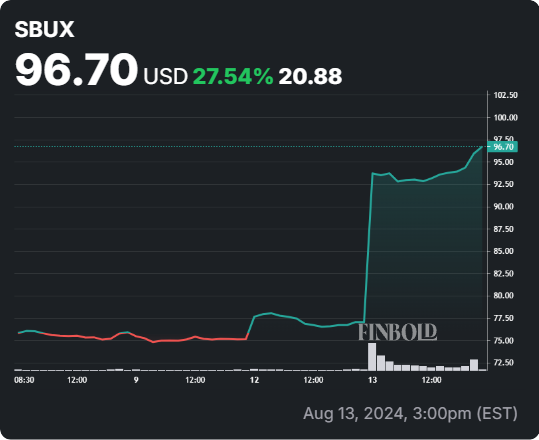

Leadership can make all the difference, as Starbucks (NASDAQ: SBUX) stock has shown with its largest one-day gain in history, which amounted to 24.5% after the company appointed former Chipotle (NYSE: CMG) CEO Brian Niccol as its new boss.

Niccol became Chipotle’s CEO in 2018, and since then, CMG stock has surged 773%, being outperformed by only nine companies from the S&P 500 during this period.

His effect on SBUX stock was immediately felt, as the 24.5% daily gain on the stock market replicated an increase of over $20 billion in Starbucks’ market cap, and investors and analysts reacted positively to the news of his appointment.

Wall Street is bullish on Starbucks’ stock after new CEO

With a stellar record in running food and beverage services companies, the news of Brian Niccol’s appointment as the new Starbucks CEO was greeted by a wave of bullish analyst updates on Wall Street.

On August 13, BMO Capital maintained its “outperform” rating and a $100 price target for SBUX shares. The company views the new appointment as a strategic move that will improve the beverage provider’s performance in key areas and benefit its revenue growth.

Stifel Nicolaus upgraded Starbucks stock from a “hold” rating to a “buy” rating and increased the price target from $80 to $110. Stifel analysts believe that the new CEO will address key issues that have persisted at the coffee giant for a long time, such as clear growth strategy and execution.

In another positive upgrade, TD Cowen raised its SBUX shares rating from “hold” to “buy” while increasing the price target from $81 to $105. Analysts see Starbucks’s founder Howard Schultz’s endorsement as a seal of approval and have confidence in the new appointment to its investor base.

On the same date, Morgan Stanley maintained its “overweight” rating and $98 price target for Starbucks stock. Experts point out that Niccol will further emphasize the coffeehouse giant’s global presence and implement necessary changes to address previous shortcomings.

In a new Wall Street high, Evercore ISI analysts raised Starbucks’ rating to “outperform” while assigning a $120 price target for SBUX stock; they believe that the new CEO will achieve margin targets and drive profit growth–two metrics that have shown decrease in the previous two quarters.

The overall SBUX stock sentiment on Wall Street set to change

As large financial institutions shift their stance on SBUX stock, positive upgrades from other analyst firms are expected to follow the bullish trend.

Currently, Wall Street analysts rate SBUX shares as a “moderate buy” based on 27 ratings. Of these, 9 opt for “buy,” 18 recommend a “hold,” and none advise a “sell.”

The average price target is $86.26, a level already surpassed by Starbucks stock and indicates a 10.05% downside from the latest closing price of $95.90.

With an overall bullish stance on Niccol as the new Starbucks CEO and his strong record at companies such as Chipotle Mexican Grill, Taco Bell, and Pizza Hut, his expertise looks bound to have a positive effect on SBUX stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.