While the Magnificent Seven stocks have been rushing toward a new milestone, totaling a market capitalization of $15 trillion for the first time in history, Wall Street analysts have updated their price targets for one of these super-performers – Amazon (NASDAQ: AMZN).

As it happens, Amazon has transformed from an e-commerce pioneer to a real technology behemoth, benefitting from advances in artificial intelligence (AI) to reshape and improve its business model, and its stocks have increased in price by over 20% this year and hit a record high in May.

Amazon stock price prediction

In this context, renowned finance experts and market participants have revised their AMZN stock price targets for the next 12 months, including Seeking Alpha’s pseudonymous blogger and investor The Alpha Oracle, who has rated Amazon shares as a ‘buy,’ arguing that they have more room for growth:

“Despite the recent increase in the stock price, it is still far away from its fair price. (…) Amazon Marketplace will perform better, AWS earnings will improve, and the company will benefit from its AI investments. (…) With the sustained dominance of the Amazon Marketplace in e-commerce, I expect the company to benefit from upcoming macroeconomic developments.”

At the same time, Bank of America (NYSE: BAC) reiterated its $210 price target and ‘buy’ rating for Amazon from May, alongside JPMorgan (NYSE: JPM), which also maintained an ‘overweight’ score and an even more bullish price target at $240, taking into account projections of the company’s future free cash flow.

Meanwhile, TD Cowen also expressed a positive outlook on AMZN shares, having assigned them a ‘buy’ rating and a $225 price target for the next 12 months, highlighting the likelihood of AWS increasing its capital expenditures in 2024 to boost its infrastructure capacity, particularly in the field of generative AI.

Bullish consensus

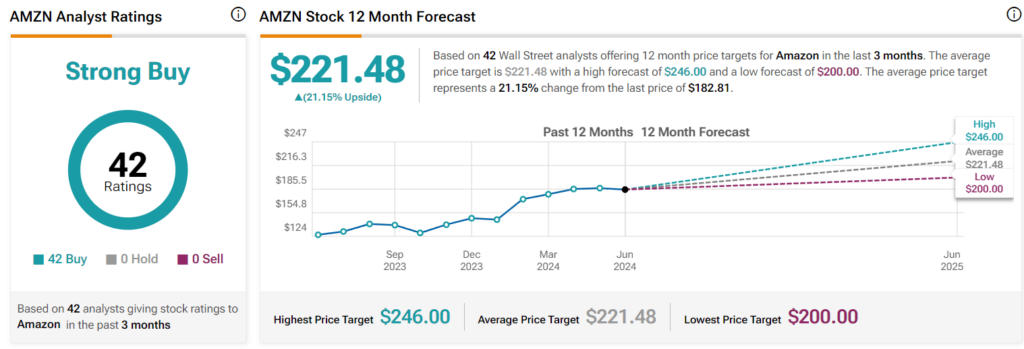

As a result of the collective insights and ratings from a group of 42 Wall Street analysts in the last three months, Amazon stocks could reach the average price of $221.48 in the next month, and they all, without exception, agree that AMZN shares are a ‘strong buy,’ according to the latest TipRanks data on June 19.

Amazon price analysis

For the time being, AMZN shares are changing hands at the price of $182.81, which indicates a very slight decline of 0.01% on the day, a more significant drop of 2.54% across the week, as well as accumulating a loss of 0.40% on its monthly chart, while gaining 21.93% since the year’s turn.

Ultimately, analysts are confident that Amazon stock will continue to grow in price for the next 12 months, relying on the company’s current progress and positive outlook. However, trends in the stock market could easily change, so doing one’s own research is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.