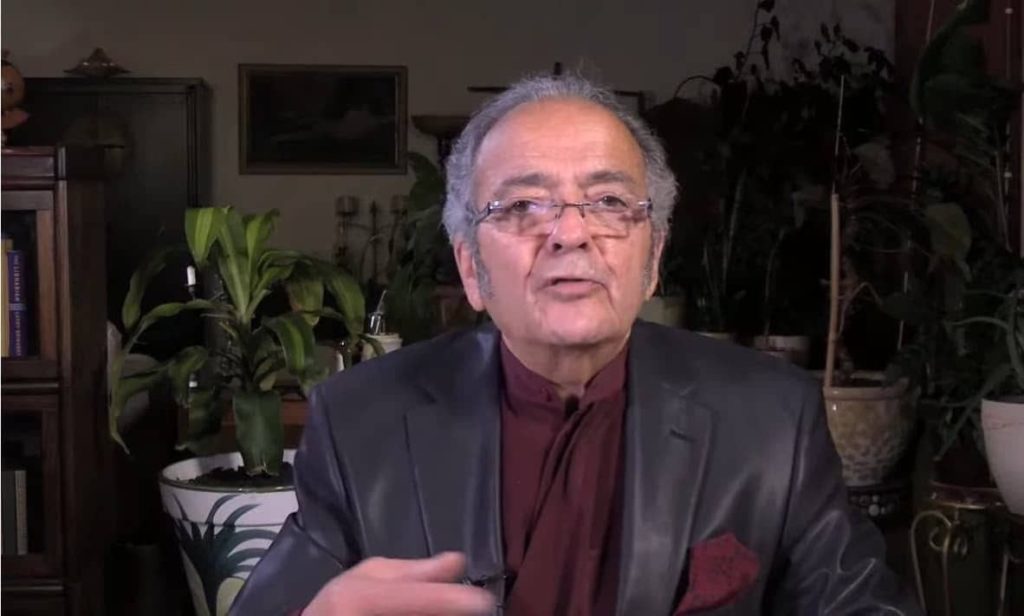

Renowned American trend forecaster, Gerald Celente has extended his long-term projection of a global economic collapse, a factor that he predicts will accelerate the shift toward central bank digital currencies (CBDC).

Celente pointed out that the collapse will be triggered mainly by emerging global economies that heavily rely on the dollar coupled with a debt crisis that is likely to accelerate this year, he said during an interview with Kitco News on January 18.

According to Celente, governments will use CBDCs in the wake of a global economic collapse as part of rectifying the mess created by fiat currencies. He also warned about the risks of surveillance with the rollout of CBDCs.

Picks for you

“They are going to use this as an excuse to come up with a new currency. They [governments] have all this debt, and they’ve got to wash it out with a new currency. <…> With a digital currency, they know every penny that you spend, where you spend it, and what you spend it on. <…> They’ll have more control over you, but most importantly, they’ll get every penny from you in tax dollars,” he said.

Bitcoin’s future under threat

Furthermore, he suggested that once governments switch to digital currencies, the existence of Bitcoin (BTC) could be threatened.

Celente noted that CBDCs would push governments to eliminate any competition, and Bitcoin might be among the main casualties. Based on the threat posed by the government, the forecaster stated that he no longer believes in the maiden cryptocurrency’s future.

“I mean, something like that [government switching to CBDCs] could bring it [Bitcoin] down because when the governments go fully digital. They’re not going to allow any competition. <…> That’s when I would say, you know, it’s a different game now. Again look what they did in China; they banned it,” he added.

His warning comes as Bitcoin attempts to build momentum above $21,000 after starting the year in a green zone alongside the general crypto market. In this case, Celente termed Bitcoin’s latest price movement as a solidification, having consolidated below the $17,000 level for several weeks.

Watch full video below:

Featured image via Stansberry Research YouTube

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.