It is hard not to think of Spotify (NYSE: SPOT) when one thinks about music and podcast streaming; its leadership role is cemented with a reported 615 million users in Q4 2024, which puts a significant spacing from its following rival Tencent Music (NYSE: TME) that had 576 million reported users in the same period.

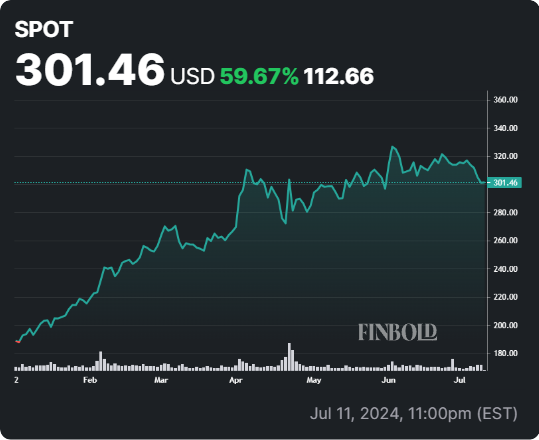

Despite a slight setback of 1.31% in the latest trading session and a 4.54% dip over the previous five trading days, SPOT stock has managed to reach a valuation of $301.46. This is particularly noteworthy given its impressive 59.67% year-to-date (YTD) gain.

However, the question arises whether SPOT stock has more room for growth after an impressive gain in the first half of 2024 or if there is no more gas left in the tank.

Picks for you

Analysts think that Spotify stock can trend higher

Rising prices for subscriptions, bundle plans, and increasing subscribers have prompted Wall Street analysts to acquire a bullish stance on the online music streaming giant.

On June 11, UBS reaffirmed its “buy” rating on Spotify stock and raised the price target from $375 to $400.

The investment bank also projects that Spotify’s marketplace growth, podcast profitability, streaming delivery, and non-royalty cost improvements will help the company achieve approximately 30% gross margins by year-end, slightly above the market’s expectation of 29.5%.

On the same date, Jefferies resumed coverage of SPOT shares, assigning a “buy” rating and substantially raising the price target to $385 from $242.

The firm has a positive outlook for Spotify, predicting that the company will maintain a revenue growth rate exceeding 15% over the next three years.

Analysts highlight that Spotify’s current subscription cost is $12 per month—much lower than the $61 spent monthly on video streaming services—and there is significant potential for periodic price hikes, possibly every two years.

Some analysts think that the SPOT stock sentiment on Wall Street has been too bullish

Redburn Atlantic analyst Agnieszka Pustula downgraded Spotify from “neutral” to “sell,” setting a price target of $230. Pustula expressed concerns that the stock’s positive momentum has led to overly optimistic forecast expectations.

The current market valuation suggests a 21% compound annual EBIT growth between 2026 and 2030, which Pustula believes overestimates Spotify’s potential for price-driven growth and subscriber expansion in developed markets.

In a research note, Redburn pointed out that this implied growth rate is double their estimates, even with an optimistic outlook that includes annual price increases for Premium plans, gross margins exceeding 32%, and operating costs dropping to 20% of sales by 2028.

However, the overall consensus on Wall Street is bullish. SPOT stock has an implied “moderate buy” rating and an average price target of $354.92, representing a 17.92% upside from the current price levels.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.