Since the beginning of the rapid rise of AI, Nvidia’s (NASDAQ: NVDA) quarterly earnings reports have been some of the most highly-anticipated days in the year. Nvidia stock has been one of the best performers of the S&P 500 thus far — but the company’s high valuation remains a pivotal concern.

On November 20, the semiconductor business released its Q3 FY2025 earnings call — and although it was a beat both in terms of earnings and revenue, sell-side pressure won out.

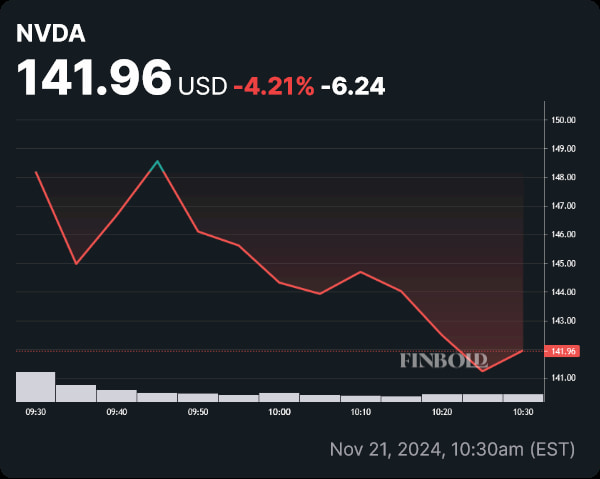

At press time, NVDA stock was trading at $141.96 — after experiencing a 4.21% drop on the daily chart. Year-to-date (YTD) gains stand at 194.69%.

While it still remains to be seen whether or not a more significant correction will occur — and how long the correction will last, major Wall Street firms reacted quite positively to the news. Several top-rated equity analysts revised their price targets upward, indicating that the Street is still confident in the prospects of the Jensen Huang-led venture.

NVDA stock receives a slew of revised price targets

Before diving into what the experts are saying, let’s backtrack a bit in the interest of context. For Q3 2025, earnings per share (EPS) came in at $0.81, in contrast with consensus estimates of $0.75. The company also saw revenue of $35.08 billion — significantly better than what was expected at $33.16 billion.

At present, the Street high price target comes from Rosenblatt Securities. In a note shared with investors on November 21, senior semiconductor research analyst Hans Mosesmann maintained a prior ‘Buy’ rating. However, his price target for Nvidia stock was raised to $220 from $200, based on a 44x price-to-earnings (P/E) multiple applied to projected FY 2027 earnings. The price target, if met, would see a 54.97% rally compared to the NVDA share price at the time of writing.

While the researcher opined that gross margins could be negatively affected by the complex infrastructure ramp-up that will doubtlessly be seen in the coming quarters, on the whole, he characterized the issues facing the chipmaker as temporary. Most notably, Rosenblatt referred to the well-publicized overheating issues with Blackwell architecture as ‘overblown’.

Elsewhere, Cody Acree of Benchmark Capital reiterated a ‘Buy’ rating — while increasing his price forecast from $170 to $190. This price target sees a 33.84% upside for NVDA shares. In a note shared with investors, Acree called the quarterly results ‘somewhat as expected’, though he did single out the 112% annual growth of the data center segment as a particular strong point.

The equity analyst noted that only a truly spectacular beat would have prevented the market from fairly aggressive profit-taking — while also adding that ‘NVDA’s shares still represent a compelling value for thoughtful investors willing to look past the near-term noise’.

Featured image via Shutterstock