Nuclear power is back in the spotlight.

Unlikely as it may seem, this once underappreciated way of generating power is gathering steam — for one, nuclear does fall under the banner of clean energy, and two, it’s arguably the best, consistent source of baseload power.

This new wave of attention is owed to the rapid rise and expansion of artificial intelligence — with key players in the space such as Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) pivoting to nuclear as a way to service the ever-increasing energy needs of data centers.

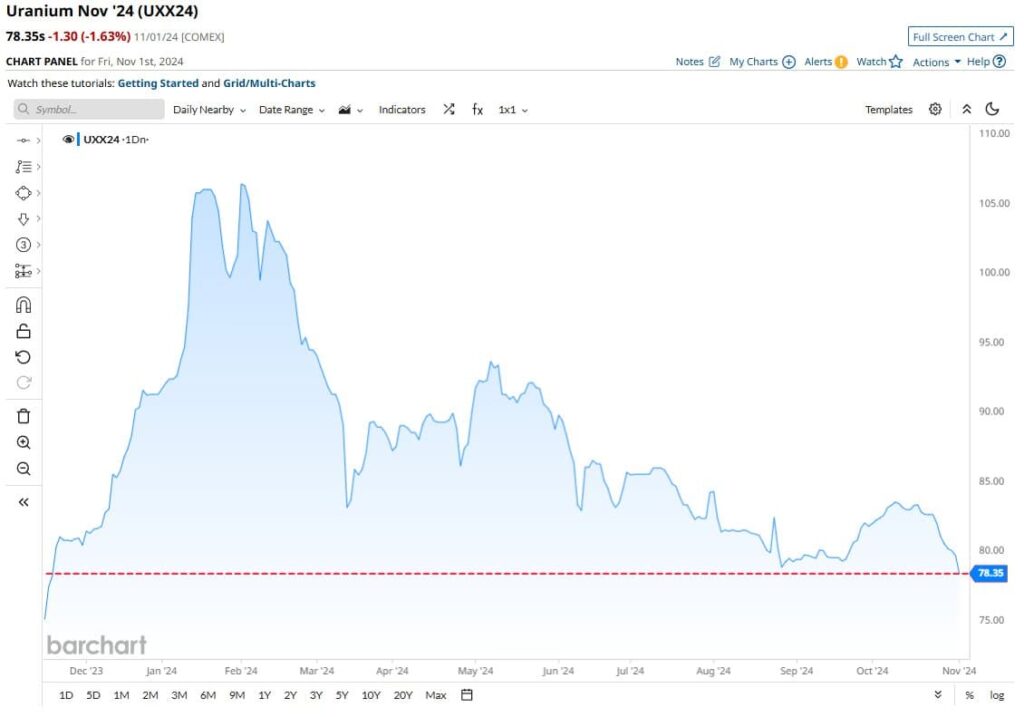

Newfound electricity demand has significantly buoyed utilities in 2024 — the best performing stock in the S&P 500, at the time of writing, is Vistra Corp (NYSE: VST), which has secured year-to-date (YTD) returns of 197.17%. However, this new nuclear renaissance is far from a done deal — the strategic investments of today will take years to play out, and uranium prices have just hit a 12-month low.

With this key commodity trading at such low prices, is a downward correction in the cards for nuclear stocks?

Low uranium prices will negatively impact nuclear stocks — but not all of them

The price of uranium as a commodity has the largest and most immediate effect on companies that are engaged in mining. In contrast, for businesses in the power generation side of the business, nuclear fuel costs amount to just 15% to 20% of the total cost of running a plant, per the World Nuclear Association.

Producers like Cameco (NYSE: CCJ) will feel the effect of these low prices most keenly — while energy companies such as Dominion Energy (NYSE: D) aren’t as likely to be affected.

In fact, electricity producers could even stand to benefit from low uranium prices — although if demand accelerates due to AI, the radioactive metal is unlikely to continue trading at low prices.

Once all is said and done, energy stocks that dabble in nuclear power remain the better bet on the whole — they’ve netted superior returns thus far, are less sensitive to nuclear fuel price changes, and have seen a slew of renewed interest from booming tech giants.

Microsoft has committed to renovating the Three Mile Island nuclear plant to satisfy its own need for energy — Amazon is funding research into smaller, modular reactors, and Sam Altman-backed reactor design company Oklo (NYSE: OKLO) has managed to secure an impressive 137.80% YTD return at the time of publication.

To boot, uranium mining is a well-established, stable industry without any revolutionary changes on the horizon — whereas the energy side of the business abounds with new developments. With that being said, it’s highly unlikely that nuclear stocks will experience a significant negative change due to commodity price action.

Featured image:

r.classen, Tihange, Belgium — September 7, 2014. Digital Image. Shutterstock