Although Dell Technologies (NYSE: DELL) shares have recorded steady growth since the beginning of this year, Wall Street analysts have generally retained their views that DELL stock is a good investment in the following 12 months, as the company is about to publish its earnings.

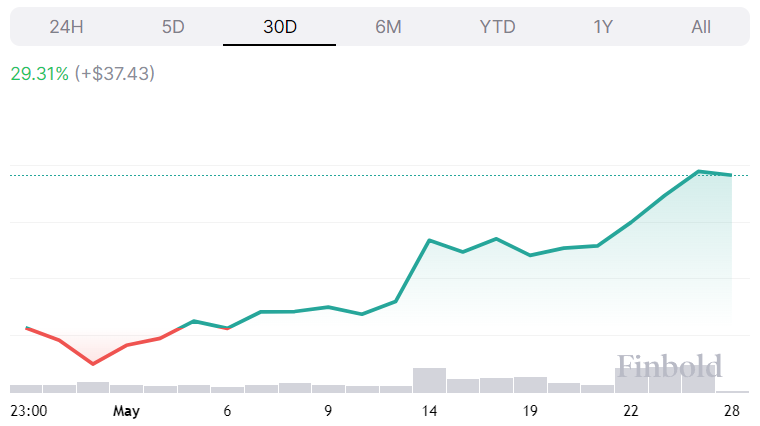

Indeed, while stock traders and investors are sitting at the edge of their seats waiting for the upcoming Dell quarterly earnings report on May 30, the price of DELL stocks has climbed over 122% year-to-date (YTD), gaining nearly 15% in the last week alone, thanks to the rally in artificial intelligence (AI) stocks.

Dell stock price prediction

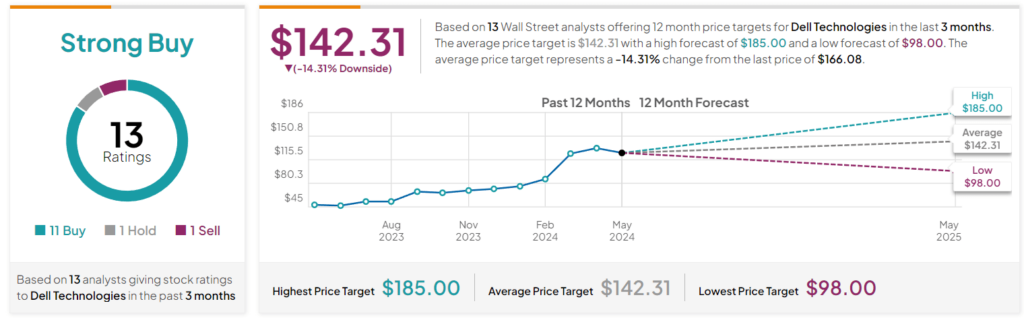

In this context, a group of 13 Wall Street analysts has offered their price 12-month Dell stock price targets in the last three months, rating DELL shares as a ‘strong buy,’ with 11 experts suggesting a ‘buy,’ one voting for a ‘hold,’ and one recommending a ‘sell,’ as per TipRanks data on May 29.

At the same time, experts have set the average price of DELL shares for the next 12 months at $142.31, which is 14.31% lower than its current price, with the lowest target standing at $98 (-40.99%), and the highest Dell stock price target at $185 (+11.39%).

Analysts share views on DELL

Specifically, one of the analysts who recently shared his views is Loop Capital Markets’ Ananda Baruah, who kept a ‘strong buy’ score for Dell shares and raised the price target from $125 to $185 on May 28, whereas Evercore ISI’s Amir Daryanani earlier reiterated an outperform rating, with $165 price target.

On top of that, a week ago, analysts at Barclays lifted the Dell stock target price from $94 to $98, albeit giving the company an underweight rating, while Citi (NYSE: C) shared its bullish views on Dell Technologies, raising its target price to $170 from $125.

Meanwhile, experts at Wells Fargo (NYSE: WFC) boosted their DELL price target from $140 to $170, and JPMorgan (NYSE: JPM) increased its price estimates on shares of Dell Technologies from $125 to $155 and gave the stock an overweight rating.

Dell stock price analysis

For now, the price of DELL shares stands at $166.08, gaining 14.85% across the past week and increasing 29.31% on its monthly chart, albeit showing signs of consolidation in pre-market trading, during which it declined 0.62%, according to the most recent information on May 29.

All things considered, Wall Street analysts are confident in the strength of Dell stocks in the future, although their offered price estimates are yet to reflect this confidence, hence the importance of doing one’s own research when investing in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.