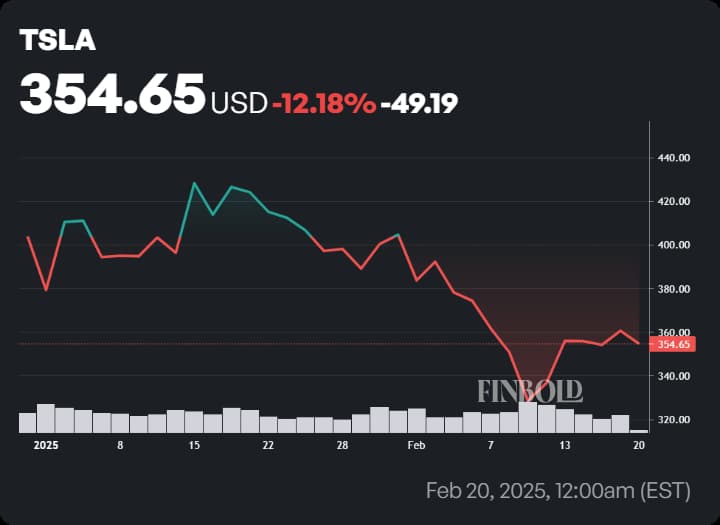

Tesla (NASDAQ: TSLA) has had a rough start to 2025, struggling to maintain the momentum that fueled its late-2024 rally. By February 20, Tesla shares had dropped to $354.65, marking a 12% year-to-date (YTD) decline.

The downturn, which began after Tesla hit a record high of $488 on December 18, 2024, has erased $500 billion in market capitalization, as the company faces mounting pressure from disappointing Q4 earnings, declining vehicle deliveries, and intensifying competition from both legacy automakers and emerging EV startups.

The stock, however, has seen a small rebound since February 11.

Despite the setbacks, Tesla continues to push forward with ambitious expansion plans. The company is preparing to launch a fully autonomous robotaxi in 2025, with test programs expected across multiple U.S. cities by year-end.

Beyond its core EV business, Tesla is expanding into humanoid robotics through its Optimus project, with Elon Musk hinting that sales could begin as early as 2026. Meanwhile, the company is also exploring a potential entry into India, with sales reportedly expected to start in Q3 2025.

While some analysts see these innovations as major long-term growth catalysts, others remain cautious, citing concerns over price wars, regulatory risks, and Musk’s divided focus between Tesla and his other ventures, including SpaceX, X, xAI, and the Department of Government Efficiency (DOGE).

As Tesla continues to command significant attention on Wall Street, a major investment firm has reiterated its outlook, citing Tesla’s mass-market launch and autonomous growth.

Wedbush reiterates Outperform rating on Tesla with $550 target

On February 20, Wedbush reiterated its outperform rating on TSLA with a $550 price target, representing a 55.08% increase from the current price. The firm cited the company’s push into autonomous driving, robotics, and mass-market expansion as key growth drivers.

In a note to investors, analyst Colin Langan addressed concerns over Elon Musk’s growing involvement with the Department of Government Efficiency, which some fear could divert attention from the automaker’s core operations.

However, Wedbush downplayed these concerns, noting that Musk’s external ventures, brand debates, and isolated protests do not alter Tesla’s long-term trajectory.

Clarifying its bullish stance, Wedbush pointed to Tesla’s ramp-up toward a new mass-market vehicle launch in the first half of 2025, as well as plans for unsupervised full self-driving (FSD) deployment in Austin by June.

Moreover, the analyst highlighted Tesla’s continued investment in Optimus, the company’s humanoid robotics project, which is expected to scale production through 2026 and beyond.

Wedbush remains confident in Tesla’s trajectory, noting that the innovation and tech machines at Tesla continue to accelerate toward an autonomous and robotics-driven future, despite skepticism over Musk’s ability to balance his various ventures.

Featured image via Shutterstock