Semiconductor companies have been on a steady and rather rapid upward climb in the last two years — primarily because of the rapid expansion of artificial intelligence. Returns have been stellar throughout 2024, with Nvidia (NASDAQ: NVDA) arguably raking in the lion’s share of the gains.

The Jensen Huang-led tech titan currently has a market capitalization of approximately $3.34 trillion — with many expert analysts speculating that it could end up being the first company with a $4 trillion valuation.

At press time, NVDA stock was trading at $136.59 — on a monthly basis, the stock is up 6.94%, bringing year-to-date (YTD) returns up to 183.57%.

Current prices are very close to the company’s all-time high (ATH) of $143.71 seen on October 20. With just two weeks to go before the company’s Q3 2025 earnings call, investors are eagerly awaiting the results — anticipating a stellar quarter that would dispel worries about an AI bubble, the company’s high valuation, or the fallout of Super Micro Computer’s (NASDAQ: SMCI) downfall.

With all of the aforementioned factors in mind, Finbold consulted OpenAI’s most powerful publicly-available model, ChatGPT-4o for an outlook as to when NVDA stock could reach a $200 price.

ChatGPT-4o’s overview of NVDA

As a reminder, this would entail the semiconductor leader’s market capitalization rising to $4.9 trillion, making it the most valuable publicly traded company in the world.

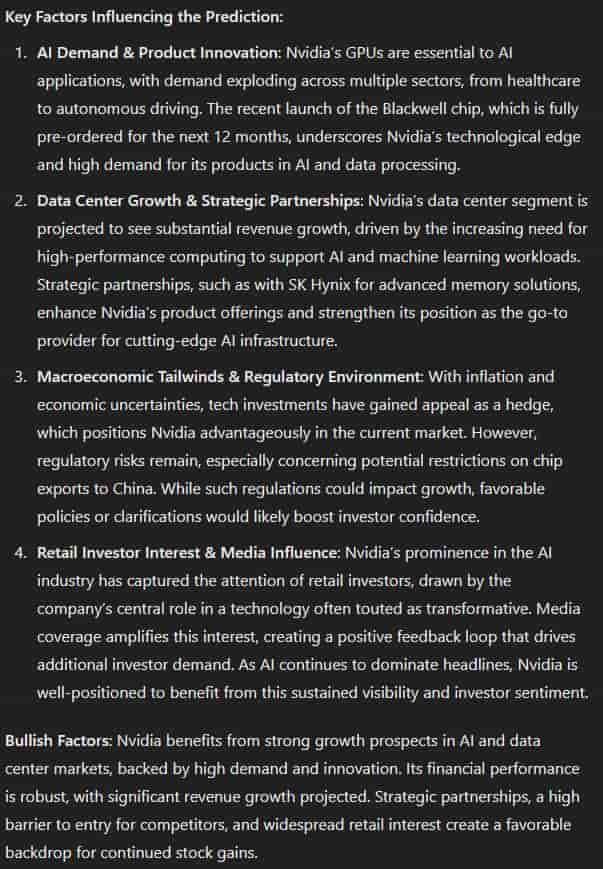

The AI model outlined several key factors that influenced its prediction. Strong demand for AI solutions driven by multiple sectors like autonomous driving and healthcare, as well as the latest Blackwell chip being pre-ordered for the next 12 months were cited as proof of a continuing technological edge.

Projected increases in Nvidia’s data center segment revenue are expected to play a crucial role in supporting its growth trajectory, as is continued retail investor interest and media visibility, which have already served to position the company as the go-to provider of high-end AI infrastructure.

To boot, the large language model also reflected on Nvidia’s robust financial performance and a high barrier to entry for competitors as bullish factors.

However, on the bearish side of the aisle, GPT-4o highlighted that NVDA stock could see short-term corrections on account of supply chain disruptions and regulatory uncertainties amidst U.S.-China trade tensions.

ChatGPT-4o’s insights on when NVDA shares will reach $200

The bullish case remains stronger— though initially reluctant to provide a specific timeline, the AI model did project that NVDA shares could reach a price of $200 between mid and late 2025, owing to the interplay of strategic positioning, strong demand, and ongoing advancements.

While the output of AI models, even the most advanced ones, can’t serve as a substitute for financial advice, the sentiments laid out by GPT-4o are echoed by analysts.

Renowned technical trader TradingShot outlined a case for NVDA stock reaching $240 even faster, in early 2025. Vivek Arya, a securities analyst with Bank of America (NYSE: BAC), doubled down on his bullish outlook on October 17, increasing his price target from $165 to $190.

The average 12-month price forecast for the stock is lower, at $153.86, although estimates at the higher end go as high as $200, signaling that at least a portion of Wall Street equity researchers agree with the model’s assessment.

Featured Image:

Below the Sky — February 15, 2024. Digital Image. Shutterstock.