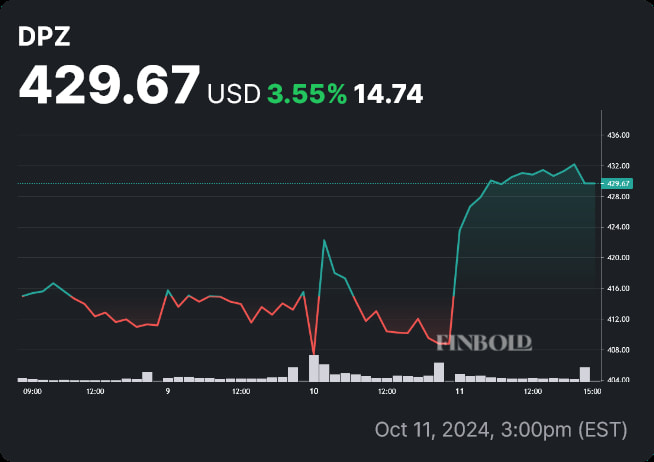

After Domino’s Pizza (NYSE: DPZ) released its Q3 2024 earnings report on October 10, shares, which opened at $407.38, quickly reached a price of $429.67 by the closing bell on Friday, October 11.

The stock is now in the green on the year-to-date (YTD) chart, having rallied by 3.91% over the course of that timeframe.

A 5.47% surge like this isn’t too noteworthy on its own — however, despite posting a strong beat in terms of earnings per share (EPS), DPZ failed to meet consensus estimates regarding revenue.

On the whole, the earnings call was a mixed bag — several analysts have revised their price targets downward, leaving some investors and traders worried that a correction of Domino’s Pizza stock price might be in the cards soon.

DPZ stock price rose on mixed earnings

Domino’s Pizza, which is the largest pizza chain in the world by stores and sales, posted an unexpectedly strong result in terms of earnings. Consensus estimates pegged EPS at $3.71 — DPZ posted a result of $4.19 for the quarter.

Revenues, however, were a miss — analysts forecast $1.10 billion, whereas the pizza chain reported $1.08 billion.

On its own, this would not necessarily be negative — rather, it indicates good cost management and strong operational efficiency.

One particularly sore spot was international growth, where same-store sales increased by only 0.8%. U.S. same-store sales also failed to meet expectations.

What really set off alarms for investors was guidance cuts. The company cut its projection for retail sales growth from 7% to 6%. In July, DPZ revised its expansion goals — the original plan called for 1,100 new stores this year, before being cut to 825 to 925. Now, it has seen another cut — down to 800 to 850 new stores.

Momentum has definitely slowed down — in Q4 2023, the pizza chain reported better results in terms of revenue and EPS while also raising dividends by 25%.

Analysts set conservative yet bullish Domino’s Pizza stock price targets

While equity researchers remain bullish on DPZ shares on the whole, their price targets are now tempered with a greater dose of caution.

Todd Brooks of Benchmark reiterated his ‘Buy’ rating and maintained his previous price target of $520. Nick Setyan of Wedbush also maintained his price target at $470 — although he still issues an ‘Outperform’ rating for the stock.

The rating issued by Peter Salhes from BTIG saw the biggest revision in terms of price target — from $580 to $500, although a ‘Buy’ rating was confirmed. Jefferies analyst Alexander Slagle cut his price target to $450 from $455 — maintaining a previous ‘Hold’ rating.

Although none of these revisions seem drastic, investors and traders should keep in mind that a slew of revisions like this — particularly after a sharp run to the upside like DPZ stock has seen, is liable to cause rapid corrections. Just recently, First Solar (NASDAQ: FSLR) saw a 9% crash owing to just two analyst revisions made on the same day.

Wall Street experts project an average price target of $472.92 a year from now — which would represent a decent 10.07% upside.

However, the overall sentiment is only moderately bullish — 16 ‘Buy’ ratings are issued, but 9 ‘Hold’ ratings and 1 ‘Sell’ rating reflect mixed outlooks.

In the short term, traders and investors should look out for a correction to the downside, as it could serve as a better entry point for a long position. While Domino’s Pizza stock is poised for further growth, if the company isn’t able to revitalize international growth, it will face strong headwinds in the coming quarters.