As a difficult period for Tesla (NASDAQ: TSLA) stock, in which it declined over 20% since earnings, seems to be ending, one Wall Street analyst is confident the previous losses are not indicative of the carmaker’s longer-term value, setting a bullish Tesla stock prediction price target.

Indeed, TSLA stock was until recently recording a bearish trend amid unfavorable developments like the recall of over 1.68 million of its electric vehicles (EVs) in China due to dangerous software issues, including the imported Model S and Model X and the domestically produced Model 3 and Model Y.

On top of that, Tesla’s narrowing profit margins, declining EV sales, and a broader shift toward autonomous driving and artificial intelligence (AI) technology over traditional vehicles, as outlined by CEO Elon Musk earlier this year, have also contributed to the poorer price action of TSLA shares.

Picks for you

Tesla price prediction

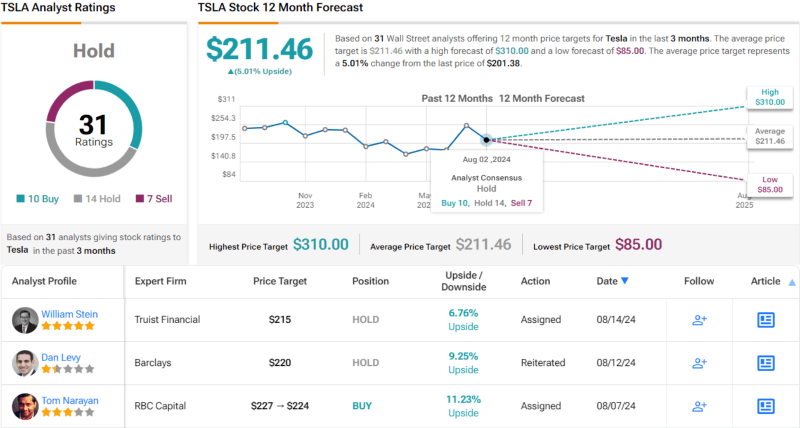

However, despite its recent problems, Truist Securities analyst William Stein believes that the switch away from mainstream carmaking and into AI might lead to Tesla stock unlocking billions of value, reiterating his ‘hold’ rating and assigning it a $215 price target on August 14, an upside of 6.76%.

Specifically, as Stein pointed out, only about a third of Tesla’s current revenue and profit comes from its car sales and energy capture and storage products, while the rest hails from its advanced driver-assistance unit, including self-driving software, robotics division, and AI training services, explaining that:

“Based on our current estimates, which we do not see as particularly conservative, we view these [car and energy-storage] businesses as worth $267 billion, or $75 per share. That’s only 35% of our Tesla price target. (…) We continue to argue that Tesla’s AI efforts are significant to the stock – including at the current price.”

Therefore, the Truist Securities financial and equities expert recommends that investors should “spend some time investigating whether Tesla’s AI project with the most history, that’s generating current revenue, and is being used in the real world already, actually works.”

Alongside Stein’s recent TSLA stock prediction, analysts’ consensus on Tesla shares stands at $211.46 (+5%), based on 12-month stock ratings and predictions they offered in the past three months, with the lowest price target at $85 (-57.79%) and the highest at $310 (+53.94%).

At the same, TSLA stock has an overwhelming ‘hold’ recommendation by 14 experts, including the 5-star analyst from Truist Securities, with 10 of them suggesting a ‘buy’ and seven ‘sell’ calls, demonstrating mixed opinions from the stock market experts, as per data on August 15.

Tesla stock price analysis

For the time being, the price of Tesla stock stands at $201.38, reflecting a 3.10% decline on the day, an increase of 2.88% across the week, an accumulated 20.29% drop in the past month, as well as having lost 18.94% since the year’s turn, but with a glimmer of hope in the form of the 0.26% advance in pre-market.

All things considered, the analyst’s TSLA stock prediction might, indeed, come true, especially as parts of its business are benefitting from the recent AI hype. However, trends in this market can easily change, so doing one’s own due diligence and researching the stock is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.