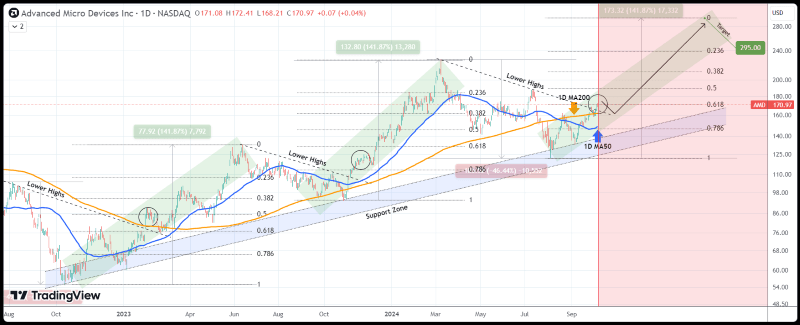

Amid analysts’ bullish predictions for the stock price of Advanced Micro Devices (NASDAQ: AMD) as its historically successful ‘Advancing AI’ event approaches, the semiconductor behemoth has just confirmed a massive rally after breaking above the lower highs trendline.

Specifically, AMD stock, which started its latest bullish leg in mid-August, is now at the 0.618 Fibonacci mark, where the past two bullish legs after the October 2023 bottom saw a technical pull-back, as observed by markets analyst TradingShot in a TradingView post on October 8.

Indeed, according to the expert, the previous two rallies both included an increase of around +142%, and last week, they broke above the lower highs trendline, which, in line with the previous legs, indicates the “confirmation of the start of the long-term rally” toward a possible target of $295.

“As a result, we have now validated that the Bearish Leg is behind us and any pull-backs this structure gives, will be buy opportunities.”

It is also worth noting that the team over at the market analytics and trading platform TrendSpider observed that AMD stock was in an uptrend and that its breakout above the resistance could indicate a continuation of the bullish move, according to their X post on October 7.

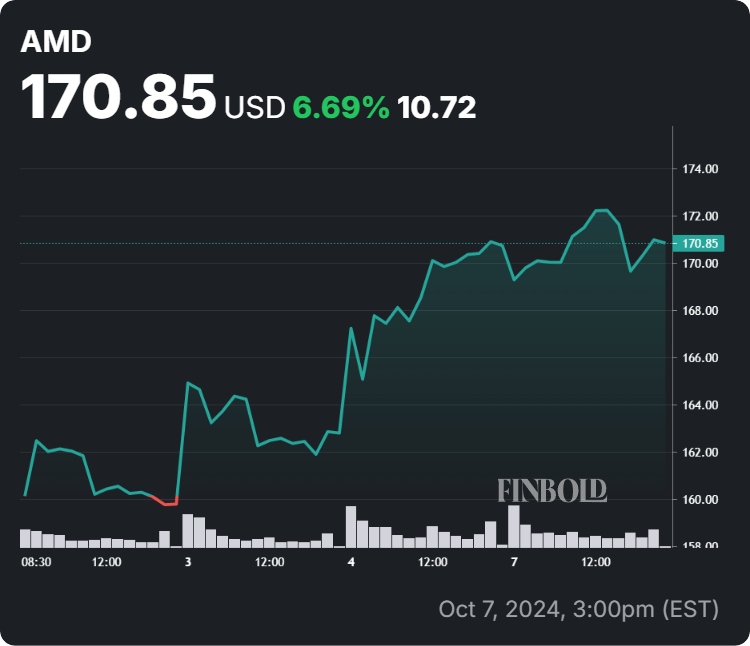

AMD stock price analysis

For the time being, the price of AMD stock stands at $170.85, which indicates an increase of 0.08% on the day, a 6.69% gain across the week, adding up to the positive change of 24.66% on its monthly chart, as well as advancing 24.19% since the year’s turn, as per data on October 8.

Meanwhile, the market is eagerly waiting for AMD’s artificial intelligence (AI) event that has historically delivered substantial returns for it and which will see the company’s CEO, Lisa Su, and other executives deliver updates on their end-to-end AI infrastructure products and solutions.

As a reminder, Vivek Anya from Bank of America (NYSE: BAC), who is among Wall Street experts offering their AMD stock price targets, recently reiterated a ‘buy’ rating and a price target of $180, arguing that the upcoming AI event “could reinvigorate AMD stock” and highlighting its massive potential:

“Faster growth could also help AMD rerate towards 30-55x forward price-to-earnings (PE) it managed to trade during prior periods of rapid share gains and 40%+ annual sales growth. (…) We expect AMD to emphasize its improving end-end positioning, including recent acquisitions (ZT Systems, Silo AI), open-source software (ROCm), and networking (infinity fabric).”

On top of that, a 5-star investor Victor Dergunov expressed a view in late September that AMD might, indeed, experience a massive turnaround and accomplish significant growth in the future, arguing it was time to “take the plunge” and buy some AMD shares.

All things considered, things seem to be looking good for AMD stocks, but trends can easily change, so doing one’s own research and keeping up with any relevant news, say, when does AMD report earnings, and the like, is critical when investing substantial amounts of money.