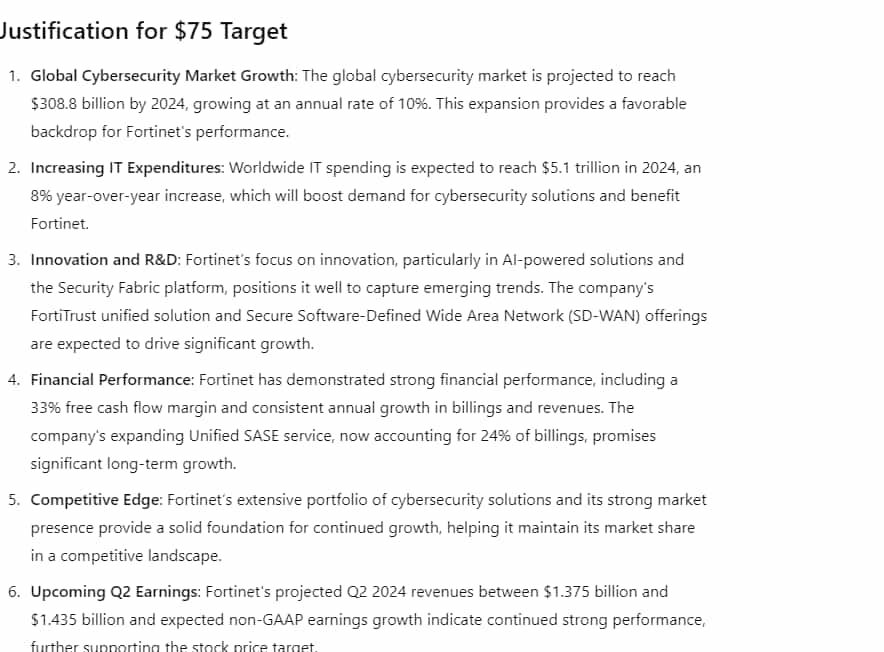

According to sources, the global cybersecurity market is projected to reach $208.8 billion by 2024, growing at an annual rate of 10%. Fortinet’s expanding market potential, expected to grow from $150 billion to $208 billion by 2027, will likely drive stock price growth.

Moreover, worldwide IT spending is expected to reach $5.1 trillion in 2024, an 8% year-over-year increase, boosting demand for cybersecurity solutions, benefiting Fortinet.

Fortinet’s focus on innovation, particularly in artificial intelligence (AI) powered solutions and the Security Fabric platform, positions it well to capture emerging trends.

The company’s FortiTrust unified solution and Secure Software-Defined Wide Area Network (SD-WAN) offerings are expected to drive significant growth.

Despite recent challenges, Fortinet’s strong financial performance, including a 33% free cash flow margin and consistent annual growth in billings and revenues, underscores its resilience and potential for recovery.

Fortinet operates in a fiercely competitive market, contending with industry giants like Palo Alto Networks Inc. (NASDAQ: PANW) and Cisco Systems (NASDAQ: CSCO). The company’s ability to maintain its market share and innovate will be crucial in determining its stock price trajectory.

Additionally, Fortinet faces challenges from macroeconomic uncertainties, including fluctuations in IT spending and economic downturns, which can impact the company’s performance and, consequently, its stock price.

The company’s performance is expected to be driven by the increasing adoption of its

Fortinet’s secure SD-WAN offerings, and the strong demand for FortiGuard security subscriptions and FortiCare technical support services are expected to drive significant growth in its evolving landscape.

In light of these events, ChatGPT-4o, OpenAI’s most advanced AI tool, forecasts Fortinet’s potential stock price for the end of 2024.

ChatGPT-4o’s prediction on Fortinet stock price

Considering the above factors, ChatGPT-4o predicts Fortinet’s stock will reach approximately $75 by the end of 2024, reflecting the company’s potential to capitalize on the growing demand for cybersecurity solutions.

Fortinet’s consistent innovation in AI-powered solutions and a solid presence in the expanding cybersecurity market underpin its growth potential.

The projected increase in global IT spending, coupled with Fortinet’s expanding Unified SASE service, positions the company favorably for sustained growth.

Strong financial metrics, including a 33% free cash flow margin and consistent annual revenue growth above 20% since 2020, further support this optimistic price target.

Investors should closely monitor upcoming earnings reports and user engagement trends to gauge the platform’s performance and potential for future growth.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.