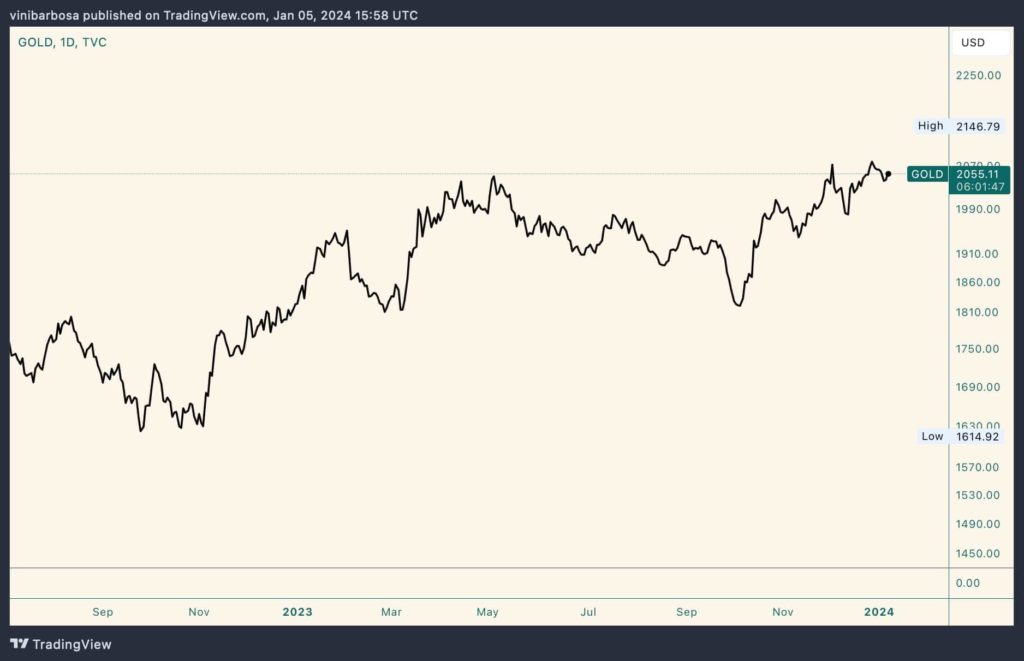

Gold has retrieved its historical uptrend against the U.S. Dollar (USD), currently trading at $2,055 per ounce (oz). This marks a surge superior to 25% since the 2022 Q4 lows, again validating its properties as a store of value.

As one of the leading commodities, Gold shines in industry and is a timeless store of value. Industries covet it for its excellent conductivity, resistance to corrosion, and malleability. Meanwhile, investors treasure Gold for hedging against inflation, currency fluctuations, and portfolio diversification benefits.

Notably, gold reached an all-time high of $2,146.79/oz on December 4, 2023, according to TradingView’s index. This renewed the excitement of Gold enthusiasts and investors worldwide, who turned their eyes back to the historical commodity.

ChatGPT-4 forecasts the price of Gold for the end of 2024

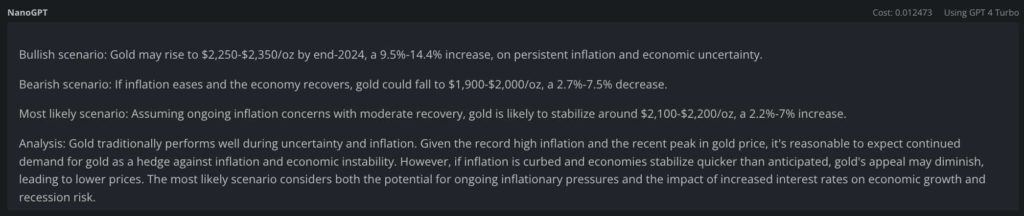

In this context, Finbold turned to a GPT-4 Turbo chatbot, asking for a price prediction of Gold for the end of 2024.

The advanced artificial intelligence (AI) model provided three forecasts. Particularly, pricing Gold between $2,100 to $2,200 per ounce, a 2.2%-7% increase, as the most likely scenario.

Moreover, Gold could reach a range of $2,250-$2,350/oz by the end of 2024 (9.5%-14.4% increase) from a bullish perspective. In the meantime, $1,900-$2,000/oz, a 2.7%-7.5% decrease, is also possible in a bearish outlook.

“Gold traditionally performs well during uncertainty and inflation. Given the record high inflation and the recent peak in gold price, it’s reasonable to expect continued demand for gold as a hedge against inflation and economic instability. However, if inflation is curbed and economies stabilize quicker than anticipated, gold’s appeal may diminish, leading to lower prices. The most likely scenario considers both the potential for ongoing inflationary pressures and the impact of increased interest rates on economic growth and recession risk.”

— GPT-4 Turbo

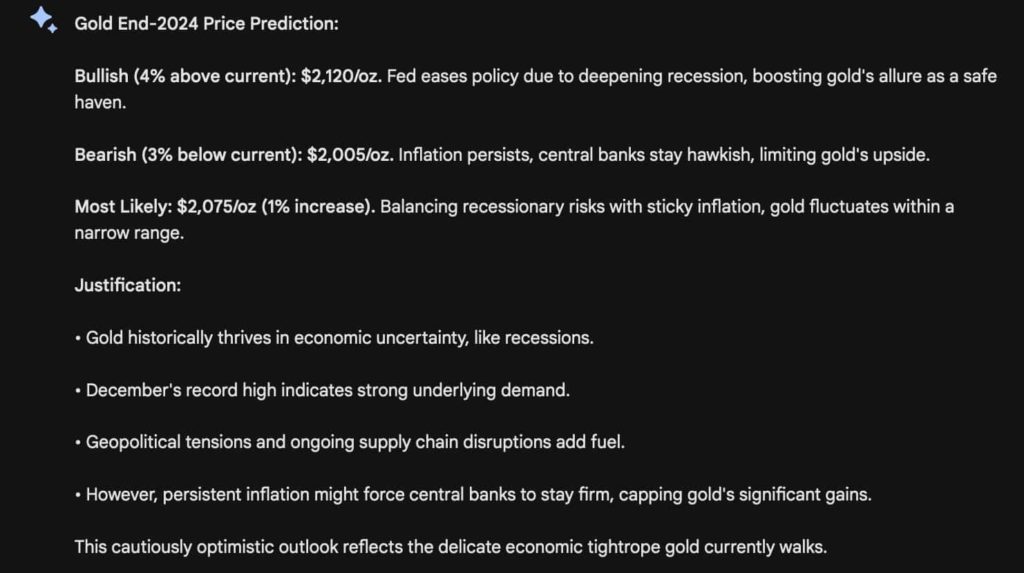

Google Bard predicts Gold price in USD

Similarly, Google Bard’s AI sees Gold at $2,075 per ounce by the end of 2024, surging 1% from current prices. As for the bullish and bearish forecasts, Bard prices Gold at $2,120/oz (+4%) and $2,005/oz (-3%), respectively.

“Despite reaching record highs fueled by recession fears and safe-haven demand, gold’s 2024 outlook remains delicately balanced. Inflationary pressures might keep central banks hawkish, limiting significant gains, but deepening recession could trigger policy easing, boosting gold’s allure. Expect a tight trading range around $2,075/oz, with potential upside to $2,120/oz if the Fed pivots, or downside to $2,005/oz if inflation remains fierce.”

— Google Bard

However, it is important to understand that artificial intelligence can make mistakes. The above Gold price predictions for 2024 consider historical data and limited knowledge consolidated through logic. Therefore, investors must not take these predictions as an absolute truth and always consider further information to make better financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.