Online commerce titan Amazon (NASDAQ: AMZN) has proven to be more resilient than most of its big tech peers.

In the week spanning the tail end of October and the beginning of November, numerous companies belonging to the ‘magnificent seven’ reported earnings. Even accounting for decent, double-digit growth, most have seen share prices decline due to concerns about the profitability of high AI spending.

Jeff Bezos’s primary venture hasn’t experienced that, however — since the company’s Q3 2024 earnings call on October 31, Amazon stock has gone up from $186.13 to $204.96, rallying by 8.85% to bring year-to-date (YTD) gains up to 36.70%.

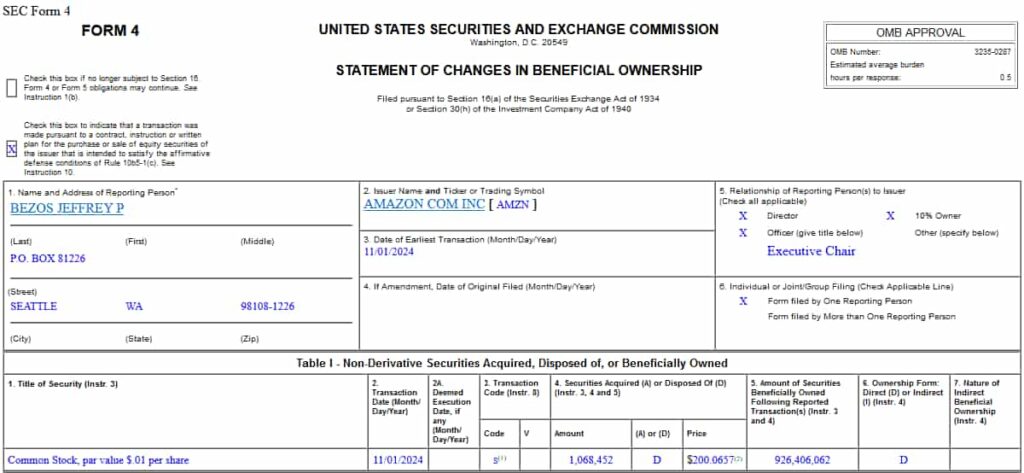

Recently, an SEC filing on November 1 revealed that former CEO and founder Jeff Bezos offloaded $3 billion worth of Amazon shares on that day. Another filing was made public on November 5, which shows that Bezos disposed of an additional 1,068,452 AMZN shares.

Is Bezos’ AMZN selloff a bearish signal?

The transaction detailed in the more recent SEC Form 4 filing also took place on November 1. Bezos sold the shares at an average price of $200.06, meaning that the value of the trade is approximately $213,754,507.

Altogether, the tech mogul dumped a total of 174,230,72 Amazon shares in a single day, worth a combined total of roughly $3,484,614,400.

On the face of it, one would expect this to be quite the bearish omen — but that isn’t the case. Both trades were made pursuant to a 10b5-1 plan adopted months ago, which will see the former CEO continue to sell shares until December 2025.

This is just the latest continuation of Bezos’ well-established ‘$200 sell wall’ — the billionaire has a habit of taking profits when Amazon stock prices are at or near $200.

For the time being, the long-term prospects of the online retailer remain solid.

In a research note shared with investors, JMP Securities analyst Nicholas Jones opined that ‘Amazon is the stock to own within e-commerce because of its wide selection of non-discretionary items, its large and growing advertising business, and AWS’s exposure to AI’. Jones raised his price target to $285 up from $265, equating to a 39% upside — and his outlook is far from solitary.

Featured image via Shutterstock