At the beginning of April 2024, the gold market witnessed a significant uptick in prices, continuing a trend that underscores gold’s role as a hedge against inflation.

This surge can be attributed to a combination of factors, including geopolitical tensions, central bank buying, and ETF outflows, that have converged to propel the demand for gold to new heights.

Despite significant outflows from gold ETFs, central banks are purchasing gold at unprecedented rates, pushing prices higher.

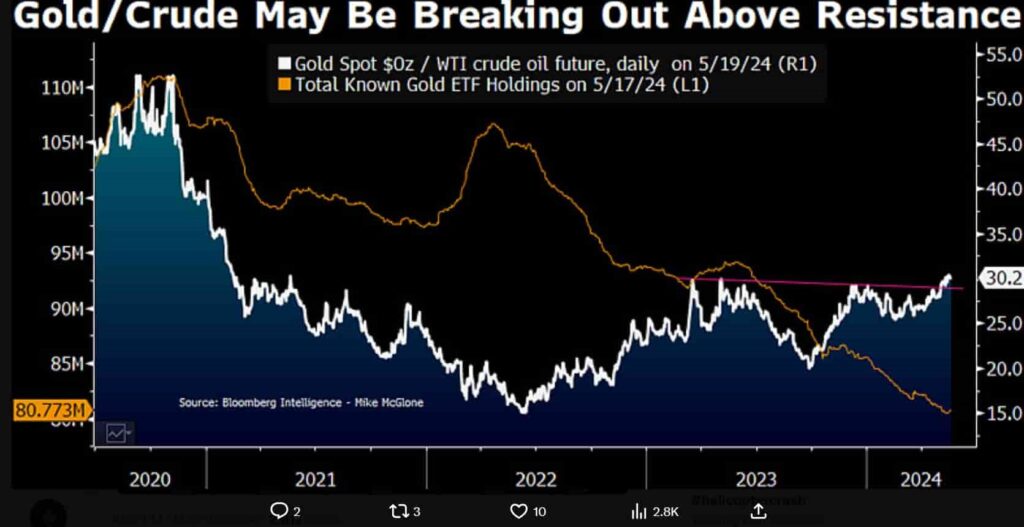

Mike McGlone, Senior Commodity Strategist for Bloomberg Intelligence, shared this analysis on X (formerly Twitter) on May 19, highlighting the 30 million ounces of ETF outflows since 2020 versus central banks’ acquisition of approximately 100 million ounces.

This divergence raises questions about what is truly influencing the gold market.

Central banks vs. ETFs – A divergent trend

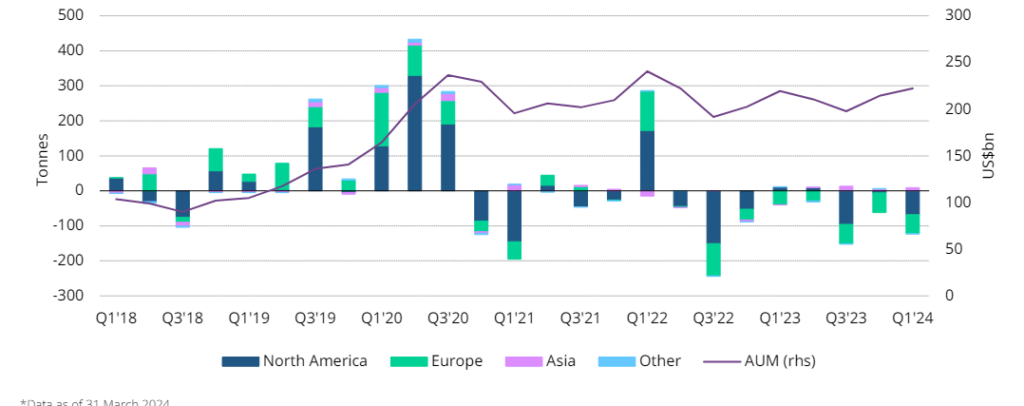

Since 2020, central banks have been aggressive buyers of gold. According to the World Gold Council, central banks bought nearly one-third of the total gold mined in 2023, totaling 1,037 tonnes.

This buying spree has continued into 2024, with 290 tonnes added to reserves in Q1 alone. In contrast, global gold ETFs have seen continuous outflows, with a significant decline of 29 million ounces since their peak in October 2020.

Economic and geopolitical drivers

Central banks are purchasing gold as a hedge against economic uncertainties and geopolitical risks. The trust deficit caused by the freezing of Russian forex reserves in 2022 spurred many countries to diversify their reserves away from the U.S. dollar.

This shift is evident as central banks aim to insulate themselves from potential financial sanctions and dollar volatility.

Several central banks have notably increased their gold reserves: the Central Bank of Turkey, the largest buyer, added 12 tonnes, bringing its total to 552 tonnes.

China’s aggressive accumulation of gold, with the People’s Bank of China (PBoC) buying 224.88 tonnes in 2023 alone, underscores this trend. The broader strategy involves moving away from dollar-denominated financial systems and enhancing economic security.

ETF outflows and market behavior

Despite the outflows, gold prices have remained resilient, highlighting a divergence in market behavior.

ETFs have been trimmed from portfolios as fund managers seek profits elsewhere. Yet, physical gold has seen increased demand from central banks, reflecting a strategic reserve management approach rather than short-term profit motives.

Gold ETFs in North America and Europe have faced continuous outflows, shrinking by significant margins.

Conversely, Asian-listed gold ETFs grew by 20.9% in Q1 2024. Despite this growth, it only offsets a fraction of the outflows from Western funds.

Gold ETFs listed in the US, Canada, UK, Germany, and other Western European bourses swelled by almost one-third by weight between January and October 2020. However, it took 42 months and a price rise of 30.9%-some-$540 per troy ounce—to reverse that inflow.

Mike McGlone also suggests that crude oil deflation could drive gold inflation. Historically, gold tends to outperform other commodities, particularly during periods of economic instability.

As crude oil prices face deflationary pressures, gold’s role as a stable store of value becomes more pronounced, potentially fueling its performance in 2024.

This divergence in market behavior underscores the strategic importance that central banks place on gold as a safeguard against financial volatility.

As global economic conditions evolve, gold’s position as a stable store of value is likely to remain pivotal, potentially driving further price increases throughout the year.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.