Although XRP is experiencing renewed bearish sentiment and trading below the $2 spot level, insights from an artificial intelligence (AI) model suggest the token could recover by Q1 2026.

To assess how XRP might trade in the first three months of the new year, Finbold turned to OpenAI’s ChatGPT, which outlined several scenarios.

According to the model, XRP’s performance during the period will likely be influenced by institutional activity via exchange-traded funds (ETFs), macroeconomic trends, and overall crypto market sentiment.

Under ChatGPT’s base-case scenario, which is considered the most likely outcome, XRP is projected to trade between $3 and $4.50 in Q1 2026. This outlook assumes continued stabilization above key support levels and a gradual improvement in market confidence.

The model suggested XRP’s consolidation toward the end of 2025 could provide a foundation for a move above $3 early in the new year, with prices potentially testing the $4 area if broader sentiment remains constructive.

XRP bullish scenario

In a bullish scenario, ChatGPT projects that XRP will trade in the $4.50- $6 range during the first quarter. This outcome is linked to increased institutional inflows, broader adoption of Ripple’s ecosystem, and improved regulatory clarity. If these factors align with a broader crypto market upswing, the model indicated that XRP could gain sufficient momentum to challenge multi-year highs.

On the downside, ChatGPT outlined a bearish or consolidation scenario in which XRP trades between $2.20 and $3. In this case, lingering macroeconomic uncertainty, reduced risk appetite, or slower capital inflows into crypto markets could limit upside. The model added that XRP could remain range-bound during Q1 if investors wait for clearer confirmation before re-entering the market.

Meanwhile, ChatGPT highlighted several variables that could shape XRP’s Q1 2026 trajectory, including the pace of institutional participation through ETFs, shifts in global liquidity conditions, and developments in crypto regulation.

Technical market structure and Bitcoin (BTC)-led market direction were also flagged as critical factors that could amplify or suppress XRP’s price movement.

XRP price analysis

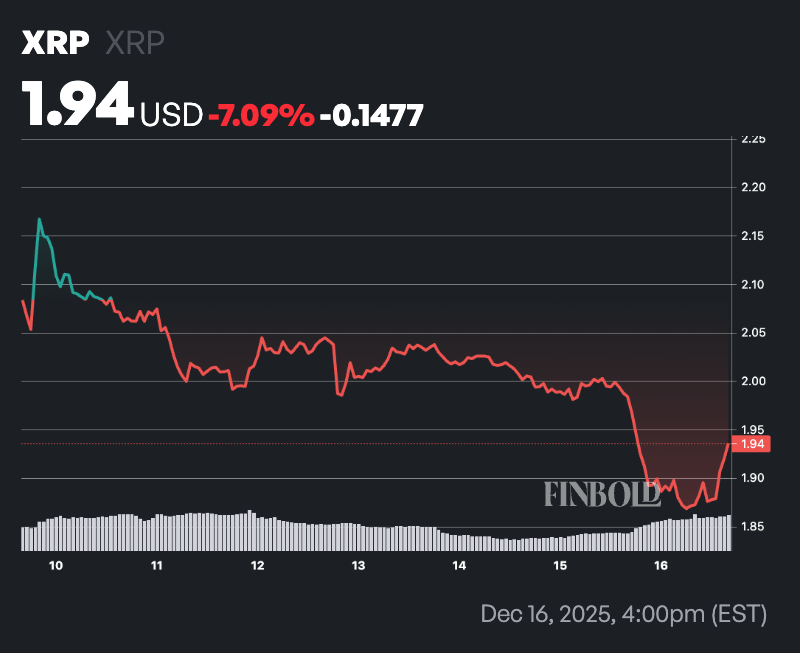

By press time, XRP was trading at $1.94, down about 2.5% over the past 24 hours, while on the weekly timeframe, the asset is lower by more than 7%.

Notably, XRP is trading well below both its 50-day SMA of $2.24 and its 200-day SMA of $2.58. This position below key moving averages confirms a clear bearish trend, with the price losing ground against both short- and long-term momentum.

Meanwhile, the 14-day RSI stands at 35.32, in neutral territory but closer to oversold than overbought. While not yet signalling an extreme condition, the reading reflects persistent selling pressure and limited buying interest.

Featured image via Shutterstock