Gold prices have reached a new all-time high (ATH) of $2,749 per ounce on October 23, up from a previous high of $2,710 on October 18.

In fact, the precious metal is well on track to secure the best annual returns since 1979.

Macro factors have been quite favorable for gold in the last two years — rising geopolitical tensions and inflation have proven to be a tailwind for the metal’s role as a store of value — while the outsized returns have brought renewed interest in the safe haven asset as an investment. At present, the commodity seems set to reach a price of at least $3,000 per ounce.

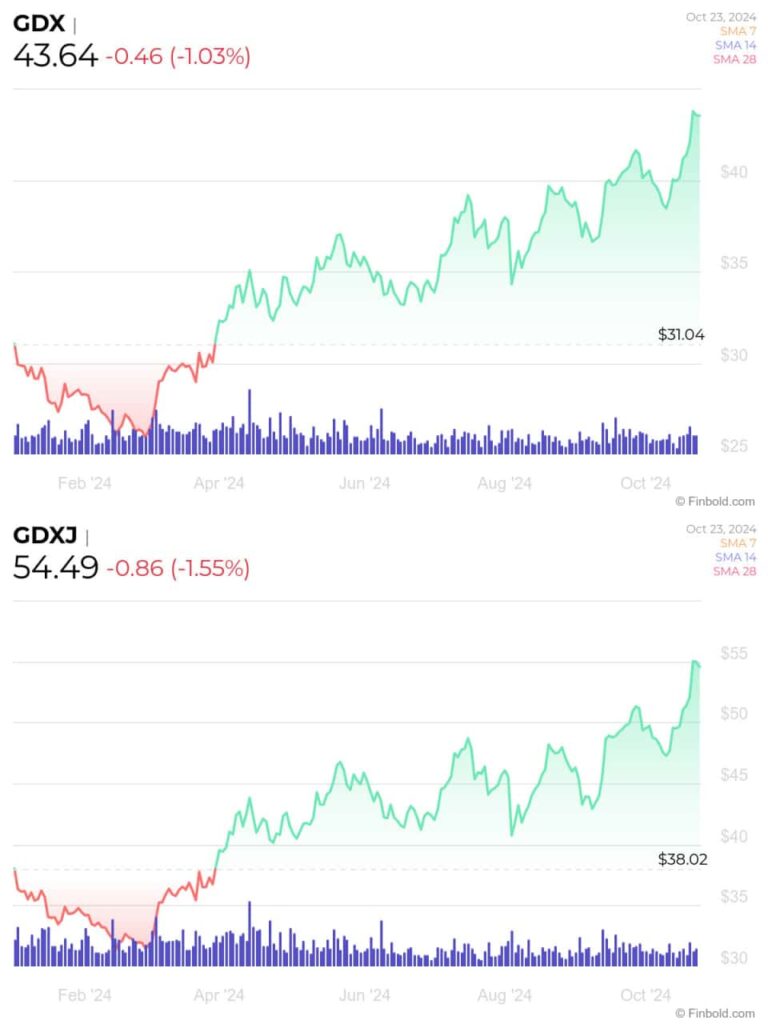

This has also left a mark on gold miners — the VanEck Vectors Gold Miners ETF (NYSE: GDX) and VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ), have both outpaced the spot price of gold. The first fund is up 40.59% year-to-date (YTD), while the second is up 43.31%.

That’s a pretty similar level of performance, all things considered — but we could see a divergence going forward.

Is GDXJ set to soar?

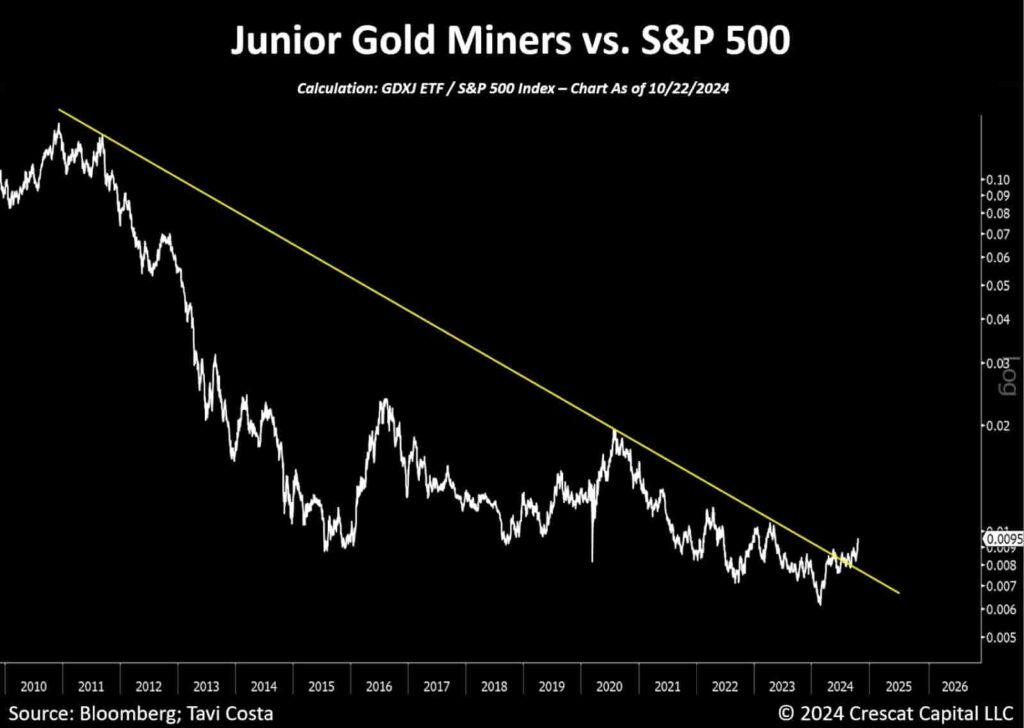

As of mid-2024, GDXJ has begun to outperform the wider stock market — specifically, the S&P 500, per Crescat Capital researcher Otavio Costa. What’s more, the ratio of performance has broken through a line of support that has held since 2011 — indicating that this could be the start of a significant shift.

The same does not hold true for GDX. To explain, we have to backtrack — whereas GDX as a fund contains mature, stable gold stocks, GDXJ is focused on junior miners — smaller companies that are primarily involved in the exploration or the development of new mines, but have a higher growth potential.

GDX is certainly poised to mirror the shining metal’s rise — but GDXJ seems to have attracted more investor attention, which could serve to drive the fund’s price up. Costa’s research is timely — as this is a recent occurrence, readers still have a chance to enter long positions on what could be the best-performing class of gold equities going forward — at reasonable prices.

Gold prices hit record highs on rising demand

The precious metal has reached new all-time highs buoyed by geopolitical instability, accumulation from central banks, and outsized returns attracting investors.

Still, investors should exercise caution — although the returns are enticing, and many influential experts like Robert Kiyosaki are urging their followers to invest in precious metals, the fact remains that a pullback is quite possible — as the asset is at its most overbought level in 5 years.

The bull case is compelling, however — GDXJ valuation hasn’t reached excessive levels, and findings from the World Gold Council indicate that demand is rising at a steady pace of 3% year-over-year (YoY) — representing a good backdrop for companies poised to provide additional supply.