Amid a continuously successful year for Walmart (NYSE: WMT) shares, crowned with the recently attained new all-time high (ATH), Wall Street analysts have revised their previous price targets for the American retail and hypermarket corporation for the next 12 months.

Indeed, WMT stocks have been making steady progress this year, adding more bullishness in mid-May after the company released a better-than-expected earnings report for the fiscal 2025 first quarter, demonstrating Walmart’s growing strength in the e-commerce segment of its business.

Walmart price prediction

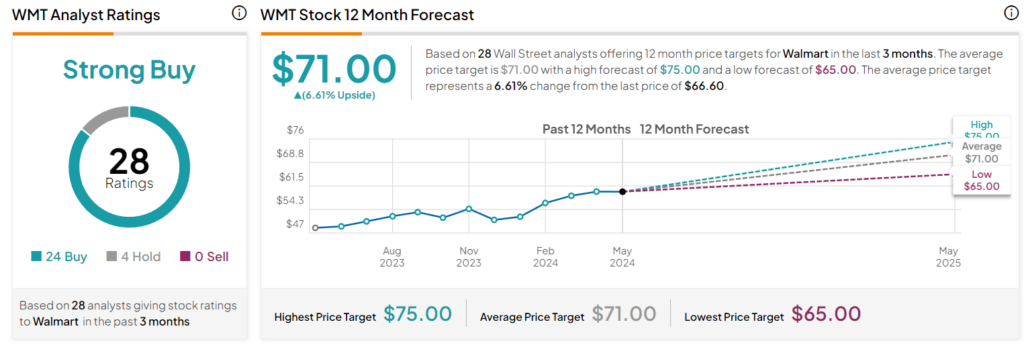

In this context, some of the Wall Street analysts offering their price targets for Walmart in the next 12 months have adjusted their views to reflect the strong earnings results, rating it as a ‘strong buy’ and setting the average price target at $71 (up 6.61% from its current price), according to TipRanks data on June 5.

Among these experts is Evercore ISI’s Greg Melich, who raised the Walmart stock price target from $70 to $72, reiterating a ‘buy’ score in a recent report, while the retail giant’s leadership is preparing to participate in the Consumer & Retail Conference hosted by the investment banking advisory firm.

Back in late May, not long after the bullish earnings report by Walmart, Barclays’ Seth Sigman raised the WMT stock price target from $60 to $66, maintaining an ‘overweight’ rating while RBC Capital’s Steven Shemesh raised his price prediction from $62 to $70, maintaining the ‘outperform’ score.

At the same time, Paul Lejuez from Citi (NYSE: C) has increased his company’s price target for Walmart from $63.33 to $75, retaining a ‘buy’ rating, with Morgan Stanley (NYSE: MS) analyst Simeon Gutman awarding a $70 prediction, up from the previous $67 price target for WMT shares.

Walmart stock price history

For now, Walmart stock is changing hands at the price of $66.60, reflecting an increase of 0.85% on the day, gaining 2.46% across the past week, and advancing 11.24% in the last month, adding up to the 25.43% growth in 2024, according to the most recent chart data.

All things considered, WMT shares might, indeed, hit the analysts’ revised price targets in the next 12 months, but trends in the stock market can sometimes do a 180 without any warning, so doing one’s own research is critical when investing a large amount of money in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.