On October 30, Carvana (NYSE: CVNA), a leading e-commerce platform for purchasing and selling cars announced its Q3 2024 results.

The earnings call blew analyst expectations out of the water — whereas consensus forecasts for earnings-per-share (EPS) were just $0.29, CVNA delivered $0.64 — revenues, likewise, beat expectations, coming in at $3.66 billion versus estimates of $3.45 billion. Gross profit per unit (GPU) was also a beat — coming in at an impressive $7,685.

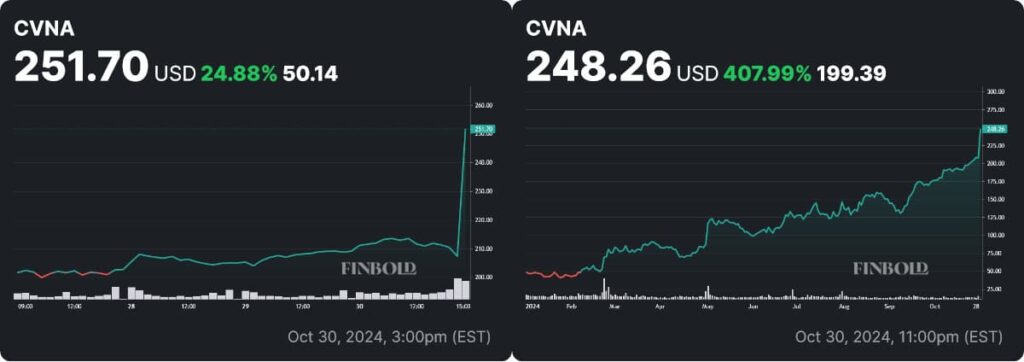

Poised to be a leader in a profitable space with a first mover advantage, and with this tailwind, CVNA stock price rose from $207.34 on October 30 to $251.70 in the premarket sessions at the time of writing — marking an impressive 24.88% surge that brought year-to-date (YTD) returns up to a staggering 407.99%.

Wall Street equity researchers have taken note — and Carvana stock received a slew of bullish, revised price targets. However, there is a faint hint that something might not be entirely on the level with the company’s earnings report.

Wall Street turns bullish on CVNA stock

Carvana vehicle sales rose by 34% year-over-year (YoY) — on top of that, EBITDA-adjusted margins rose by 6.4% to an automotive retailer industry-record of 11.7%.

The biggest bullish catalyst for Wall Street researchers was guidance — previously, CVNA had forecast a range of $1 billion to $1.2 billion for 2024 — and although no exact figures were given, the report states that a result ‘significantly above the high end of the previously communicated range’ is expected.

Adam Jones, an analyst with Morgan Stanley (NYSE: MS), opined that the earnings beat makes a strong case that the business has achieved ‘escape velocity’ in terms of profitable growth, solidifying the business as more than just a temporary phenomenon.

Elsewhere, BTIG’s Marvin Fong increased his price target from $188 to $295 — citing expectations that vehicle sales will grow even more rapidly in the coming quarter, as well as a large total-addressable market (TAM) and better than expected GPU.

Michael Baker, a senior research analyst at DA Davidson, reiterated a ‘Neutral’ rating — although the price target was increased to $240 from the prior $155. He noted that, while the earnings call was impressive, the company’s valuation is significantly above industry norms.

Is Carvana using misleading metrics?

Notably, you might have been caught off guard by the company’s use of GPU as a metric. Of course, this isn’t a graphics processing unit — we’re not talking about Nvidia’s (NASDAQ: NVDA) latest chipset.

GPU is gross profit per unit — and at $7,685, it’s a bit eye-catching for a company that deals in used cars. A simple formula is used — profits divided by units sold.

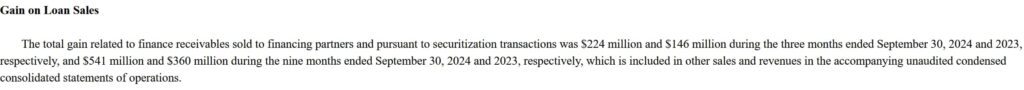

However, the company derives a significant portion of profits from selling loans — in the three months that ended on September 30, the company had made $370 million this way.

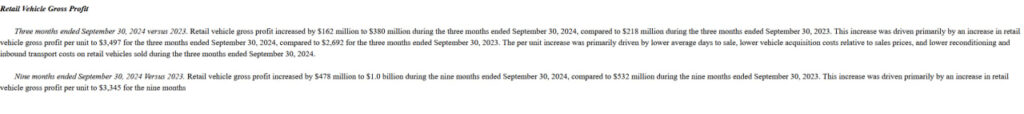

So — what is the figure for actual vehicles sold? To find that, Finbold had to take a closer look at the company’s 10-Q form, which was submitted to the SEC. It clearly states that retail vehicle gross profit per unit stands at $3,497. While this marks a 30% increase compared to this time last year, it is both much less impressive and more importantly, much more in line with industry averages.

At the time of publication, the stock has a market cap of $42.9 billion dollars — and all of this is on the back of operating 40 used car sale locations across the United States. This looks simply unsustainable — and although the business could very well have a bright future, current prices do not provide a reasonable entry point for a long position.

Featured Image:

Blueee77, Miami, FL, USA — April 8, 2021. Digital Image. Shutterstock.