Electric vehicle (EV) maker Rivian Automotive Inc. (NASDAQ: RIVN) is set to release its third-quarter earnings report on November 7, marking a critical moment for the company as it grapples with substantial headwinds.

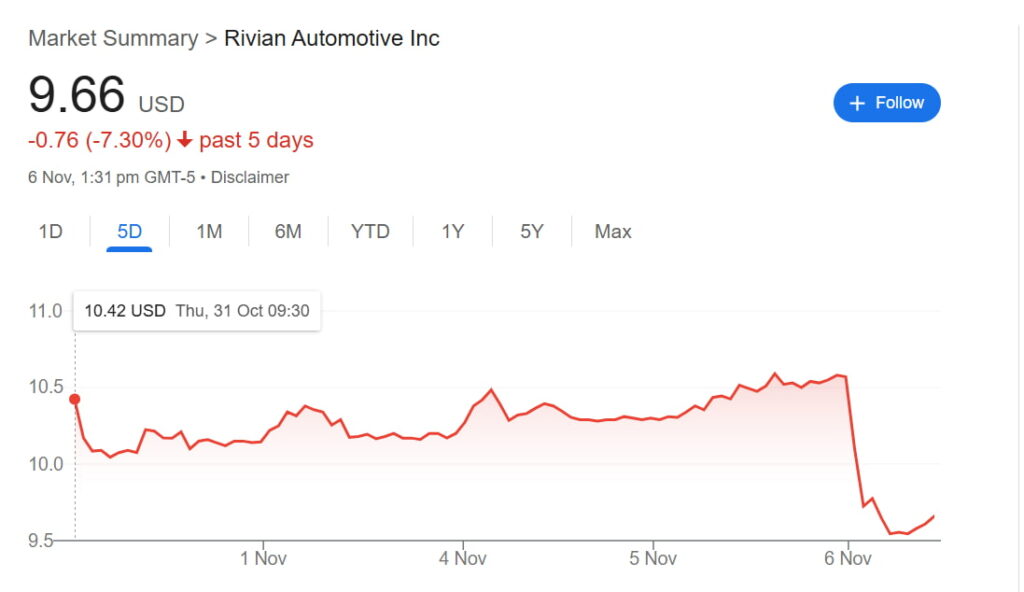

Currently trading at around $9.64, Rivian’s stock has suffered a steep 55% decline year-to-date, attributed to lower-than-expected Q3 deliveries, mounting losses, and slowing demand amid intensifying competition.

This earnings report, therefore, could either rekindle investor confidence or deepen concerns over Rivian’s near-term outlook.

Navigating supply chain setbacks and demand challenges

Rivian’s recent struggles stem largely from supply chain disruptions, with a shortage of essential components for its R1 and RCV platforms.

These issues, which emerged in Q3 and have since escalated, forced Rivian to lower its annual production forecast from an initial 57,000 to a range between 47,000 and 49,000 vehicles.

Nevertheless, the company expects to deliver between 50,500 and 52,000 units this year, reflecting modest growth over 2023 levels.

In response to weakened EV demand and increased competition, Rivian has announced plans to expand its model lineup, aiming to capture a wider consumer base.

Starting in 2026, Rivian will introduce three new models, the R2, R3, and R3X, under $50,000 to appeal to the mass market. If successful, this expansion could serve as a long-term growth engine, counterbalancing the current headwinds.

Analyst revisions reflect market caution

In light of these challenges, analyst sentiment around Rivian reflects a balanced mix of caution and optimism, with several notable firms revising their price targets.

Notably, Truist lowered Rivian’s price target from $16 to $12, maintaining a Hold rating. Analysts highlighted that ongoing production challenges and missed delivery targets continue to hamper investor confidence.

Mizuho adjusted the price target from $15 to $12, holding a Neutral rating. The analyst noted persistent EV demand challenges in the U.S. while expressing optimism about Rivian’s longer-term potential.

This is driven by the anticipated R2 platform launch and improved balance sheet stability due to a recent partnership with Volkswagen.

Moreover, Guggenheim reduced its price target from $21 to $18, yet kept a Buy rating. The analyst cited ongoing supplier issues, which are expected to impact Rivian’s production capacity into Q4.

A key moment for long-term investors

For Rivian, the upcoming earnings report could prove pivotal. With macroeconomic challenges and intensified competition in the EV sector, Rivian faces a tough road ahead.

However, if the company can present a confident outlook on ramping up R2 SUV production and solidifying its growth plans, it may sway investor sentiment positively.

For long-term investors, Rivian’s current stock price could present an appealing entry point, provided the company demonstrates progress in stabilizing operations and securing funding to support its ambitious goals.

Featured image via Shutterstock