Tesla’s stock (NASDAQ: TSLA) is soaring in reaction to Donald Trump’s election win, raising questions about the long-term performance of the equity given that CEO Elon Musk has close ties to the president-elect.

Trump’s win boosted TSLA when the stock retraced gains made after the better-than-expected Q3 earnings.

By the end of the latest trading session, the electric vehicle maker’s share price was valued at $288.53, up almost 15% for the day. This increase has turned Tesla positive year-to-date, with the equity up 16%.

Picks for you

However, after an impressive post-election rally, TSLA’s share price is showing some weakness, down 0.65% in pre-market trading on November 7.

Tesla’s momentum may be attributed to Musk’s role in Trump’s re-election campaign, as investors anticipate that the victory could be bullish for TSLA.

At the moment, it remains to be seen what impact Trump will have on the EV market after he officially assumes office in January 2025.

Trump is expected to reduce the EV sector’s government rebates and tax incentives. Although this is seen as a bearish move, analysts like Wedbush Securities’ Dan Ives believe Tesla will be less affected, relying on its market dominance to stay afloat.

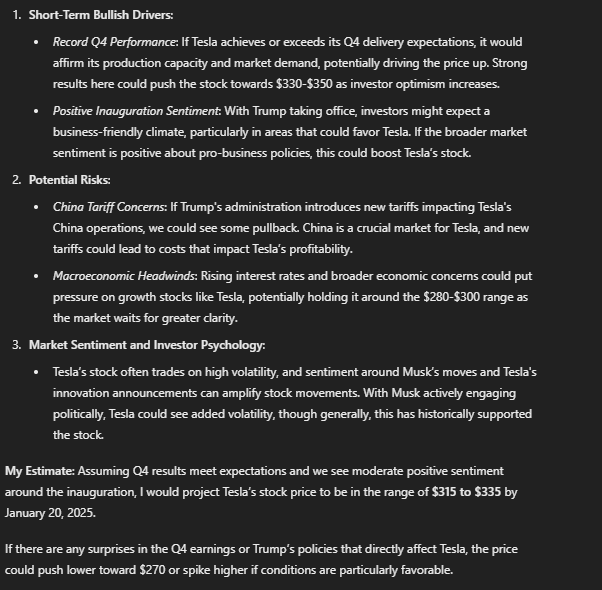

AI sets TSLA share price for January 20, 2025

With this in mind, the question remains whether Tesla can sustain its current momentum until Trump assumes office. Therefore, Finbold consulted OpenAI’s ChatGPT-4o for insights on the EV maker share price for January 20.

ChatGPT noted that several factors, such as the Q4 2024 earnings report, could impact Tesla’s price ahead of the inauguration. If the results are impressive, this could signal more bullishness for the stock.

Alternatively, if Trump’s administration brings expectations of a business-friendly climate favoring EVs and positive market sentiment, it could push Tesla past the current resistance point of $300.

To this end, ChatGPT-4o predicted Tesla will trade between $315 and $350 by January 20.

This projection aligns with Ives’ estimate, suggesting that Trump’s win could add at least $40 to Tesla’s share valuation, potentially reaching a $1 trillion market cap.

However, if Trump maintains his stance on tariffs, Tesla could face headwinds. The stock could suffer if these tariffs impact Tesla’s operations in China. The AI tool anticipates that Tesla could drop to $270 in this challenging market environment with bearish sentiment.

Aside from potential Trump-related influence, Tesla still needs to reassure investors of its commitment to critical projects.

Investor interest will focus on updates regarding full self-driving technology and the ‘Cybercab’ rollout, especially after a disappointing ‘Robotaxi’ event.

Additionally, there will be attention to Tesla’s advancements in AI, especially with Musk noting that “Tesla FSD is now almost entirely AI-driven.”

What next for Tesla stock price

Tesla’s main challenge is breaching the $300 resistance zone, a target that a Finbold report based on AI insights noted could be achieved in early 2025.

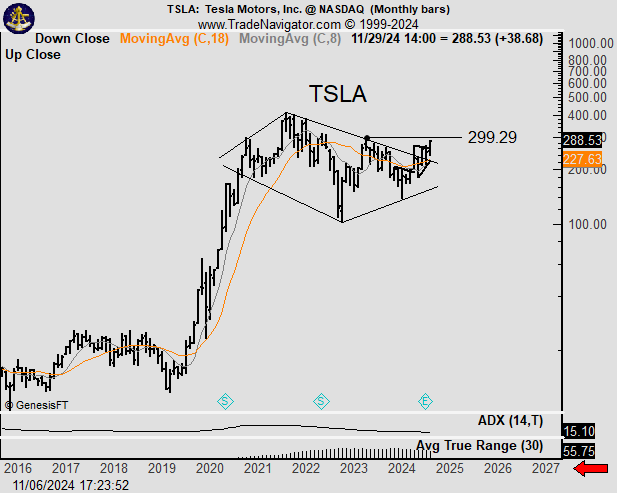

From a technical perspective, trading expert Peter Brandt observed in an X post on November 7 that TSLA is forming a substantial continuation pattern.

The stock has been trading within a ‘diamond pattern,’ which, depending on the breakout direction, could indicate either continuation or reversal.

This pattern has developed over recent years, suggesting a period of consolidation following Tesla’s rapid growth from 2019 through 2021. After the recent rally, Tesla has approached $299.29 resistance, and a breakout above this level could lead to further gains.

Finally, with Trump’s win, Tesla appears to be poised for a sustained rally in the coming months, with the $300 level as a critical test. Once the chatter on Trump’s re-election subsides, attention will return to Wall Street, as most analysts had offered a mixed outlook before the election.

Featured image via Shutterstock