As Alphabet (NASDAQ: GOOG) prepares to announce its second-quarter earnings on July 23, investor attention is focused on profit margins amid expectations of decelerating revenue growth.

Alphabet stock has risen 47% in value over the last 12 months, with 33% of that growth occurring this year alone, driven by the growing interest in generative artificial intelligence (AI) and Google’s dominance in the advertising sector.

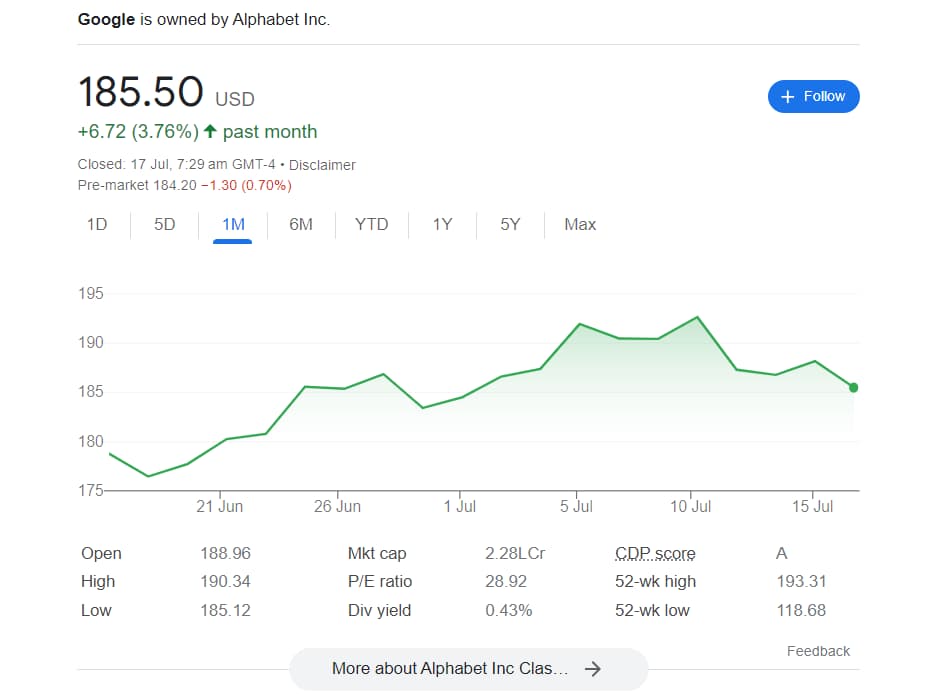

Despite the recent strong price gains, Alphabet shares are currently trading at a forward P/E multiple of 23.6x, which is slightly below their average over the past five years. This suggests that Alphabet may still be undervalued due to growth prospects driven by advertising trends and AI in cloud computing.

Analysts forecast a 27% rise in earnings per share (EPS) to $1.83 for Q2, with revenue expected to increase by 13% to $84.1 billion.

Growth prospects and challenges

The impact of generative AI on Google’s core internet search advertising business is a key concern. Google has incorporated its Gemini AI model tools and chatbot technology into its search engine, which could significantly influence advertising revenue.

While this integration could enhance the effectiveness of advertising by providing more personalized and engaging ad experiences, potential downsides such as user privacy concerns and algorithmic bias remains as a major concern.

On a positive note, reports suggest Alphabet is in advanced discussions to acquire Wiz, a fast-growing cybersecurity startup. This would be a major bet by Google and potentially strengthen its position in the cloud security market.

Additionally, Alphabet’s growth in cloud computing and its Performance Max advertising platform, which automates ad buying across various platforms, also play crucial roles in driving revenue

Alphabet’s performance and strategic targets

Alphabet’s strong performance, driven by robust ad spending trends and advancements in AI capabilities, has solidified its position as a two trillion-dollar company with double-digit growth.

Additionally, Alphabet has set ambitious targets for 2024, aiming for Google Cloud and YouTube to achieve a combined annual run rate exceeding $100, according to sources.

Analysts’ take on Alphabet stock price

Analysts have revised their price targets to reflect their growing optimism for the tech giant’s search and YouTube businesses given effective AI capabilities.

BMO Capital Markets analysts recently raised their price target for Alphabet from $215 to $222. Additionally, BMO analysts forecast a significant boost in YouTube revenue, anticipating a reduction in TikTok ad spending.

This optimism is underpinned by Google’s advancements in AI tools, including direct video uploads from Studio mobile, expansion of YouTube Create, and new ad tools that help creators monetize content more effectively.

On July 3, Needham, another prominent investment firm, maintained its “buy” rating on Alphabet stock with a price target of $210.

Similarly, Wells Fargo analyst Ken Gawrelski also recently increased the firm’s price target on Alphabet to $187 from $168 while maintaining an equal weight rating.

Despite anticipating a strong second quarter, Gawrelski notes that future catalysts appear more challenging.

As Alphabet prepares to report its Q2 earnings, its performance in generative AI, cloud computing, and core internet search advertising will be closely watched.

With analysts revising price targets and expressing varying degrees of optimism, investors should carefully consider their own risk tolerance and investment strategy before deciding whether to invest in Google stock.

Alphabet’s strong financial performance, strategic AI integration, and robust growth in cloud computing make it a compelling option for long-term investors, despite the ongoing regulatory challenges and competitive pressures in the tech industry.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.