Meta Platforms (NASDAQ: META) is scheduled to release its Q2 2024 earnings results on July 31, coinciding with the stock’s high year-to-date performance.

Although the stock has experienced volatility in recent days, it is still trading in the green YTD with gains of over 34%. Notably, the volatility is highlighted on the weekly chart, where the stock is down over 4% after being impacted by the slowdown affecting the general tech space. As of the close of markets on July 26, META was trading at $465.

Ahead of the earnings call, a stock market analyst by the pseudonym vnkumar trades provided META’s outlook post-Q2 release in an X post on July 27.

The analyst noted that Meta’s stock has historically shown significant volatility during earnings seasons, with a notable 20% increase in February and a 15% decrease in April. The forthcoming Q2 results are expected to be another pivotal moment for the stock.

The analyst predicted two potential scenarios post-earnings. If Meta surpasses earnings expectations, the share price could climb to $510. Conversely, the stock might fall to around $400 if the company misses projections. These projections are based on the company’s recent performance and market conditions.

“Bracing for another big move! Possible to see $510 level on upside if ER beat or gap fill to $400 level on miss,” the analyst stated.

Meta Platforms earning projections

Notably, in its forthcoming report, META’s revenue estimates stand at $4.69 per share, representing an increase of 45.2% year over year. Revenues are projected to reach $38.27 billion, increasing 19.6% from the same quarter last year. Several key factors, including solid growth in advertising revenue and advancements in artificial intelligence (AI), drive the company’s robust performance.

Advertising revenue remains a crucial driver for Meta, with the company showing significant growth despite competitive pressures from platforms like TikTok. Analysts believe Meta’s AI initiatives, particularly the release of Llama 2, will enhance ad monetization across its platforms, including Facebook and Instagram.

The rise of artificial intelligence will also be a key topic for analysts and investors to watch. In the first quarter, Meta Platforms CEO Mark Zuckerberg highlighted the opportunity for the company. He noted that AI work is driving good results across Meta’s apps and business, becoming more efficient and better positioned to deliver its long-term vision.

Additionally, investors are looking for updates on Meta’s capital allocation. Following a negative CAPEX surprise in Q1, a steady buyback pace and effective capital expenditure management are expected to impact the stock price positively.

Wall Street analysts take on META share price

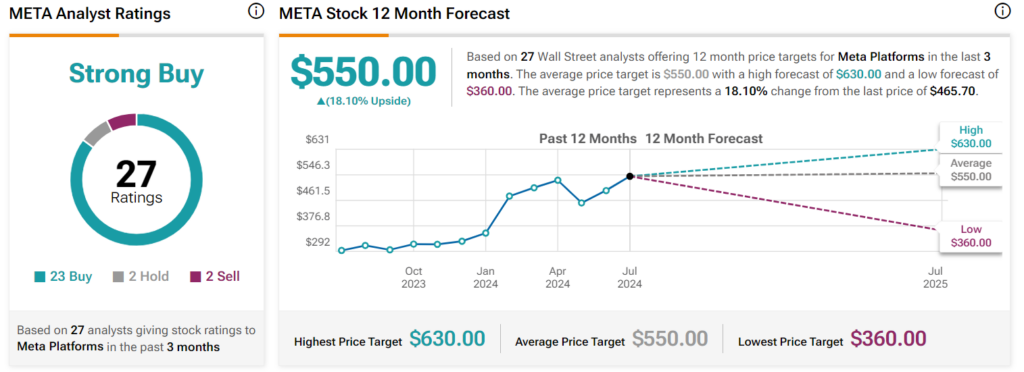

Elsewhere, Wall Street analysts at TipRanks have a ‘strong buy’ rating for META over the next 12 months. According to 27 analysts, META’s average target for the next 12 months is $550, reflecting an upside of about 18% from the last recorded price. The analysts have a high target of $630, while the low estimate is $360.

In the meantime, regardless of the impact of the earnings report, Meta investors should watch the general trends in the tech sector, as they play a crucial role in determining META’s trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.Share