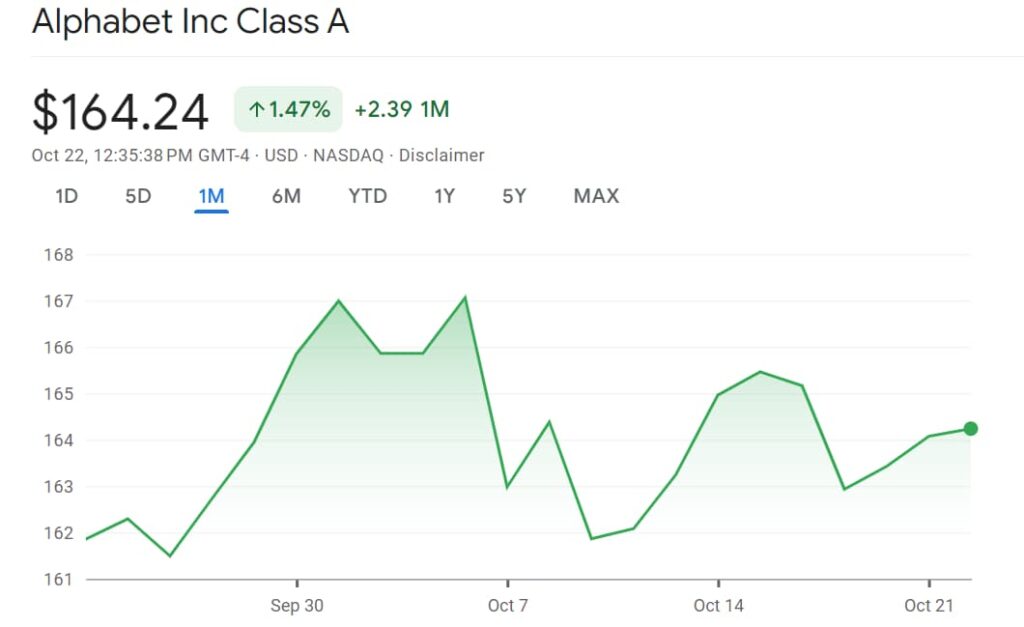

After reaching an all-time high of $192 in early July, Alphabet Inc. (NASDAQ: GOOGL) has experienced a pullback due to a mix of antitrust pressures and growing competition in the artificial intelligence (AI) landscape.

With Alphabet’s Q3 earnings report set for release on October 29, investors are eagerly awaiting insights into how these developments are affecting the tech giant’s outlook.

Currently trading at $164, with a modest 1% gain over the past month, investors are left wondering where Google’s stock will land by the end of 2024.

To provide a clearer outlook, Finbold consulted OpenAI’s ChatGPT-4o, which predicted that Google could see its stock price reach between $170 and $190 by the end of 2024, driven by several key factors.

Key factors impacting Google’s stock price

Legal uncertainty and antitrust concerns

A significant overhang for Google is the ongoing antitrust case brought by the U.S. Department of Justice, accusing the tech giant of maintaining an illegal monopoly in search and text advertising.

Google recently achieved a temporary victory by securing a delay in the enforcement of court-mandated remedies related to its Play Store.

This decision is part of a broader legal battle involving game developer Epic Games and companies like Google, Apple, and Samsung over the availability of third-party app stores on their platforms.

Although Google has had some success in the courts, the legal challenges are far from over, and a potential adverse outcome could have long-term implications for the company’s core business.

AI dominance and growth opportunities

Google’s dominance in the search engine market is being eroded by emerging AI competitors like Perplexity and OpenAI’s ChatGPT. eMarketer predicts Google’s U.S. search ad market share will drop below 50% for the first time in over a decade by next year.

Despite increasing competition, Google has made significant moves in AI. A recent partnership with Honeywell stands out, with Google’s Gemini AI poised to revolutionize industrial efficiency for the manufacturing giant.

“By combining Google Cloud’s AI technology with our deep domain expertise–including valuable data on our Honeywell Forge platform–customers will receive unparalleled, actionable insights bridging the physical and digital worlds to accelerate autonomous operations, a key driver of Honeywell’s growth,” said Vimal Kapur, Honeywell CEO

This collaboration marks Google’s push beyond its core search business, tapping into industrial AI applications to create new revenue streams. While concerns over AI disrupting Google’s core business persist, these strategic partnerships offer a promising path for future growth.

Waymo’s autonomous vehicle expansion

Alphabet’s autonomous vehicle division, Waymo, continues to lead the robotaxi race despite stiff competition. Tesla’s (NASDAQ: TSLA) recent underwhelming robotaxi event has only boosted Waymo’s lead, with analysts predicting that Waymo could significantly scale its operations well ahead of Tesla becoming a serious contender.

Notably, Wall Street analysts have yet to fully account for Waymo’s growth in Alphabet’s overall valuation. This suggests there is untapped upside potential if Waymo continues to execute its strategy successfully, offering a promising avenue for Alphabet’s long-term growth.

AI prediction for Google stock by year-end

Given these factors, AI-driven models predict that Google’s stock could reach $190 by the end of 2024. This projection assumes that Google’s legal challenges don’t escalate and that Waymo’s expansion gains further traction, offsetting the pressures from rising AI competition.

However, if antitrust rulings and AI rivals further erode Google’s market share, a more conservative year-end price closer to $170 is possible, representing a modest increase from the current price of $164.

In conclusion, Google’s stock trajectory for the rest of 2024 will depend on how well it navigates legal challenges and AI competition while capitalizing on growth opportunities in its AI and autonomous vehicle divisions.

Investors should watch for further developments, particularly around the October 29 earnings report, which could provide crucial insights into Alphabet’s future.