Intel Corporation (NASDAQ: INTC), once a dominant force in the semiconductor industry, is facing intense scrutiny from financial analysts following disappointing second-quarter earnings and a challenging profit forecast.

As Intel navigates strategic hurdles and a rapidly changing market landscape, several leading financial institutions have drastically lowered their price targets for INTC stock, reflecting growing concerns about its future performance.

Analysts’ INTC stock downgrades are a grim consensus

Susquehanna has reduced its price target to $26 from $35, highlighting the challenges Intel faces in managing its diverse business segments. Similarly, Citigroup has slashed its target to $25 from $35, pointing to the company’s difficulties with inventory management and outdated production techniques.

JPMorgan has also adjusted its target to $26 from $35, maintaining an “Underweight” rating, which signals expectations of continued underperformance. Adding to the grim outlook, Goldman Sachs cut its price target to $22 from $29, reiterating a “Sell” rating due to Intel’s inability to meet profit forecasts.

Elsewhere, Evercore ISI revised its target to $25 from $36, maintaining an “In Line” rating, while Truist set a new target of $25 from $33, keeping a “Hold” rating, reflecting widespread skepticism about Intel’s ability to rebound in the near term.

Even firms with a slightly more optimistic view have tempered their expectations. Mizuho has set its target at $36, down from $45, while maintaining an “Outperform” rating. Meanwhile, Cantor Fitzgerald has adjusted its target to $27 from $40, maintaining a “Neutral” stance, and Morgan Stanley revised its target to $25 from $36, holding an “Equalweight” rating.

Intel shares set to feel the impact in the market

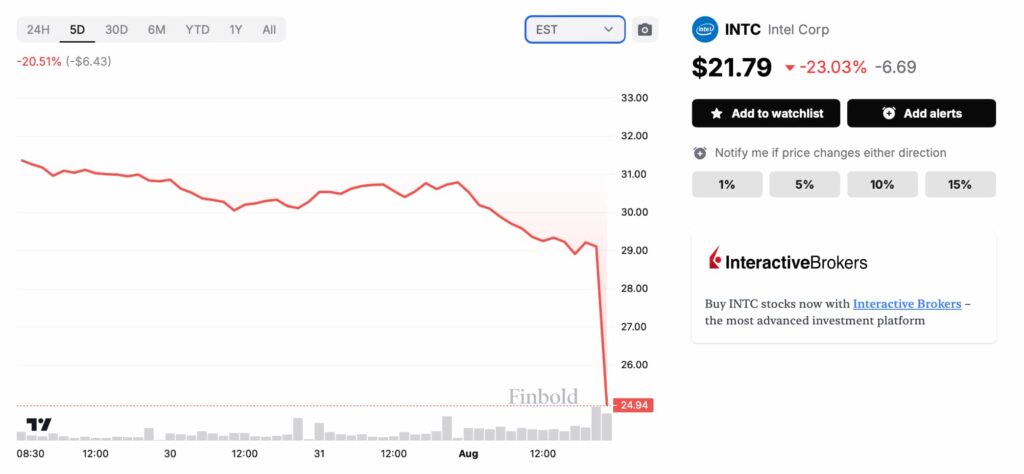

The impact of these downgrades is evident in the market’s reaction. Intel shares have experienced a significant decline, plummeting nearly 54% this year.

To make matters worse, the pre-market value of INTC shares stands at $21.79, down 23%, indicating heightened investor anxiety following the Q2 earnings report. Notably, this decline has wiped out almost $25 billion in market value, marking one of Intel’s most severe sell-offs since the early 2000s.

At the core of Intel’s strategy under CEO Pat Gelsinger are ambitions to scale across the artificial intelligence (AI) spectrum and expand its contract chip-foundry business. These efforts are supported by President Joe Biden’s Chips Act legislation, which aims to bolster domestic semiconductor production.

Despite these initiatives, Intel is struggling to execute its plans effectively. The Q2 report revealed an adjusted profit of just 2 cents per share, falling short of Wall Street’s 10-cent forecast, while revenue decreased by 1.15% to $12.8 billion.

As Intel attempts to navigate these challenges, its ability to address inventory issues and modernize production techniques will be crucial for its recovery. The semiconductor industry is evolving rapidly with the likes of Nvidia (NASDAQ: NVDA) and Intel must adapt quickly to maintain its competitive edge.

Overall, Wall Street analysts’ revised price targets reflect a lack of confidence in the company’s immediate prospects, but Intel’s long-term potential in the AI and foundry markets remains a key focus.

For now, the message from the market is clear: Intel must demonstrate its capacity to execute its strategic vision and deliver consistent financial performance to regain investor trust and stabilize its stock price.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.