Electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) is still waiting for Chinese authorities to approve its Full Self-Driving (FSD) technology, which has been touted to positively impact the firm’s equity.

As it stands, Chinese authorities are reportedly reviewing the technology, focusing on elements such as data safety and compliance with laws. Tesla had indicated that the system could be in place within the first three months of 2025, with the Asian economic giant primarily concerned with data security.

Indeed, the FSD garnered more attention during the October 10 Robotaxi launch, when the company showcased the integration of the technology in its new and upcoming vehicles. Some analysts believe this technology will allow Tesla to showcase its ability in the artificial intelligence scene, which could affect TSLA’s share price.

AI predicts Tesla stock price

Considering the size and significance of the Chinese market, any delay in the FSD rollout could impact investor interest. Therefore, to determine how TSLA might trade in the wake of these developments from China, Finbold consulted OpenAI’s ChatGPT-4o.

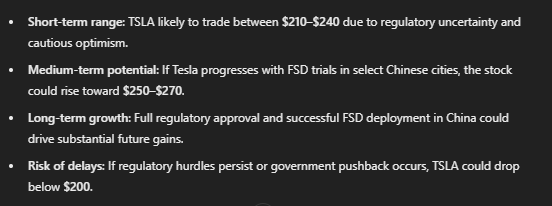

According to the AI platform, the regulatory hurdle in China could affect TSLA both in the short and long term. As the regulatory review continues, Tesla could remain in the $210 to $240 range, reflecting cautious optimism.

However, if the Texas-based firm demonstrates significant progress towards approval (e.g., successful trials in Chinese cities), the stock could reach $250 to $270 in the medium term, according to ChatGPT-4o.

Longer-term success would depend heavily on regulatory clearance, partnerships with local Chinese firms, and actual FSD deployment, potentially driving the stock significantly higher.

Conversely, delays or government pushback could pressure the stock downward, possibly below $200.

FSD facing concerns in the United States

On the other hand, as Tesla seeks approval in China, the company is facing hurdles in the United States. This follows revelations that authorities are investigating a series of crashes—one of them fatal—involving cars equipped with FSD technology.

To this end, Tesla needs to reassure investors that the technology is viable for the long term since it remains one of the critical fundamentals for the company heading into 2025. Notably, the EV giant will showcase FSD capabilities in current models, such as the Model 3 and Model Y, in 2025.

To this end, analysts maintain that FSD’s success in these models will signal what to expect from the Cybercab.

The company also received criticism at the ‘We, Robot’ event, where it showcased its advancements in autonomous driving. Some analysts expressed disappointment with the event, noting that it did not meet expectations as Elon Musk failed to provide a clear road map for the technology.

Despite this, there remains some optimism that autonomous driving could elevate Tesla to a $1 trillion valuation.

What next for TSLA share price

At the moment, Tesla’s share price is attempting to maintain its valuation above the $200 support level after investors failed to react positively to the Robotaxi event. As of press time, TSLA was valued at $220, gaining about 0.02% in the past 24 hours. The equity has made modest gains of about 0.7% on the weekly chart.

Regarding the technical outlook, a stock trading expert with the pseudonym Scot1and’s analysis in an X post on October 18 observed that TSLA has entered a rare trading phase, with the price action tightening over the past several sessions.

The equity has fluctuated narrowly, hovering around the $220–$222 mark, with key support at $216 and resistance at $222. Meanwhile, overhead resistance levels are becoming apparent, particularly at $230. Therefore, a breakout above the $222 mark could push Tesla toward the next resistance level at $230, but failure to do so could send it back to test support at $216.