Back on October 8, noted activist short-selling group Hindenburg Research released a comprehensive report alleging that Roblox (NYSE: RBLX) was engaged in misleading and careless business practices.

Every Hindenburg report is a matter of concern — as previous releases have led to immense drops in stock price, like in the case of Super Micro Computer (NASDAQ: SMCI), or even arrests, like in the case of The Nikola Corporation (NASDAQ: NKLA).

The activist firm accused the video game developer of using inflated metrics for public releases and investor relations, while internally using a set of separate, more accurate figures. On top of that, a longstanding investigation led to renewed calls for scrutiny, as the lackluster moderation on the platform was made apparent.

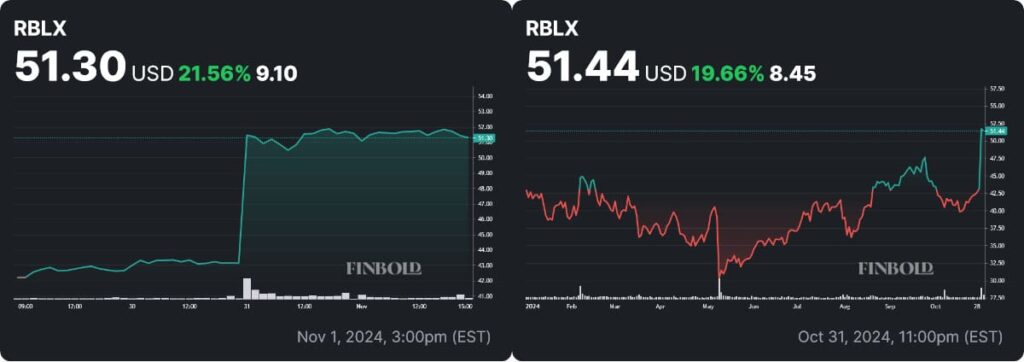

In the immediate aftermath of the investigation, RBLX share price dropped by 7.30% — however, it has since rebounded. At press time, Roblox stock is trading at $51.42, having surged by 21.56% over the last five trading days. With this latest development, the stock is back in the green on a year-to-date (YTD) basis, having seen growth of 19.66%.

Wall Street researchers bullish on RBLX stock after earnings

On October 31, RBLX released its Q3 2024 financial report. The video game business beat analyst expectations across a wide variety of metrics. Earnings per share (EPS) came in at -$0.37 — slightly ahead of consensus estimates of $-0.38. Bookings increased to $1.13 billion, outpacing expectations of $1.02 billion by 10.8%.

With that being said, Roblox did see several areas of underperformance. Most notably, revenue came in at $919 million slightly below the average $1.02 billion estimate. Revenue guidance for Q4 was likewise below expectations — the company expects to see $947 million, whereas Wall Street anticipated $968.2 million.

All in all, it’s a mixed bag — but Roblox shares surged 21.56%, and analysts are confidently bullish.

Thomas Champion, a top equity researcher at Piper Sandler, reiterated an ‘Overweight’ rating on November 1 and increased his price target to $64 from $54, equating to a 26.58% upside. In a note shared with investors, Champion opined that ‘the beat was driven by console users ramping on PlayStation, which implies core trends improved materially as well’. In addition, he expects estimates to be revised, having called current guidance ‘conservative’.

On the same day, Ken Gawrelski, a senior internet analyst at Wells Fargo (NYSE: WFC), maintained his ‘Overweight’ rating. The researcher raised his price target from $54 to $58, citing exceptionally strong bookings and the expectation of a solid holiday quarter.

Did Hindenburg misjudge Roblox?

Most of the reports released by Hindenburg Research cause a rather rapid chain reaction as investors flock to safer assets, culminating in a wide selloff. This hasn’t exactly played out with RBLX shares.

There are two important factors to keep in mind. While the allegations surrounding inflated metrics like daily active users could be credible, bookings, which are a reliable measure of growth, are on a very positive trajectory.

On the flip side, Hindenburg’s report came out just three and a half weeks before the earnings call — meaning that the company’s issues with content moderation could still come to a head in upcoming quarters if advertisers decide to take their business elsewhere.

For now, at least, Wall Street seems unfazed and is clearly expecting a stable growth trajectory.

Featured image:

Ink Drop, London, UK — March 14, 2021. Digital Image. Shutterstock