Although Bitcoin (BTC) initially saw sideways price action during the weekend, it mounted a notable move to the upside late on Sunday.

While disparate narratives abound online, a closer look at the actions of long-term Bitcoin holders can provide additional insight into market dynamics.

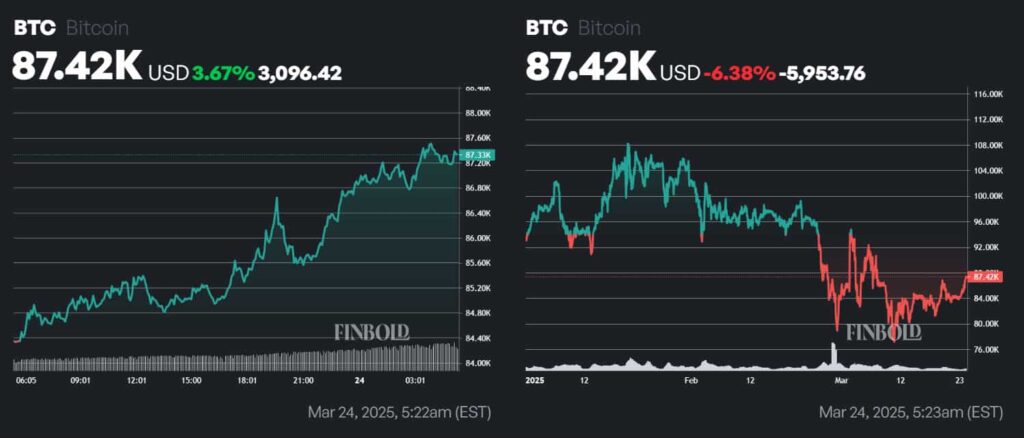

First, let’s dig a little deeper into that recent move. As of press time on March 24, BTC was changing hands at a price of $87,420. The price of Bitcoin has increased by 3.67% over the past 24 hours, bringing year-to-date (YTD) losses down to 6.38%.

The primary driver behind the rally was a recent report by the Wall Street Journal that suggested that the White House will narrow the tariffs slated to come into effect on April 2. Per the report, instead of broad, far-reaching tariffs, the Trump administration will only focus on reciprocal levies, which will be imposed on the 15 countries that the U.S. maintains the largest trade deficit with.

Such an approach, if executed, would cause a lot less uncertainty in the financial markets. The President’s tariff policies have, thus far, reduced the number of Bitcoin millionaires by almost 20%.

However, on-chain analysis clearly demonstrates that this is a function of the decrease in Bitcoin’s value — and not a sign of widespread liquidations.

Long-term Bitcoin holders appear to be holding firm

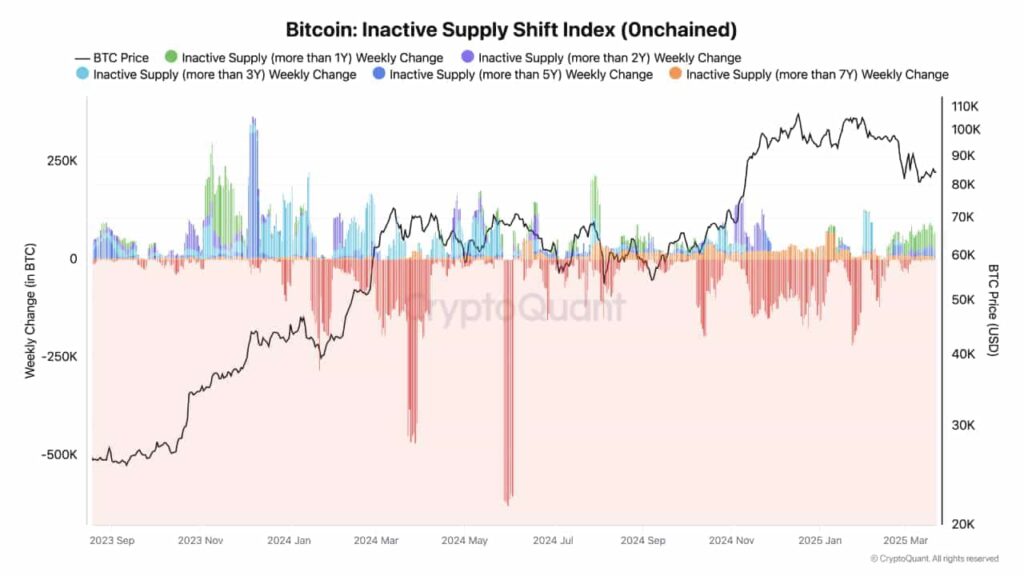

The Bitcoin Inactive Supply Shift Index (ISSI) is a metric that was created by market intelligence platform CryptoQuant contributor onchained in late 2024. It charts the inactive supply of Bitcoin, which has been dormant for one to seven years, and tracks shifts in that supply.

Thus, ISSI provides an additional layer of insight into the sentiment of long-term BTC holders.

Despite narratives suggesting long-term Bitcoin holders are capitulating, the bulk of the recent supply shift corresponds to coins held for more than a year but less than two years.

In addition, on the whole, the degree to which supply that had been dormant for three years or more is being moved has dropped significantly since January. At the same time, holders who have been sitting on their assets for more than five years are moving minuscule amounts of supply.

These findings suggest that the majority of long-term Bitcoin holders still hold a bullish view of the leading cryptocurrency.

While it stands to reason that recent geopolitical and macroeconomic developments have blunted the extent to which buying pressure can rise at the moment, the digital asset’s long-term outlook appears to be intact — at least per buy-and-hold investors.

Another factor to consider is that Wall Street has enacted a record sell-off of Bitcoin exchange-traded funds (ETFs) — but it would be hasty to attribute that to shifts in the long-term outlook, as it might very well constitute portfolio rebalancing.

At present, BTC is anchored by its 1-week moving average (1W MA50) — but per technical analysis from chart expert TradingShot, a break above a channel structure could ignite a rally to $150,000 or even potentially $200,000, if price action follows trends established in previous market cycles.

Featured image via Shutterstock