After spending over six years as CEO of Chipotle Mexican Grill (NYSE: CMG), Brian Niccol announced his departure due to his new appointment at Starbucks (NASDAQ: SBUX), starting from September 1.

During his tenure, CMX stock has risen over 773%, boasting a performance that was only matched by a few other companies from the S&P 500.

The effect of Niccol’s departure was immediately felt, as CMG shares closed the August 13 trading session at $51.68 after losing 7.50%.

However, pre-market trading shows signs of recovery, with a 0.81% gain, as investors and Wall Street analysts believe Chipotle will continue to fare well after its CEO leaves.

There is optimism for CMG stock after CEO’s departure

Despite being an instrumental figure in Chipotle’s success, analysts at Wall Street believe that the foundation Niccol left will allow the company to continue its strong performance in the future.

On August 13, Truist Securities analysts reiterated their “buy” rating on CMG shares while keeping the price target of $69 unchanged. Although they view the CEO’s departure as a negative development, analysts believe that the company’s long-term growth prospects and margin expansion will remain unaffected.

Correspondingly, experts at Deutsche Bank maintained a “buy” rating while keeping the $67 price target for CMG stock. The promotion of Scott Boatwright, CFO, as an interim CEO and Jack Hartung’s announcement of remaining President of the Strategy, Finance, and Supply Chain sector instills confidence among experts that the company believes in its current workforce and capabilities.

On the same date, Stifel reaffirmed its ‘buy” rating on Chipotle Mexican Grill shares with a $70 price target. The firm remains optimistic about Chipotle’s strategic direction, citing ongoing opportunities for improvement and a stable senior leadership team that stays in place.

They anticipate continued revenue growth, with at least half expected from new unit development, particularly ‘Chipotlane’ locations, which are projected to deliver significant cash returns.

Same-restaurant sales (SRS) are also expected to grow, bolstered by enhancements in throughput, marketing, product launches, and digital capabilities.

The rest of Wall Street is yet to weigh in on CMG stock

As news of Niccol’s departure from Chipotle’s CEO position came as a surprise, most analyst firms have yet to deliver their verdicts on the situation.

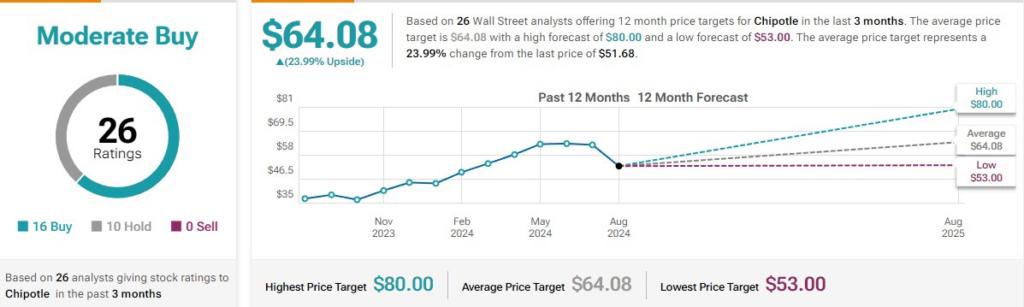

However, the current sentiment on CMG stock remains bullish, as analysts from 26 firms have a “moderate buy” consensus. Of these 16, rate CMG stock as a “buy,” 10 advise a “hold,” and none advise a “sell.”

The average price target is $64.08, which implies a 23.99% upside from the latest closing price of $51.68.

Despite the profound impact that the CEO’s departure has on this fast-food firm, the future outlook remains positive. Analysts cite strong fundamentals and progress made over the years to reassure investors about the firm’s performance.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.